Bitcoin has once again defied expectations, soaring to an unprecedented all-time high of $118,000. While this milestone ignites excitement in the spot market, a closer look at the derivatives landscape, specifically the options market, reveals a palpable sense of caution among traders. This disparity between bullish spot sentiment and bearish options expectations hints at a potentially divided market poised for significant movements.

The Options Market: A Signal of Apprehension

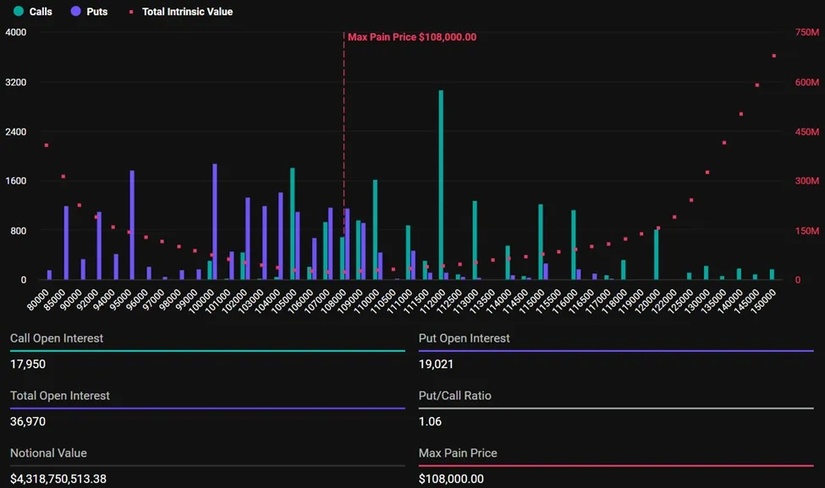

The recent surge to $118,000 might seem like an unbridled triumph, but the underlying sentiment in the options market suggests otherwise. Options expiring today, with a substantial notional value of $4.3 billion, exhibit a Put/Call ratio of 1.06. This ratio is a critical indicator: a value above 1 signifies a higher volume of put (sell) contracts relative to call (buy) contracts. In essence, a significant portion of sophisticated traders in the options market is hedging against, or actively betting on, a potential price pullback in the immediate future. This cautious stance stands in stark contrast to the exuberance seen in the spot market, creating a compelling narrative of conflicting expectations.

Max Pain and Technical Pressure

Further contributing to the cautious outlook is the “max pain” point, identified by data from Deribit at $108,000. The max pain theory suggests that the price of an underlying asset at expiration will gravitate towards the strike price where the largest number of options contracts (both puts and calls) will expire worthless, causing the maximum financial loss for option buyers. While a controversial theory, it often establishes a psychological pressure point for the market as expiry approaches, potentially influencing short-term price action. The current max pain point below the all-time high suggests a downside magnet for the price.

Moreover, the derivatives space is witnessing an alarming rise in extreme leverage. Platforms like Greeks.Live have reported trades with margins reaching up to 500x. Such aggressive strategies, though representing a minority of positions, underscore the speculative fervor permeating the market. While offering amplified potential gains, they also expose traders to magnified losses in a highly volatile environment. This increased leverage, coupled with the buildup of bearish contracts, intensifies the technical pressure in the derivatives sector, making the market susceptible to sharp price swings.

A Market Divided: Spot Optimism vs. Options Caution

The resilience observed in the spot market, where Bitcoin continues to find strong buying interest at record levels, presents a fascinating dichotomy with the apprehension in the options market. The rise of the Put/Call ratio above 1 has historically coincided with “overbought” episodes, where the asset’s price has risen rapidly, leading some to believe it is due for a correction. In these scenarios, options often serve as a crucial hedging mechanism, allowing traders to protect their portfolios against potential downturns after significant price rallies.

The current landscape is characterized by high open interest and a concentrated presence of bearish positions. This creates a technically tense situation. If Bitcoin manages to extend its rally beyond current levels, these bearish derivatives could trigger a “short squeeze”—a phenomenon where a rapid increase in price forces traders with short positions to buy back the asset to limit their losses, further fueling the upward momentum. Conversely, if the price begins to retreat, the extensive leverage exposure of numerous traders could dramatically heighten volatility, potentially leading to cascading liquidations and a sharper correction.

Navigating the Crossroads: What Lies Ahead?

The Bitcoin market finds itself at a pivotal juncture, where the thrill of achieving new record highs coexists with explicit technical signals advocating for prudence. The coming days are critical and will likely dictate the market’s immediate trajectory. Will the relentless bullish momentum of the spot market prevail, pushing Bitcoin even higher? Or will the cautionary signals from the options market and the inherent risks of extreme leverage force a significant adjustment of positions, paving the way for a new consolidation phase?

Stay informed, read the latest crypto news in real time!

The interplay between spot market dynamics and derivatives activity will be key to understanding Bitcoin’s next move. Traders and investors are keenly observing this delicate balance, as the choices made now will determine whether Bitcoin continues its ascent or experiences a healthy, albeit potentially volatile, recalibration.

📩 Subscribe Now

Join thousands of crypto readers who stay ahead of the market. 100% Free. No Spam. Unsubscribe anytime.