CoinMarketCap Launches Proof of Reserves Feature

Data platform CoinMarketCap introduces a Proof of Reserves feature. Although the leading crypto exchange expects this to increase trust, the current situation continues to draw attention to a lack of transparency.

CoinMarketCap Releases Proof of Reserves Feature

CoinMarketCap (often CMC ) is one of the leading data aggregators in the crypto industry. The website went online in 2013. Next to CoinGecko, CMC is the most popular place to find crypto market data and understand the token economy of nearly 22,000 cryptocurrencies.

The portal is now introducing a Proof of Reserves function, following the expectations of Binance founder Changpeng Zhao ( CZ ). After the FTX crash , he campaigned for better transparency in the industry.

Officially, it was said, he wants to protect end users. He secretly hopes that this step will also increase the popularity of his own crypto exchange Binance .

From now on, under the “ Exchanges ” tab on CoinMarketCap, you will not only find a list of different crypto exchanges, but also their crypto reserves. Next to the vendor’s name, participating agents have three stacked coins with a green check mark.

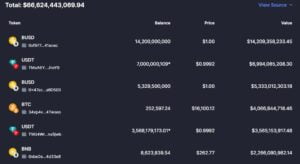

If you click on this area, you end up with the financial reserves of the provider. There you can then see which system has the largest part of the reserve, how many coins are available and what the equivalent value is in your desired fiat currency.

Some big players are already making their data available. In addition to Binance, KuCoin, Bitfinex, OKX, Huobi and Crypto.com, among others.

How to read the Proof of Reserves on CMC?

Listed are individual wallets on which the cryptocurrencies are located, which are mostly owned by the customers of the trading platforms. That is why their existence is so important. When a crypto exchange embezzles assets or sells cryptos that don’t actually exist, a bank run leads to illiquidity. Customers can then no longer access their money.

On the left side of the table you can see two symbols. The larger symbol shows the respective coin or token. The smaller symbol represents which blockchain this cryptocurrency exists on.

The sources can be found at the top of the table on the right-hand side. There, as a user, you can see where CMC gets its data from. Because crypto exchanges split assets across different wallets for security reasons, a cryptocurrency can be listed multiple times on the same blockchain.

Proof of Reserves on CMC illustrates lack of transparency

The allegedly complete transparency of the reserves has so far been a sham on both of the crypto exchanges. These include Binance and KuCoin. Although the providers list the market leaders Bitcoin and Ethereum reliably, they struggle with smaller independent projects.

There are currently hundreds of tokens in the proof of reserve, mostly on the Ethereum blockchain. For example, the independent cryptocurrencies Solana and Monero are not listed once on either crypto exchange.

In addition, there is no comparison with the liabilities. It is therefore not clear whether the respective crypto exchange actually holds the complete investments of its users.