Almost nobody pays crypto taxes. This is the conclusion reached by the Swedish tax company Divly in a new study. However, the working methods of the investigation possibly caused a badly distorted impression.

Recommendation: Tax crypto profits in Germany: How to reduce taxes

No one pays crypto taxes?

The proportion of crypto investors who pay statutory taxes on their cryptocurrencies is vanishingly small – so small that it could be argued that almost nobody pays them.

This is the finding of Divly in the new Global Cryptocurrency Taxation Report 2022 study . According to estimates by Swedes, a tiny 0.53 percent of crypto investors globally pay proper taxes.

Most users avoid ever notifying tax authorities that cryptocurrencies are private wealth, the report said.

The Swiss rarely pay taxes on crypto

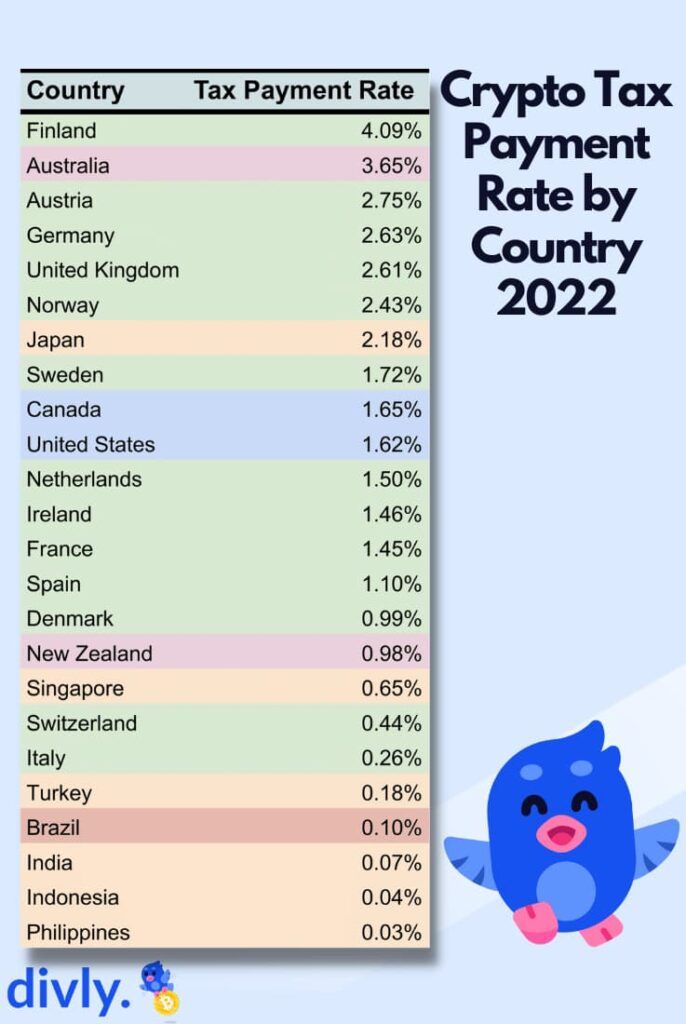

Divly split the estimate into individual countries. In absolute numbers, it is assumed that most tax payments on crypto profits were made in the USA by number. In percentage terms, however, the Americans are only in the middle with 1.62 percent.

On the other hand, most law-abiding citizens are believed to be in Finland, where, according to estimates by the Swedes, at least 4.09 percent of investors pay taxes. This is followed by Australia with 3.65 percent and Austria with 2.75 percent of the users.

The statistics contain 24 different countries of the Asian, European and American continents. Compared to other European countries, the Swiss rarely pay taxes on their profits.

Switzerland is second to last in Europe. Divly estimates the proportion of taxpayers here at 0.44 percent. In Europe, only Italy can undercut this value with 0.26 percent.

Three Asian countries bring up the bottom globally: India, Indonesia and the Philippines. The tax takes place here by 0.07 to 0.03 percent of the investors. This trend is catching on globally.

Although very few people pay taxes on crypto in percentage terms in North America and Europe, the two continents are significantly above average in an international comparison, while Asia even undercuts the average. Most law-abiding citizens Divly suspects in Oceania.

Why crypto taxes are so often avoided

The fact that crypto taxes are so often avoided has to do with various points. Many jurisdictions only require levies when an exchange is made in a currency.

Many crypto users hold their cryptocurrencies and do not exchange them. Other people pay for products or services using cryptocurrencies. Often this is a tax event that people may ignore due to poor traceability.

Anyone who trades crypto may only exchange it for other cryptos. Here, too, pseudonymity and anonymity could result in few users being willing to pay taxes.

In addition, there are various loopholes depending on the jurisdiction. In Germany, due to a one-year holding period , it is even possible to generally waive tax payments for Bitcoin and altcoin.

Possibilities of concealment, legal ambiguity and a lack of state structures can, according to Divly, promote the arbitrary waiver of taxes.

Therefore Divly’s data could be wrong

The accuracy of Divly’s report is very difficult to assess. The company used various data to make the estimates. This includes, for example, the search volume of various crypto terms from specific countries on Google.

However, Divly cannot make fact-based statements about the proportion of taxpayers. Since these are only very rough estimates, the information could be far from reality.