Ki Young Ju, the outspoken founder and CEO of CryptoQuant, has taken a bold and potentially paradigm-shifting stance by openly declaring the long-held Bitcoin cycle theory obsolete. This admission comes after he publicly acknowledged an erroneous bearish prediction earlier this year, when in April, he had warned that Bitcoin’s bull phase was finished with the price hovering near $80,000. Defying these expectations, Bitcoin embarked on one of its strongest rallies in recent memory, smashing through fresh all-time highs and peaking at an impressive $123,236 in July. This sharp divergence from his forecast, rooted in traditional cyclical analysis, has prompted a critical re-evaluation of how the leading cryptocurrency behaves in an increasingly institutionalized market.

Ju contends that the traditional Bitcoin cycle theory, characterized by whales accumulating during downturns and offloading to retail traders in upswings, has fundamentally broken down. He argues that today’s market environment presents a radically different dynamic: established “legacy whales” are now primarily selling their holdings to corporate treasuries, pension funds, and long-term institutional investors. According to Ju, this profound shift in ownership patterns creates a far steadier holder base for Bitcoin, significantly dampening the impact of short-term speculation and traditional boom-and-bust cycles. For many, this re-evaluation marks a pivotal moment, signaling a maturation of the crypto market that demands new analytical frameworks.

Institutional Demand Sparks New Holding Patterns

Recent market data overwhelmingly supports Ju’s argument regarding the burgeoning institutional presence in the crypto space. Large institutions are deepening their involvement with digital assets through significant, long-term Bitcoin and Ethereum purchases, moving beyond mere speculative trading. The Ethereum staking queue, for example, has continued its rapid ascent, surpassing 519,000 ETH locked since January 2024, an amount equivalent to nearly $2 billion. This substantial volume of ETH being locked up and moved off exchanges for staking purposes reflects a strong institutional appetite for yield and long-term participation in network security.

This trend is further amplified by the ongoing wave of U.S. spot Ethereum ETF proposals from major financial players like Fidelity and WisdomTree, following the successful launch of Bitcoin and initial Ethereum ETFs. These regulated investment vehicles are providing traditional financial institutions and their clients with unprecedented access to digital assets, contributing to a more stable and less retail-driven market. This confluence of factors—direct institutional purchases, significant staking activity, and expanding ETF offerings—reflects a maturing market where the volatility associated with traditional retail-driven booms and busts may indeed begin to fade, rendering the classic Bitcoin cycle theory less relevant.

While Ki Young Ju definitively dismisses the four-year cycle, it is important to note that not all analysts share his view. Fidelity’s Jurrien Timmer, a respected voice in traditional finance, recently pointed out that, despite the new market dynamics, Bitcoin’s price movements still exhibit a close alignment with the classic halving-driven cycle. This divergence in expert opinion highlights the ongoing debate within the crypto community regarding the enduring influence of historical patterns versus the transformative power of institutional adoption.

Regulatory Moves and Macro Shifts Shape the Path Ahead

Despite the undeniable growth in institutional support, the global regulatory landscape remains a complex puzzle for crypto expansion. Jurisdictions like South Korea continue to enforce stringent rules, blocking local crypto ETFs from adding more direct crypto assets to their funds, citing outdated regulatory frameworks from 2017. This creates a challenging environment for local institutional adoption and contrasts sharply with the more permissive approaches seen in other major markets.

Adding another layer of complexity, Citadel Securities, a leading market maker in traditional finance, has recently lobbied the U.S. Securities and Exchange Commission (SEC) to resist relaxing guidelines for tokenized equities. While acknowledging the innovation of tokenization, Citadel argues against broad exemptions for “look-a-like” securities, advocating for a level playing field between traditional and tokenized assets to ensure investor protection and market integrity. This push-and-pull between innovation and regulation continues to shape the pace and direction of crypto’s integration into mainstream finance.

Stay informed, read the latest crypto news in real time!

Simultaneously, broader macroeconomic shifts are at play. In the U.S., discussions around potential monetary policy adjustments are gaining traction. Treasury Secretary Benson’s calls for lower interest rates, if realized, could potentially push more capital into risk assets, including cryptocurrencies, as investors seek higher yields in a looser monetary environment. Such macro shifts could provide further tailwinds for Bitcoin and the broader crypto market, regardless of traditional cycle patterns.

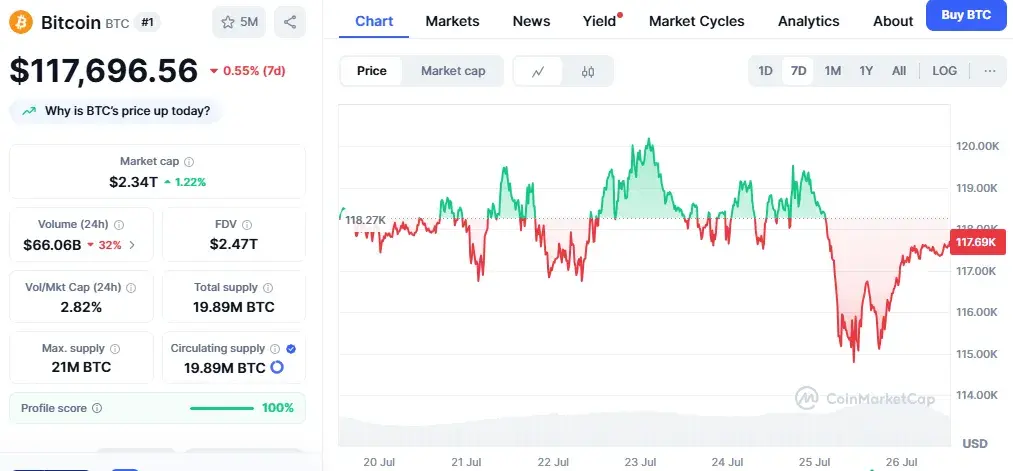

For now, Bitcoin’s price sits at approximately $117,696.51, down 2.16% in the past 24 hours, but still significantly above its April levels. The market is clearly in a new phase of price discovery, grappling with unprecedented institutional involvement and evolving regulatory landscapes. Ki Young Ju’s controversial declaration about the Bitcoin cycle theory underscores the necessity for continuous adaptation and critical re-evaluation of analytical models in a rapidly maturing and increasingly institutionalized digital asset market. The old rules may indeed be giving way to new realities, demanding a fresh perspective from investors and analysts alike.

📩 Subscribe Now

Join thousands of crypto readers who stay ahead of the market. 100% Free. No Spam. Unsubscribe anytime.