Bitcoin, long revered as digital gold and a store of value, is rapidly evolving beyond its traditional role. The burgeoning world of decentralized finance (DeFi) on Bitcoin is opening new avenues for the network, transforming its native asset from a passive holding into a productive force within a multi-chain ecosystem. At the forefront of this transformation is Bitlayer, a pioneering DeFi infrastructure startup backed by investment giant Franklin Templeton. Bitlayer has just unveiled its innovative smart contract bridge, BitVM, on the Bitcoin mainnet, marking a significant milestone in making BTC more versatile across diverse blockchain environments.

The Innovation of BitVM Bridge: Unlocking Bitcoin’s Versatility

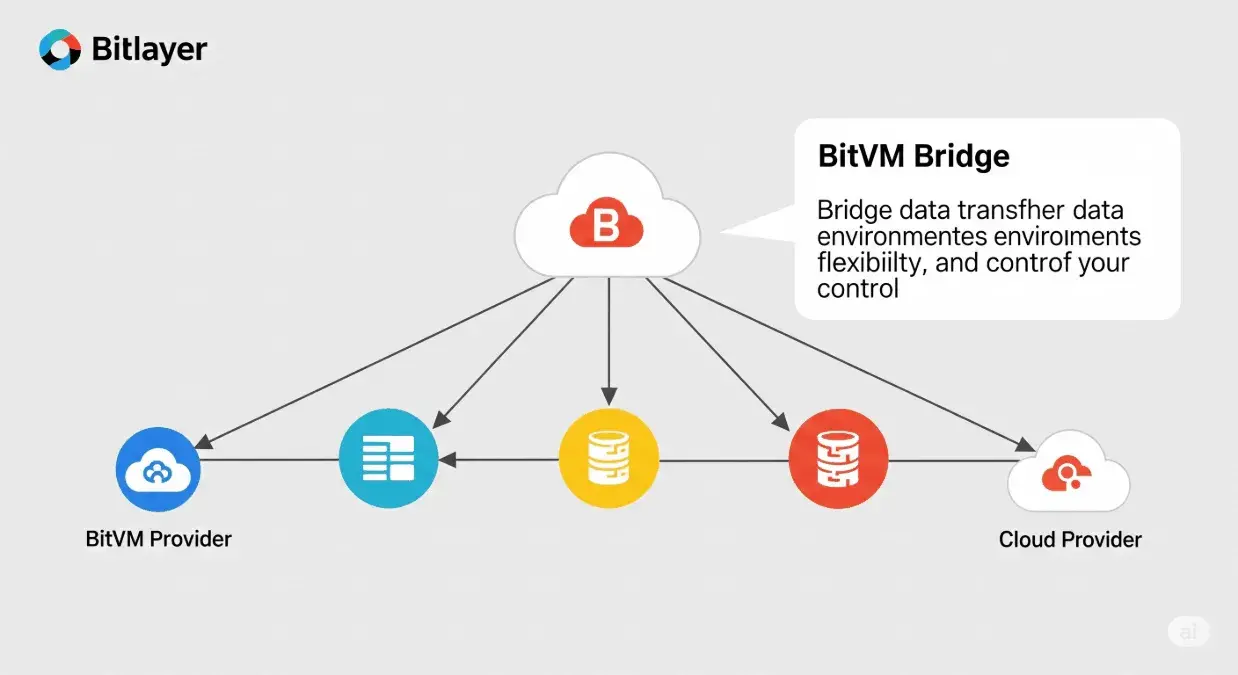

The core purpose of the BitVM Bridge is to enhance Bitcoin’s interoperability and utility within the broader DeFi landscape. This trust-minimized bridge allows users to seamlessly convert their native BTC into Peg-BTC, also known as YBTC. Once converted, this tokenized version of Bitcoin can be utilized across various networks that support advanced DeFi applications, including Sui, Arbitrum, Base, Cardano, and Plume. This mechanism effectively unlocks Bitcoin’s vast liquidity, enabling BTC holders to engage in yield-generating activities, swapping, lending, and other complex financial applications previously unachievable on Bitcoin’s base layer.

The BitVM Bridge protocol operates through a sophisticated, orchestrated process involving several key roles to ensure secure and efficient transfers. A “Peg-in User” locks native BTC into a smart contract on the Bitcoin network and simultaneously mints an equivalent amount of Peg-BTC on the target chain. Conversely, a “Peg-out User” burns their Peg-BTC on the target chain to withdraw the corresponding BTC from the Bitcoin side. To facilitate these transactions, “Brokers” provide short-term liquidity for peg-out requests, while “Vigilantes” actively monitor on-chain activity for fraudulent behavior, initiating challenges if any invalid reclaim requests are detected. This multi-faceted design contributes to the bridge’s robust and trust-minimized architecture.

Single-Signer Security: A Paradigm Shift in Cross-Chain Bridging

Cross-chain bridges have historically been a significant vulnerability point in the blockchain ecosystem, frequently targeted by hackers due to their complex designs and large pools of locked assets. The notorious Wormhole bridge exploit in February 2022 serves as a stark reminder of these risks, resulting in a staggering loss of 120,000 Wrapped Ether (wETH), valued at over $320 million at the time. This incident, caused by the exploitation of a deprecated function that bypassed signature verification, underscored the urgent need for enhanced security in bridging mechanisms.

Unlike many conventional bridges that rely on multi-signature (multisig) models, Bitlayer’s BitVM solution introduces a unique single-signer setup. While multisig models offer security through requiring multiple keys for transaction approval, they can also present larger attack surfaces and potential complexities in managing multiple signers. The BitVM bridge, leveraging the BitVM smart contract framework, employs a trust-minimized design that utilizes a single signer. This approach aims to drastically reduce potential attack vectors and strengthen oversight, providing a more streamlined yet highly secure method for cross-chain asset transfers. The resulting signature appears identical to a single-signature system, enhancing privacy and potentially reducing transaction costs compared to on-chain multisig validations.

Bitlayer’s Growing Momentum and Market Position

Despite being a relatively new entrant, Bitlayer has rapidly gained significant traction within the Bitcoin DeFi space. The protocol has already locked over $384 million on-chain, demonstrating growing user confidence and a strong demand for its services. This impressive growth is further highlighted by the generation of more than $1.7 million in fees in June alone. While it currently trails larger competitors like BabylonChain, which boasts a substantial $5.2 billion in total value locked (TVL), Bitlayer’s rapid ascent underscores increasing confidence and investment in innovative Bitcoin-focused DeFi solutions. This momentum positions Bitlayer as a crucial player in the ongoing expansion of Bitcoin’s utility.

Bitcoin DeFi’s Evolution: Taproot, Ordinals, and Beyond

For years, Bitcoin’s blockchain was primarily known for simple peer-to-peer transactions, lagging behind smart contract-enabled platforms like Ethereum and Solana in DeFi capabilities. However, this narrative is rapidly changing, driven by key technical upgrades and innovative protocols that have expanded Bitcoin’s functionality.

The Taproot upgrade, activated in November 2021, was a pivotal development. It introduced Schnorr signatures, which allow for the aggregation of multiple signatures into a single, compact signature. This not only enhances transaction privacy by making complex multi-signature transactions indistinguishable from simpler single-signature ones but also improves efficiency by reducing transaction size and fees. Taproot, codified by Bitcoin Improvement Proposals (BIPs) 340, 341, and 342, laid crucial groundwork for more complex smart contract applications and decentralized finance on Bitcoin.

Complementing Taproot, the emergence of the Ordinals protocol and Inscriptions in 2023 unlocked novel use cases by enabling users to embed arbitrary data directly onto individual satoshis (the smallest unit of Bitcoin). This innovation paved the way for “Bitcoin NFTs” and other digital artifacts, generating significant network activity and demonstrating new ways to utilize Bitcoin’s robust security and immutable ledger for diverse applications. These developments have energized the ecosystem, leading to the proliferation of approximately 30 active DeFi projects now operating within the Bitcoin ecosystem.

Key Players in the Bitcoin DeFi Ecosystem

Beyond Bitlayer, several other protocols are contributing to the vibrant and competitive Bitcoin DeFi landscape:

- Stacks: As a Layer-2 solution, Stacks extends Bitcoin’s capabilities by introducing smart contracts and decentralized applications without altering Bitcoin’s core protocol. It utilizes a unique Proof of Transfer (PoX) consensus mechanism, which reuses Bitcoin’s Proof of Work to secure its network. Stacks also introduced sBTC, a 1:1 pegged Bitcoin token, allowing BTC holders to participate in its ecosystem, and features its own programming language, Clarity, designed for safety and security. Its “Stacking” mechanism allows STX holders to earn Bitcoin rewards.

- BounceBit: This protocol introduces a pioneering approach to Bitcoin restaking, establishing itself as a native BTC restaking chain. BounceBit leverages a dual-token staking system, securing its network by staking both Bitcoin and its native BounceBit tokens, while also offering full Ethereum Virtual Machine (EVM) compatibility. It enables BTC holders to earn yields through native validator staking, participation in the DeFi ecosystem, and a CeFi mirroring mechanism, ensuring critical infrastructure like bridges and oracles are secured by restaked BTC.

Stay informed, read the latest crypto news in real time!

The Future of Bitcoin in a Multi-Chain World

The growth of Bitcoin DeFi is part of a larger trend in the decentralized finance market, which is projected to expand dramatically, with global market size estimates reaching $231.19 billion by 2030, growing at a CAGR of 53.7% from 2025. As more liquidity shifts toward these innovative tools, bridges like Bitlayer’s BitVM are expected to play an increasingly vital role in keeping Bitcoin relevant and productive in an increasingly interconnected, multi-chain world. By unlocking dormant BTC liquidity and enabling seamless interaction with advanced DeFi applications across different blockchains, Bitlayer is not just participating in Bitcoin’s DeFi evolution, but actively shaping its future, paving the way for a more versatile and programmable Bitcoin ecosystem.

📩 Subscribe Now

Join thousands of crypto readers who stay ahead of the market. 100% Free. No Spam. Unsubscribe anytime.