Arbitrum Explodes: Yapyo Presale and Robinhood Rumors Ignite Massive Rally

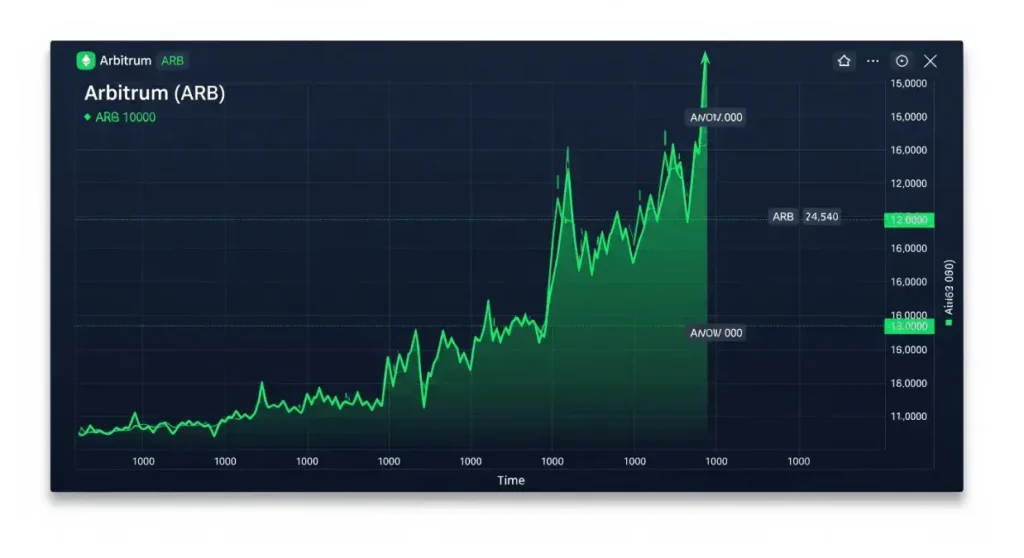

The cryptocurrency market is a dynamic landscape, constantly shaped by technological advancements, community engagement, and strategic partnerships. In a recent dramatic turn, Arbitrum, a leading Layer 2 scaling solution for Ethereum, witnessed an extraordinary 14% surge in a single day, captivating the attention of investors and enthusiasts alike. This remarkable upward movement was primarily driven by two potent catalysts: the highly anticipated presale of Yapyo, a new SocialFi platform, and swirling rumors of a groundbreaking partnership with financial giant Robinhood.

The confluence of these events propelled Arbitrum’s trading volume to an astounding $770 million, marking a staggering 590% increase from the previous day. This surge underscores the growing confidence in Arbitrum’s ecosystem and its potential to reshape the decentralized finance (DeFi) and social finance (SocialFi) landscapes.

The Yapyo Effect: A SocialFi Catalyst Ignites Demand

At the heart of Arbitrum’s recent rally lies the excitement surrounding Yapyo. Yapyo is an innovative SocialFi platform, poised to conduct its highly anticipated presale directly on the Arbitrum network. SocialFi, short for Social Finance, represents the convergence of social media and decentralized finance, aiming to empower users by giving them greater control over their data, content, and the potential to monetize their social interactions within a decentralized framework.

The presale event immediately triggered a massive demand for specific digital assets: Arbitrum’s native token, ARB, along with USDC and ETH. These assets are crucial prerequisites for participants eager to join the Yapyo presale, creating a significant buying pressure that directly translated into ARB’s price appreciation. The mechanism of a crypto presale involves offering tokens to early investors at a discounted rate before they become publicly available on exchanges. This incentivizes early adoption and helps projects raise initial capital. In Yapyo’s case, launching on Arbitrum not only leveraged the network’s efficiency but also directed a flood of capital and interest directly into the ARB ecosystem.

This enthusiastic participation pushed Arbitrum to an intraday high of $0.3891, a significant recovery after its price dipped below $0.26 in June. While the token currently trades around $0.3523, market analysts are now optimistically eyeing the $0.50 mark as a feasible target if the current momentum persists in the coming days.

Technical Analysis: A Bullish Structure Emerges

Beyond the immediate market excitement, the technical indicators for Arbitrum paint a largely bullish picture. The token has successfully broken out of a descending consolidation pattern that had constrained its price action for some time. This breakout is a strong signal for traders, often indicating a potential reversal from a downtrend to an uptrend.

On short-term charts, ARB maintains a distinctly bullish structure, suggesting a continuation of its upward trajectory. Key resistance levels for traders to monitor are identified at $0.3828, $0.4009, and $0.4229. A sustained breach of these levels could confirm further bullish momentum, potentially paving the way towards the $0.50 target. While market movements are inherently unpredictable, these technical milestones provide a roadmap for understanding potential price action.

Robinhood Partnership: Speculation Takes Flight

Adding another layer of intrigue to Arbitrum’s rapid ascent are widespread rumors of a potential strategic partnership with Robinhood, the popular U.S. financial services company. The speculation centers on the development of a new blockchain platform, specifically designed to simplify U.S. stock trading for European investors.

These rumors gained considerable traction following the confirmation of a meeting scheduled in Cannes, involving representatives from both Arbitrum and Robinhood, alongside Ethereum co-founder Vitalik Buterin. Such a high-profile gathering, especially with Buterin’s involvement, lends significant weight to the partnership speculation. A collaboration with a mainstream financial platform like Robinhood could be a game-changer for Arbitrum, offering a gateway to a massive retail investor base and potentially driving significant adoption of its Layer 2 technology for traditional financial services. This could position ARB as a critical component in bridging the gap between traditional finance and the decentralized world.

Institutional Accumulation and Ecosystem Expansion

The recent price action in ARB is not solely driven by retail frenzy. There’s clear evidence of increased institutional activity, signaling deeper confidence in Arbitrum’s long-term prospects. A notable instance includes a multisig wallet linked to Gelato, a prominent web3 infrastructure provider, transferring 20 million ARB tokens to GSR, a leading crypto market maker. Subsequently, GSR moved approximately 9.5 million tokens to Binance, indicating what appears to be a systematic accumulation strategy by institutional players. This systematic accumulation suggests a long-term bullish outlook from well-capitalized entities, adding a layer of stability and legitimacy to the current rally.

Furthermore, the positive sentiment has permeated through the broader Arbitrum ecosystem. Native tokens within the network have also experienced significant rallies. For example, GRAIL, the native asset of Camelot DEX, a decentralized exchange operating on Arbitrum, jumped a remarkable 34%. This surge is largely attributed to Yapyo’s decision to launch its presale exclusively on Camelot DEX, creating a positive feedback loop within the Arbitrum ecosystem and benefiting associated projects. This demonstrates the interconnected nature of the DeFi landscape and how a significant event like a popular presale can create ripple effects across the network.

Arbitrum’s Robust Network Indicators

A deeper look into Arbitrum’s fundamental metrics reinforces its position as a dominant Layer 2 solution. The network’s Total Value Locked (TVL) has continued its impressive upward trend, now standing at a robust $2.5 billion. TVL represents the total amount of digital assets currently staked or locked within a DeFi protocol, serving as a key indicator of a network’s health and user engagement.

Equally impressive is Arbitrum’s stablecoin capitalization, which has surpassed $3.3 billion. This figure signifies a lead of over $1 billion against other prominent Layer 1 and Layer 2 competitors such as Polygon, Sui, Avalanche, and Aptos. A high stablecoin capitalization suggests significant liquidity and a strong foundation for DeFi activities, making the network attractive for users and developers alike.

The network’s user base is also experiencing healthy growth, with 440,000 active addresses recorded in the past week alone, marking a substantial 20% increase since May. This consistent growth in active addresses points to increasing utility and adoption of the Arbitrum network for various decentralized applications and services.

Navigating Potential Volatility: Technical Cautions

While the overall outlook for Arbitrum appears highly positive, certain technical indicators suggest that traders should remain vigilant for potential short-term volatility. A notable concern is the presence of a liquidity cluster at the $0.29 mark. Should buying pressure weaken, this cluster could act as a magnet, potentially triggering pullbacks as prices are drawn towards this level where many orders are concentrated.

Additionally, the Chaikin Money Flow (CMF) indicator, which measures the accumulation and distribution of an asset over a given period, currently displays a bearish divergence. A bearish divergence occurs when the price of an asset makes higher highs, but the CMF indicator makes lower highs. This discrepancy signals declining capital inflows and could indicate that the buying momentum is weakening, potentially foreshadowing a correction or a period of consolidation. While not a definitive sell signal, it suggests caution and careful monitoring of market dynamics.

Stay informed, read the latest crypto news in real time!

Conclusion: A Promising Future with Cautionary Notes

Arbitrum’s recent surge, driven by the Yapyo presale and tantalizing Robinhood partnership rumors, firmly establishes its position as a formidable force in the crypto landscape. The robust growth in its network metrics – including TVL, stablecoin capitalization, and active addresses – underscores its fundamental strength and increasing utility. Institutional interest further validates the long-term potential of ARB.

However, the crypto market remains inherently volatile. While the bullish structure and ambitious price targets are exciting, the technical signals from the liquidity cluster and the bearish divergence in the CMF serve as important reminders for investors to exercise caution. Diligent monitoring of these indicators, alongside a keen eye on broader market sentiment and the progress of its strategic initiatives, will be crucial for navigating Arbitrum’s exciting, yet potentially bumpy, journey ahead. The coming weeks will undoubtedly be pivotal in determining whether ARB can sustain its momentum and truly unlock its full potential.