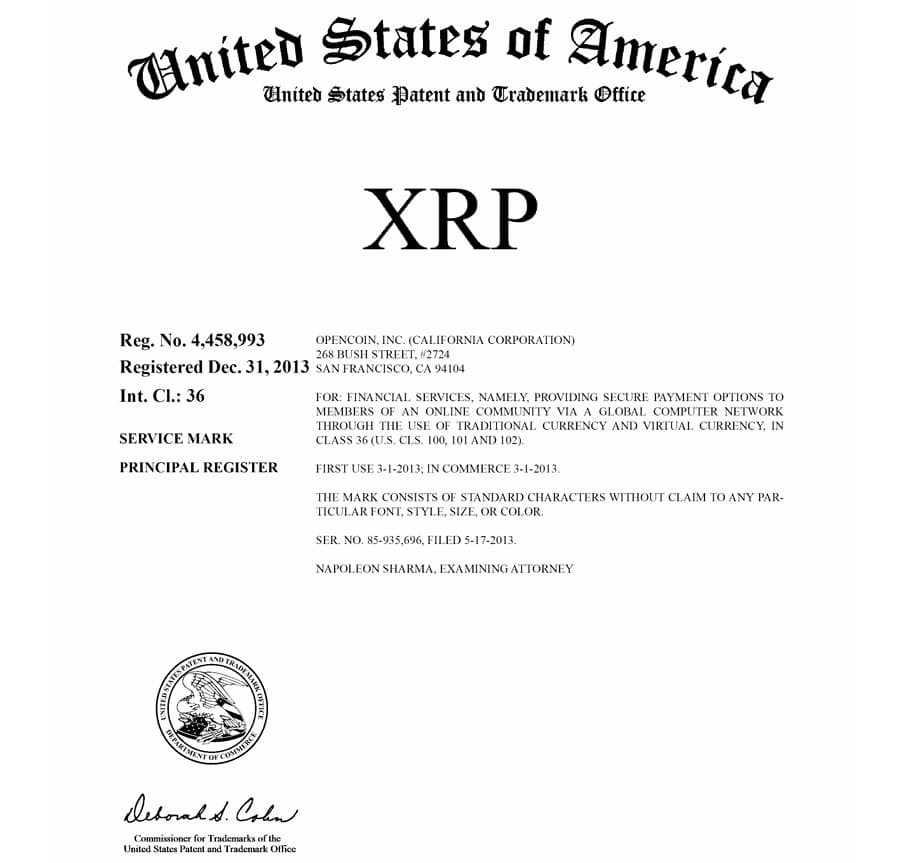

In the fast-paced and often speculative world of cryptocurrency, old news can sometimes have a surprisingly powerful second life. This has been particularly true in the case of a decade-old United States trademark registration for “XRP,” which has recently resurfaced, sparking a fresh wave of debate and confusion across social media and crypto forums. The certificate, originally issued on December 31, 2013, by the U.S. Patent and Trademark Office (USPTO) under Registration Number 4,458,993, has been incorrectly interpreted by some as definitive proof that XRP had received official U.S. government approval as a regulated payment method. This narrative, however, is a fundamental misinterpretation of what a trademark truly is and what it signifies.

The frenzy surrounding this piece of ripple labs news underscores a broader challenge within the digital asset community: distinguishing between brand protection and regulatory approval. While the resurfaced document is indeed authentic, a deeper look reveals that it serves as a service mark for financial dealings and not as government recognition of the token as a currency or a regulated payment network. This distinction is critical, especially in the context of Ripple Labs’ ongoing legal battles, which have brought the very classification of XRP into question.

Decoding the 2013 Trademark Filing

To understand why this trademark is not a smoking gun for XRP’s legal status, it’s essential to examine the details of the filing itself. The application was initially filed on May 17, 2013, by OpenCoin, Inc., the company that would later become Ripple Labs. The filing was made under International Class 36, a category reserved for financial services. The description of the trademark indicated that XRP was intended for “providing secure payment options to members of an online community via a global computer network through the use of traditional currency and virtual currency.”

On the surface, this description seems to align perfectly with XRP’s modern utility as a tool for cross-border payments. However, the legal purpose of the filing was not to secure government approval for the token itself. Rather, it was to secure the name “XRP” in standard characters as a service mark. A service mark is a legal term that protects a brand name used in connection with services. This is no different from how financial giants like Mastercard or Visa trademark their names to prevent others from using them in a way that could confuse consumers. It protects the brand, not the underlying technology or its regulatory status.

Trademark vs. Regulatory Approval

The confusion stems from a lack of understanding of the U.S. intellectual property and regulatory systems. A trademark is a form of intellectual property that a company files to protect its brand, words, or symbols. The USPTO’s role is to ensure that the trademark is unique and does not infringe on existing marks. It does not evaluate the product or service itself for regulatory compliance.

Conversely, a regulatory body like the Securities and Exchange Commission (SEC) or the Financial Crimes Enforcement Network (FinCEN) determines the legal status of an asset. The SEC’s claim against Ripple is that it sold XRP as an unregistered security, an “investment contract,” from 2013 onwards. This is a very different legal question from whether Ripple Labs had the right to use the name “XRP” for a financial service. The trademark filing, in this context, does not provide a legal defense for the sale of XRP as a security; it only shows that as early as 2013, Ripple Labs was positioning XRP as a service mark for a financial offering.

Why Is This Old News Resurfacing Now?

The timing of this old ripple labs news is not a coincidence. It is likely fueled by several factors, including the ongoing SEC lawsuit and a desire among some in the XRP community to find evidence that validates their position. The debate in the cryptocurrency space has been particularly heated, and with every development in the SEC case, speculation runs rampant. The resurfacing of an official government document, even if its purpose is misunderstood, provides a sense of validation for those who believe XRP is a currency.

Social media platforms and crypto-focused news sites play a significant role in this phenomenon. A single post from a community member or influencer can go viral, leading to widespread misinterpretation and the spread of misinformation. While the original text provides factual information, the context is often lost in a retweet or a quick summary. This is a common pattern in a market driven by sentiment and fueled by a 24/7 news cycle.

The Role of Ripple Labs in the Early Days

The trademark filing also provides a historical snapshot of Ripple Labs’ early vision. The records indicate that the company made its first commercial use of XRP on March 1, 2013, a full two months before the trademark application was filed. This shows that the company was actively developing and deploying the technology from the very beginning. The description in the trademark, “secure payment options across global networks using both digital as well as conventional currencies,” is a testament to the fact that Ripple’s core business model has remained consistent over the years.

However, the legal environment for cryptocurrencies in 2013 was vastly different from today. There was no clear regulatory framework, and the SEC had not yet brought its first enforcement actions against crypto issuers. This lack of clarity meant that companies like Ripple operated in a gray area, making business decisions based on their interpretation of existing laws. The trademark filing reflects this early-stage approach, where the focus was on building a brand and a network, while the legal classification of the underlying asset remained an open question.

Stay informed, read the latest crypto news in real time!

Conclusion: A Lesson in Nuance

In the end, this episode serves as a powerful reminder of the importance of nuance in the cryptocurrency world. While a piece of old ripple labs news may seem like a major breakthrough, it’s crucial to look beyond the headlines and understand the underlying facts. The 2013 trademark registration for “XRP” is a valuable historical document that proves Ripple Labs’ long-standing vision for its financial services. It shows that the company had the foresight to protect its brand and position itself as a key player in the digital payments space.

However, the trademark filing is not and was never a government endorsement of XRP’s status as a payment method. It did not grant it the same legal standing as the U.S. dollar, and it does not resolve the central debate in the ongoing SEC lawsuit. The debate over XRP’s status will ultimately be decided in court, not in the USPTO’s archives. For now, the resurfacing of this old document simply provides more fuel for the fire, highlighting the persistent speculation and the need for greater regulatory clarity in the digital asset industry.

Steven Andros is a crypto enthusiast whose main goal is to tell everyone about the prospects of Web 3.0. His love for cryptocurrencies began in his student years, when he realized the obvious advantages of decentralized money over traditional payments. Email: [email protected]