Seamless Protocol: Unlocking Amplified DeFi Yields with Automated Leveraged Tokens

Decentralized Finance (DeFi) continues to push the boundaries of financial innovation, offering users unprecedented control and access to sophisticated strategies. At the forefront of this evolution is Seamless Protocol, a pioneering platform that has recently unveiled a groundbreaking solution: leveraged tokens on the Base network. These tokens are set to revolutionize how users engage with DeFi, packaging intricate strategies into simple, automatically managed ERC-20 assets.

The Power of Simplified Leverage in DeFi

The core innovation introduced by Seamless Protocol is the ability to encapsulate complex DeFi mechanisms—including collateral management, lending, swaps, and automated rebalancing—into a single, user-friendly ERC-20 token. Traditionally, participating in leveraged positions or multi-step yield farming strategies required significant technical know-how, constant monitoring, and manual intervention to manage risks and optimize returns. This often deterred many potential users, limiting DeFi’s reach.

Seamless Protocol addresses this challenge head-on. By automating these processes within the token’s infrastructure, it removes the need for manual user intervention, making advanced DeFi strategies accessible to a much broader audience. Imagine gaining amplified exposure to staking yields or engaging in complex arbitrage loops, all by simply holding a single token in your wallet. This marks a significant leap towards democratizing sophisticated financial instruments in the decentralized space.

The Flagship Offering: 17x Staking Loop on weETH/ETH

The inaugural leveraged token launched by Seamless Protocol exemplifies this innovative approach. It offers an impressive 17x staking loop on the weETH/ETH pair, designed to maximize returns from Ethereum staking. For users, the process is remarkably straightforward: holding this ERC-20 asset automatically grants exposure to amplified staking yields.

This particular token goes beyond mere staking amplification. It is engineered to also accrue reward points from two prominent protocols: Ether.fi and EigenLayer. Ether.fi is a liquid restaking protocol that allows users to stake ETH while retaining liquidity through weETH (wrapped eETH). EigenLayer, on the other hand, introduces the concept of “restaking,” enabling staked ETH to be used to secure additional decentralized services (Actively Validated Services, or AVSs) in exchange for further rewards.

The integration of these elements means that users of Seamless Protocol’s leveraged token effectively participate in a compounding loop. The underlying strategy automatically re-stakes earned rewards and leverages the position, continuously enhancing the staking yield. This entire intricate process runs on-chain via Seamless Protocol’s leverage engine, which is programmed to automate each position adjustment, actively manage risk, and ensure the desired leverage ratio is maintained without the user needing to lift a finger. This automation is crucial for both maximizing returns and mitigating the inherent risks associated with leveraged positions, such as liquidation.

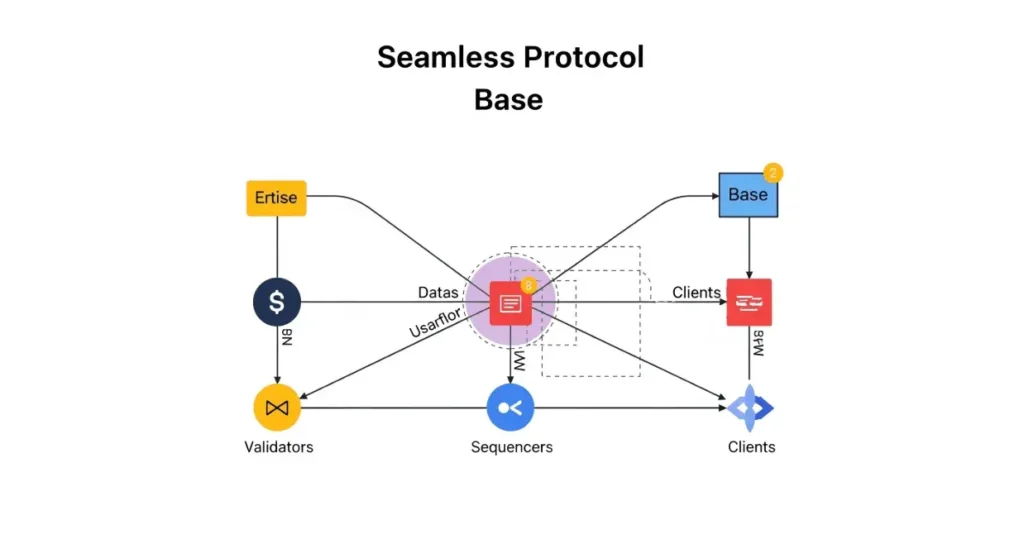

A Robust Foundation: Seamless Protocol’s Journey on Base

Seamless Protocol has been a significant player in the Base ecosystem since its inception. Debuting in 2023 as Base’s first native lending platform, it has steadily built a robust network. This foundational period allowed Seamless Protocol to establish a strong presence, accumulating over 250,000 active wallets and maintaining more than $100 million in total value locked (TVL). Such metrics underscore the community’s trust and the protocol’s proven ability to manage substantial capital.

A key strategic move in early 2025 further solidified its infrastructure. Seamless Protocol migrated its core lending system to Morpho’s permissionless lending system. Morpho provides a highly customizable and efficient infrastructure for on-chain loans, enabling isolated, tailor-made markets with specific collateral types, loan assets, and risk parameters. This migration allowed Seamless Protocol to operate in a fully open and more capital-efficient environment, enhancing its flexibility and scalability for future innovations. This move to Morpho is critical, as it provides the backbone for the complex, automated strategies now offered through their leveraged tokens.

Expanding the Horizon: A Modular and User-Centric Approach

The introduction of these leveraged tokens is just the beginning of Seamless Protocol’s ambitious roadmap. The protocol has implemented a highly modular system, utilizing collateral, lending, and rebalancing adapters. This modularity allows Seamless Protocol to connect to a diverse range of capital sources and dynamically adjust leverage levels across different strategies.

Crucially, the decision to package these strategies into standard ERC-20 tokens offers immense benefits. ERC-20 tokens are the backbone of the Ethereum ecosystem and, by extension, Layer 2 networks like Base. Their standardized nature ensures seamless interoperability. This means these leveraged tokens can be freely traded on decentralized exchanges, used as collateral in other lending protocols, or integrated with a myriad of other DeFi applications on Base. This composability amplifies their utility and potential within the broader DeFi landscape.

Looking ahead, Seamless Protocol intends to broaden its product lineup significantly. Future offerings are expected to include:

- Directional Exposure Tokens: For users seeking amplified long or short positions on major cryptocurrencies.

- Delta-Neutral Yield Farming Strategies: Designed to generate yield while minimizing exposure to price fluctuations of the underlying assets.

- Memecoin Loops: Leveraging the highly volatile nature of memecoins for potentially high-yield, albeit higher-risk, strategies.

- Multi-Strategy Combinations: Allowing users to combine different leveraged strategies into a single token for diversified and optimized returns.

Furthermore, Seamless Protocol is committed to decentralized governance. It will introduce a DAO-governed fee switch, enabling the community to decide on the redirection of revenue generated from these leveraged tokens to stkSEAM holders. This ensures that the growth and success of the protocol directly benefit its dedicated community members who stake the native SEAM token.

Bridging the Gap: Decentralized Leverage vs. Traditional ETFs

The vision behind Seamless Protocol’s leveraged tokens draws a clear parallel with the multi-billion dollar traditional financial market for leveraged Exchange-Traded Funds (ETFs). By 2023, leveraged ETFs in traditional markets had surpassed $130 billion in assets under management, demonstrating a significant appetite for amplified exposure strategies.

However, traditional leveraged ETFs come with their own set of limitations, primarily institutional barriers, opaque fee structures, and centralized control. Seamless Protocol is betting on replicating and improving upon this model through a fully decentralized structure. This approach eliminates intermediaries, fosters transparency through on-chain operations, and reduces costs by removing traditional institutional overheads.

By delivering complex financial products packaged into simple, accessible tokens, Seamless Protocol empowers any user to hold and manage these strategies directly from their crypto wallet. This aligns perfectly with the core ethos of DeFi: financial inclusivity and self-sovereignty. Users are no longer beholden to banks or brokers; they become their own fund managers, with the power of automated smart contracts working on their behalf.

Stay informed, read the latest crypto news in real time!

In essence, Seamless Protocol is not just offering new tokens; it is building a new paradigm for how users interact with and benefit from advanced DeFi strategies. By simplifying complexity and maximizing accessibility, it stands poised to capture a significant share of the growing demand for sophisticated, yet user-friendly, decentralized financial products. The future of leveraged finance is here, and it’s automated, on-chain, and open to all, thanks to the innovations pioneered by Seamless Protocol.