MEI Pharma’s $100M Litecoin Treasury: A Game-Changer for Institutional Crypto Adoption

In a bold move that’s redefining crypto’s relationship with traditional finance, MEI Pharma, a Nasdaq-listed company known for its pharmaceutical research, has announced a monumental shift in its treasury strategy by committing over $100 million to Litecoin (LTC). Partnering with Titan Partners Group and digital asset heavyweight GSR, MEI Pharma aims to build the first institutional-grade Litecoin treasury—a move that could inspire other listed companies to follow suit.

Litecoin Enters the Big Leagues

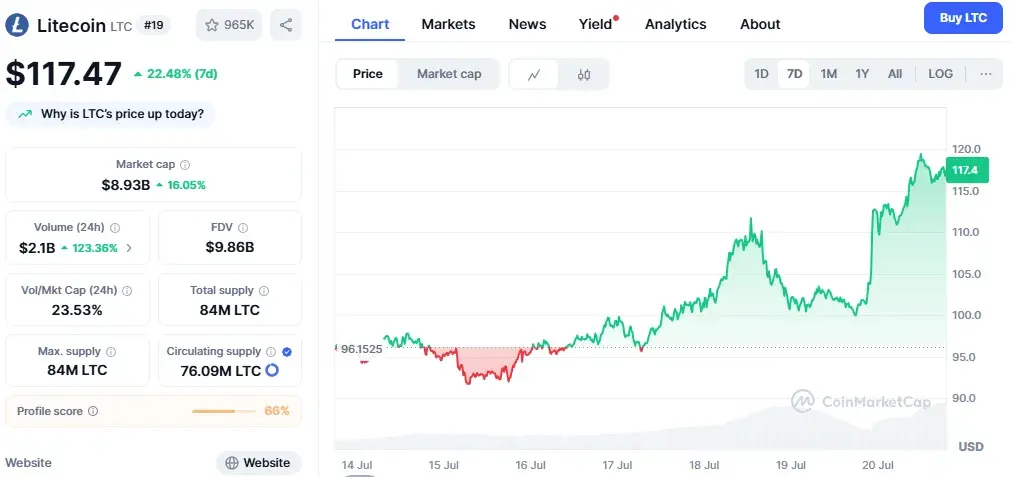

This isn’t just another crypto headline. MEI Pharma’s unprecedented private placement makes Litecoin a primary asset on its balance sheet, signaling increasing trust in digital assets for long-term value storage. The plan coincides with Litecoin’s surge in daily trading volume, which skyrocketed by nearly 96% to $1.88 billion, indicating mounting institutional interest and investor confidence.

With Litecoin priced at $117.55 and its market cap touching $7.19 billion, the timing couldn’t be better for this crypto to enter corporate treasuries. Litecoin’s reputation for reliability and low-cost transactions positions it as a viable alternative to Bitcoin and Ethereum for enterprise use.

Charlie Lee Joins MEI’s Board: Legacy Meets Strategy

The appointment of Charlie Lee, the creator of Litecoin, to MEI Pharma’s Board of Directors reinforces the project’s credibility. Lee, who launched Litecoin in 2011, has consistently advocated for innovation, including SegWit activation and Lightning Network adoption. His experience not only brings credibility but also strategic oversight that could supercharge the integration of LTC into MEI Pharma’s treasury framework.

“For 14 years, Litecoin has consistently delivered a stable, low-cost, and accessible network for millions and over a decade. Already leading global transaction volume on platforms like BitPay, Litecoin is trusted as a legitimate payments alternative for remittance, cross-border and retail. by users and integrated across retail and payments. This partnership with GSR and MEI Pharma brings that utility and mission into an institutional setting for the first time.” – Charlie Lee, Creator of Litecoin.

Lee’s participation signifies a philosophical shift—blending decentralization with corporate governance. His voice on the board will likely help guide MEI Pharma as it navigates crypto market cycles and broader institutional sentiment.

The Litecoin Foundation Invests in MEI Pharma

In a move that shows deep alignment, the Litecoin Foundation has also invested in MEI Pharma. This partnership underscores a shared commitment to advancing Litecoin’s global use cases. With growing traction across platforms like BitPay, Litecoin remains a frontrunner in transaction volume among major crypto payment systems.

This investment goes beyond mere capital—it’s a strategic endorsement. By investing in MEI Pharma, the Litecoin Foundation is pushing LTC into real-world application zones, including healthcare and enterprise finance.

Institutional Muscle: GSR and Titan Partners Group Fuel the Initiative

The collaboration with Titan Partners Group and GSR lends MEI Pharma not just financial support but institutional credibility. GSR’s involvement brings capital markets expertise, strategic insight, and infrastructure support. Their US Chief Strategy Officer, Joshua Riezman, highlighted the move as a clear vote of confidence in Litecoin’s regulatory resilience.

Quynh Ho, Head of Venture Investment at GSR, emphasized how this structure offers a reliable path for institutions to gain exposure to LTC. This partnership provides MEI Pharma the necessary safeguards to integrate crypto assets into its treasury while mitigating volatility and regulatory risk.

Why This Is a Watershed Moment for Corporate Crypto Strategy

Historically, crypto has been seen as volatile, speculative, and perhaps too risky for boardrooms. But MEI Pharma’s initiative challenges this stereotype. By positioning Litecoin alongside conventional financial assets, the company is signaling that crypto can—and should—be part of mainstream corporate finance.

This move sets a precedent. Treasury departments, compliance officers, and CFOs across industries will likely be watching closely. The initiative also opens new questions: Could crypto be the next standard for liquidity management? Will other Nasdaq-listed companies follow MEI Pharma’s lead?

The Broader Market Impact

Litecoin’s nearly 96% jump in trading volume isn’t just noise—it’s indicative of a larger narrative shift. As institutional actors like MEI Pharma, GSR, and Titan Partners Group embrace crypto, we may see LTC evolve from a niche altcoin into a foundational digital asset.

It’s not the first time crypto has flirted with institutional backing, but this strategy feels more committed. Unlike short-term speculative buys, MEI Pharma’s treasury plan appears to be designed for sustainable value creation over time. That could change how LTC is evaluated by analysts and market watchers alike.

MEI Pharma’s Potential Ripple Effect

Although the company’s core business lies in biopharma, MEI Pharma is now staking a claim as a crypto innovator. Its integration of Litecoin into the treasury could inspire other firms—especially those in volatile sectors—to diversify with crypto assets.

The ripple effect may reach beyond finance. Institutions across healthcare, logistics, and even government may start to consider crypto-based treasuries as hedges against fiat depreciation or as tools for faster global payments.

Strategic Risk Management and Compliance

One reason institutional crypto adoption has lagged is the perceived risk around security and regulation. But MEI Pharma’s collaboration with seasoned players like GSR brings a level of compliance and strategic oversight that de-risks crypto exposure.

By setting up proper custodianship, liquidity pools, and governance structures, MEI Pharma can use LTC without compromising its regulatory obligations or financial stability. This roadmap could soon become a blueprint for others interested in crypto treasury deployment.

The Role of Litecoin in the New Financial Era

Litecoin isn’t a stranger to enterprise use. It’s accepted on payment platforms, integrated into wallets, and used in cross-border commerce. But MEI Pharma’s adoption takes its utility to a new level—one where digital assets are no longer experimental but essential.

With its low fees, fast transaction speeds, and strong security track record, Litecoin is uniquely positioned to serve both retail and institutional needs. If more companies adopt similar strategies, we could see LTC emerge as the backbone of decentralized finance infrastructure.

Stay informed, read the latest crypto news in real time!

Final Thoughts: A Strategic Inflection Point

This initiative signals more than just a shift in financial strategy—it reflects a mindset evolution. MEI Pharma is embracing innovation, resilience, and digital transformation. Their partnership with leaders in crypto capital markets and the entry of Charlie Lee into corporate governance combine to create a rare synergy.

While this may be only the beginning, it’s a landmark case for how digital assets like Litecoin can be treated not as fringe experiments but as core financial instruments.