Chainlink Reserve: A Strategic On-Chain Reserve Redefining Enterprise Adoption

The launch of the Chainlink Reserve marks a pivotal moment for the Chainlink Network, establishing a strategic on-chain reserve designed to funnel the growing wave of enterprise demand into its native LINK token. This initiative represents a significant evolution in Chainlink’s economic model, solidifying the network’s long-term sustainability and connecting off-chain enterprise revenue directly to the on-chain ecosystem. By creating a transparent, self-sustaining mechanism for token accumulation, the Chainlink Reserve positions the network as an indispensable bridge for traditional finance (TradFi) and the emerging digital economy.

Understanding the Mechanism: How the Reserve Works

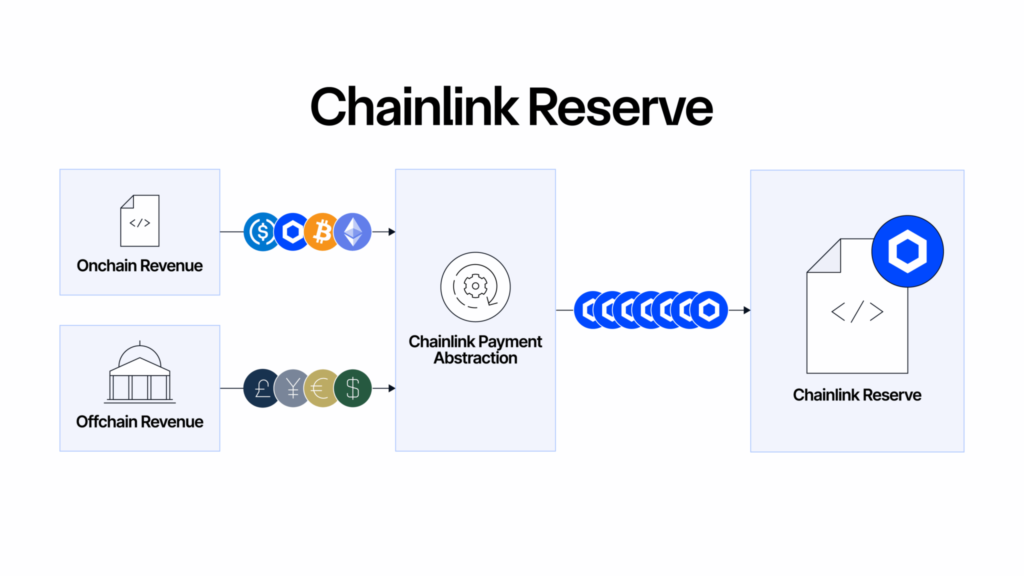

At its core, the Chainlink Reserve is an on-chain smart contract that automatically accumulates LINK tokens. This is achieved through a process called “Payment Abstraction,” which was introduced earlier this year. When large institutions and decentralized applications (dApps) pay for Chainlink’s services, they can do so in their preferred currency, such as a stablecoin or another gas token. Chainlink’s services, including its Price Feeds, Chainlink Automation, and Cross-Chain Interoperability Protocol (CCIP), then programmatically convert these payments into LINK tokens using decentralized exchanges (DEXs). These newly acquired LINK tokens are then deposited into the Chainlink Reserve.

This innovative approach serves a dual purpose. First, it streamlines the payment process for enterprise clients, who are often more comfortable transacting in fiat-pegged stablecoins. Second, it creates a constant, organic demand for the LINK token, ensuring that as the adoption of Chainlink’s services grows, so too does the value and security of the network. The reserve is built entirely from these converted payments and is meant to fund long-term growth and help secure the network, creating a powerful flywheel effect where network usage directly strengthens the network’s economic foundations.

Connecting Off-Chain Revenue to On-Chain Value

The introduction of the Chainlink Reserve provides a clear and transparent answer to a crucial question: how will off-chain enterprise revenue translate into on-chain value for the Chainlink ecosystem and its token holders? As Chainlink co-founder Sergey Nazarov stated, “The launch of the Chainlink Reserve marks a pivotal evolution in Chainlink, establishing a strategic LINK reserve funded using off-chain revenue, as well as from on-chain service usage.”

For years, Chainlink has been a quiet force in the background of the crypto world, powering tens of trillions of dollars in on-chain value across DeFi, banking, and real-world assets (RWAs). This has generated hundreds of millions of dollars in revenue, much of which has come from large enterprises paying off-chain for access to the Chainlink Platform. The Chainlink Reserve now formalizes the process of bringing this value on-chain, ensuring that the network’s success is directly reflected in its native token’s utility and economic security. This is particularly relevant as the industry moves toward greater tokenization of real-world assets, a trend that is expected to create an acceleration in the adoption of Chainlink services.

Institutional Partnerships and the Growing Ecosystem

The launch of the Chainlink Reserve is perfectly timed to coincide with a surge in institutional adoption. The provided text highlights two major examples: Mastercard and JPMorgan.

Mastercard Partnership: Bridging Billions of Cardholders

Chainlink’s collaboration with Mastercard is a testament to its role as a secure connectivity layer for both traditional finance and the on-chain economy. This partnership allows Mastercard cardholders to purchase crypto assets directly on-chain using a streamlined process. Under the hood, this involves a complex integration of services: Shift4 for card processing, zerohash for fiat-to-crypto conversion, and a decentralized exchange like Uniswap for the final token swap, all orchestrated by Chainlink’s secure interoperability infrastructure. This initiative is about more than just transactions; it’s about removing the barriers that have historically kept mainstream users from accessing the on-chain economy. By making crypto purchases as simple as a card swipe, Chainlink and Mastercard are paving the way for mass adoption, a move that will inevitably drive further demand for Chainlink’s services and, by extension, contribute to the growth of the Chainlink Reserve.

JPMorgan and Kinexys: Enabling Cross-Chain Payments

Another critical partnership is with JPMorgan, whose Kinexys Digital Payments platform is linked to Ondo Chain using Chainlink’s technology. This collaboration is focused on enabling cross-chain Delivery vs. Payment (DvP) transactions, a core settlement mechanism in securities trading. The Chainlink Runtime Environment (CRE) orchestrates a seamless settlement between JPMorgan’s permissioned blockchain-based payment network and a public RWA blockchain like Ondo Chain. This “first-of-its-kind” transaction demonstrates how different blockchain networks can securely interact for real-world asset tokenization. The success of such a pilot project signals JPMorgan’s interest in extending its institutional payment platform into the burgeoning market of tokenized assets. As more major financial institutions follow suit, the demand for Chainlink’s robust, secure interoperability solutions will only grow, creating a positive feedback loop for the Chainlink Reserve and its LINK holdings.

The Long-Term Vision: Economic Sustainability and Security

The Chainlink Reserve is more than just a treasury; it is a fundamental component of Chainlink’s long-term economic model, known as Chainlink Economics 2.0. This framework aims to create a virtuous cycle of adoption and value capture. The reserve’s initial balance of over $1 million worth of LINK is just the beginning. Chainlink has stated that it does not expect any withdrawals for “multiple years,” allowing the reserve to grow steadily over time. This long-term commitment to growth and sustainability is a powerful signal to the market.

Furthermore, the reserve enhances the security of the network. The accumulation of LINK in this strategic reserve increases the economic security of the network by making it more costly for malicious actors to attempt to manipulate the oracle services. A larger reserve balance, funded by real-world and on-chain usage, directly translates into a more secure and reliable network. This reinforces Chainlink’s position as the industry’s most trusted decentralized oracle network, securing hundreds of billions of dollars in on-chain value across a wide range of applications, from DeFi protocols to stablecoins and tokenized assets.

To ensure community visibility and transparency, Chainlink has published a public dashboard to track the reserve’s balance, which can be found at reserve.chain.link. The reserve contract on Etherscan is also publicly available for anyone to audit. This level of transparency is crucial for building trust and community confidence in the initiative, a core tenet of the decentralized ethos. The dashboard provides a real-time view of the reserve’s growth, allowing the community to witness firsthand how enterprise adoption is directly contributing to the network’s long-term health and sustainability.

Stay informed, read the latest crypto news in real time!

Conclusion: The New Era of a Self-Sustaining Network

In conclusion, the launch of the Chainlink Reserve is a watershed moment for the Chainlink ecosystem. By creating a strategic on-chain reserve funded by both on-chain and off-chain revenue, Chainlink has effectively created a powerful, self-sustaining economic engine. This initiative not only simplifies the payment process for enterprises but also provides a clear and transparent mechanism for translating enterprise adoption into tangible value for the LINK token and the overall network. As major players like Mastercard and JPMorgan continue to leverage Chainlink’s infrastructure to bridge the gap between traditional finance and the decentralized world, the Chainlink Reserve is poised to grow, reinforcing the network’s security, stability, and its position as the global standard for Web3 services.