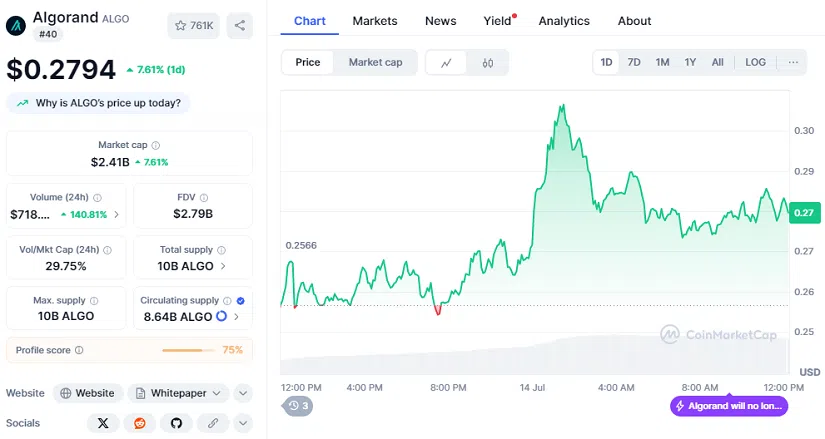

Algorand (ALGO), a blockchain often discussed for its technological prowess and institutional appeal, has suddenly burst into the spotlight with an impressive 11% surge, reclaiming a four-month peak. This significant price action has propelled ALGO to trade at $0.2794, after briefly touching $0.31, sparking renewed interest in an altcoin that had largely remained range-bound for months. Despite this notable climb, the market remains a battleground, with a considerable number of traders still betting short as derivatives activity spikes, hinting at a potentially volatile path ahead.

The underlying strength of Algorand’s recent move is undeniable. Daily trading volume for ALGO has skyrocketed by an astonishing 140% to over $718 million, clearly indicating a substantial influx of capital back into the token. This surge in volume suggests that buyers are re-engaging with conviction, a sentiment further corroborated by Coinalyze data. For two consecutive days, the “Buy Sell Delta” has been positive, signifying a greater aggression from spot buyers than sellers. Specifically, ALGO recorded over 111 million in Buy Volume against approximately 110 million in Sell Volume, demonstrating steady demand even amidst quick profit-taking by some holders.

This sudden resurgence has caught many off guard. For a blockchain that prides itself on its energy-efficient Pure Proof-of-Stake (PPoS) consensus mechanism, designed to offer high throughput and instant finality, this kind of volatile price action is a double-edged sword. While it attracts attention and liquidity, it also invites speculative trading, potentially overshadowing the fundamental developments that long-term believers champion.

Derivatives Market Heats Up: A Double-Edged Sword

The increase in spot buying is mirrored, if not amplified, in the derivatives market. According to CoinGlass, Algorand’s Open Interest (OI), which represents the total number of outstanding derivative contracts, surged by an impressive 54.85% to hit $163 million. Concurrently, Futures Volume exploded by an astounding 575% to nearly $981 million. These figures are a clear testament to the heightened activity among futures traders, who are actively opening fresh positions, likely to capitalize on short-term price swings.

However, a closer look at the Long/Short ratio, currently standing at 0.9837, reveals a nuanced picture. This ratio indicates that short sellers are still very much present and actively testing the resilience of the bullish momentum. It suggests that while there’s significant buying interest, there’s also a strong contingent betting on a price reversal, leading to a tug-of-war that could dictate Algorand’s immediate trajectory. This interplay between bullish spot buying and persistent short interest creates an environment ripe for significant price fluctuations. The market is effectively weighing the long-term potential of Algorand against the short-term profit-taking impulses of traders.

Profit-Taking and Technical Caution

The notion of immediate profit-taking is further reinforced by on-chain data. Exchange Netflow, which tracks the movement of tokens onto and off exchanges, showed $3.14 million in inflows on July 13th, though this eased to $480K shortly thereafter. Positive Netflow typically suggests that investors are moving their tokens to exchanges, often signaling an intent to sell if prices appreciate too rapidly. This behavior can act as a natural ceiling, preventing Algorand’s price from rocketing too quickly without healthy corrections.

Technical indicators also paint a picture of caution, despite the bullish momentum. The Relative Strength Index (RSI), a popular momentum oscillator, sits at 83.18. A reading above 70 is generally considered “overbought” territory, implying that the asset’s price has risen too much too quickly and might be due for a pullback. Complementing this, the Stochastic RSI is maxed out at 100, reinforcing the highly overbought conditions. These indicators collectively suggest that while the current buying pressure is strong, a rapid correction could ensue if bulls lose their grip, or if short sellers gain confidence.

From a technical perspective, if buyers can maintain their strength and overcome the current overhead resistance, the next target for Algorand is $0.34. This level would represent a significant psychological and technical hurdle. Conversely, any signs of weakness could see ALGO retrace to $0.25, a level where previous buying interest has historically stepped in to provide support. The coming days will be crucial in determining whether the bulls can sustain this newfound momentum or if profit-takers will force a consolidation or even a deeper correction.

Algorand’s Enduring Appeal and Future Outlook

Beyond the immediate price action and trading dynamics, Algorand maintains a compelling appeal for long-term investors. With a current market capitalization of $2.41 billion, Algorand continues to foster a steady stream of partnerships, particularly within the burgeoning decentralized finance (DeFi) space and various Central Bank Digital Currency (CBDC) experiments. Its commitment to an energy-efficient blockchain design, through its Pure Proof-of-Stake consensus mechanism, remains a significant differentiator in an increasingly environmentally conscious world. This design minimizes computational power requirements, making it a “green” alternative that aligns with growing global sustainability efforts.

This focus on efficiency and scalability positions Algorand as a potential key player in future institutional projects, which demand robust, reliable, and environmentally sound blockchain infrastructure. The ongoing development of its ecosystem, including advancements in real-world asset (RWA) tokenization and multichain interoperability, further strengthens its fundamental value proposition. Recent reports highlight a surge in Algorand adoption rates, indicating a growing interest in its ecosystem and utility, despite prior price stagnation. The growth in Total Value Locked (TVL) within its DeFi protocols and an increase in active addresses underscore the organic expansion of its network.

Stay informed, read the latest crypto news in real time!

As the summer trading season heats up, all eyes will be on Algorand. Can it sustain this impressive push and break through the technical resistances that lie ahead, driven by its fundamental strengths and growing adoption? Or will short-term profit-taking and the overbought technicals lead to a temporary cooling-off period? The coming weeks will be a pivotal test for Algorand, revealing whether this recent surge is the start of a sustained uptrend or merely a temporary peak in a volatile market. The interplay of speculative trading and foundational growth will ultimately determine the altcoin’s path forward.

📩 Subscribe Now

Join thousands of crypto readers who stay ahead of the market. 100% Free. No Spam. Unsubscribe anytime.