Cross-Chain Bridges: The Essential, Yet Risky, Infrastructure of Crypto Interoperability

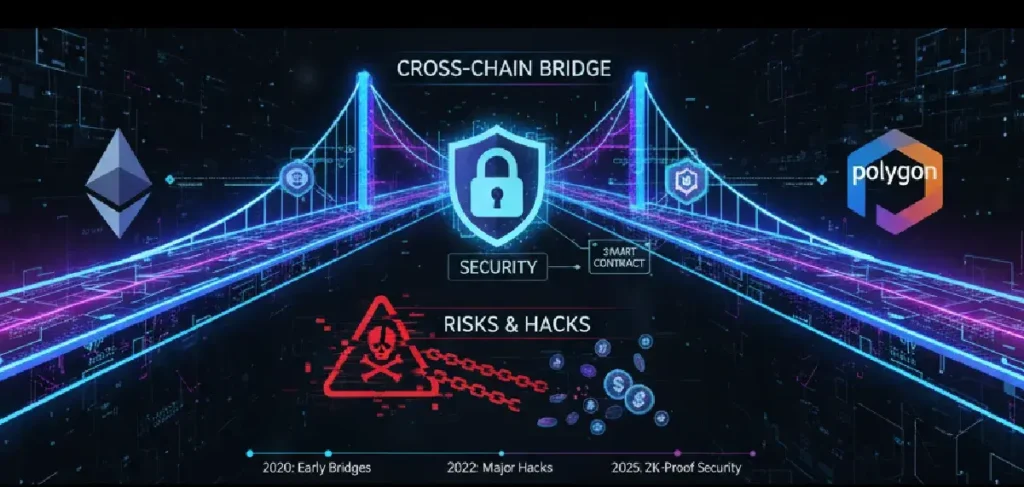

The blockchain landscape is no longer a single, monolithic entity. It’s a vibrant, multi-chain universe where thousands of distinct networks—Ethereum, Solana, Polygon, Avalanche, and others—exist side-by-side. This fragmentation, while fostering innovation, presents a critical challenge: interoperability. How do you move an asset or data from Chain A to Chain B when they use different protocols, languages, and consensus mechanisms?

The answer lies in cross-chain bridges crypto.

These protocols are the foundational infrastructure of a connected Web3. They act as the vital connective tissue, allowing users to unlock liquidity, leverage different network benefits, and generally move assets freely across the fragmented ecosystem. However, this essential role comes with a significant caveat: cross-chain bridges crypto have become the single largest attack vector in the decentralized finance (DeFi) world, resulting in billions of dollars lost to sophisticated bridge hacks blockchain.

This article will delve into the mechanics of these crucial tools, explore their immense benefits, dissect the inherent risks, and highlight the lessons learned from the most high-profile security breaches.

How Cross-Chain Bridges Work: The Mechanics of Interoperability

A cross-chain bridge is essentially a mechanism that facilitates the transfer of tokens or data between two separate, otherwise incompatible, blockchain networks. They generally operate using one of two primary methods to ensure that assets maintain their value and are not double-spent across different chains.

The Lock-and-Mint Mechanism

This is the most common model, often used for transferring native tokens to other chains.

- Lock: A user wants to move their native asset (e.g., Ether on Ethereum) to a different chain (e.g., Polygon). They send their Ether to a smart contract vault on the source chain (Ethereum), which locks the assets.

- Verify & Relay: The bridge’s security mechanism (often a set of validators, oracles, or a specific protocol) verifies the locking event on the source chain. A message confirming the transaction is then relayed to the destination chain.

- Mint: On the destination chain (Polygon), an equivalent amount of a “wrapped” or mirrored token (e.g., wETH) is minted and sent to the user’s address. This wrapped token is now usable within the destination chain’s ecosystem, backed 1:1 by the original, locked asset.

When the user wants to return the asset, the wrapped token is burned on the destination chain, triggering the release and unlocking of the original asset from the smart contract vault on the source chain.

The Liquidity Pool Mechanism

Some bridges use decentralized liquidity pools to facilitate instant swaps. Users deposit one asset into a pool on the source chain and receive an equivalent asset from a corresponding pool on the destination chain. This is less about minting wrapped assets and more about facilitating a direct, cross-chain exchange, though it still relies on mechanisms to balance the pools and ensure fairness.

The Unrivaled Benefits of Cross-Chain Bridges

Despite the well-publicized risks, cross-chain bridges crypto are an indispensable technology for the growth of Web3. Their core benefits unlock possibilities that single-chain ecosystems simply cannot provide.

Unlocking Liquidity and Capital Efficiency

One of the most significant advantages is the pooling of resources. Before bridges, assets were trapped on their native chains, creating liquidity silos. Bridges allow capital to flow freely, making tokens from one chain accessible to the DeFi applications on another. This boosts overall market efficiency and depth, as liquidity can be deployed where it yields the best returns.

Enhanced Scalability and Reduced Costs

Blockchains like Ethereum can suffer from high transaction fees and network congestion during peak demand. Newer or Layer-2 chains (like Arbitrum or Optimism) offer much faster throughput and cheaper transactions. Bridges allow users to move assets from a high-cost chain to a low-cost, high-speed chain to interact with dApps, effectively offloading transaction volume and improving the overall scalability of the entire crypto ecosystem.

Fostering True Interoperability and Innovation

Cross-chain bridges crypto enable true application interoperability. A developer can build a protocol that leverages the security of Ethereum, the speed of Solana, and the specialized functions of a third chain. This allows for complex, multi-chain applications (dApps) that combine the unique strengths of various networks, paving the way for creative financial products and expanded use cases.

Bridge Hacks Blockchain: The Security Trade-Off

The same complexity that makes bridges powerful—coordinating transactions across multiple disparate chains—also creates massive security challenges. Bridges have become a massive target for hackers because they act as giant honey pots, custodializing enormous amounts of locked capital. According to Chainalysis, billions of dollars have been stolen from bridge protocols in the last few years, making crypto bridge explained security a top industry priority.

The Attack Surface Vulnerabilities

The multi-chain nature of bridges creates an expanded attack surface, where a vulnerability in one component can compromise the entire system.

1. Centralization Risks and Validator Compromise

Many bridges rely on a small, centralized set of validators (or a multi-signature wallet) to confirm transactions. If a simple majority of these private keys are compromised, attackers can approve fraudulent transactions and drain the locked funds.

- Case Study: The Ronin Bridge Hack: In March 2022, the Ronin Network bridge, which connected to the Axie Infinity game, was exploited for over $625 million. The attackers gained control of five out of nine validator keys—a simple majority—by using social engineering to compromise an employee of Sky Mavis (the developer). This demonstrated the catastrophic risk of a centralized validator set.

2. Smart Contract Flaws

The core logic of a bridge is governed by complex smart contracts. Any bug, error, or logic flaw in the code—especially in the functions that handle locking, minting, or burning tokens—can be exploited. Attackers can trick the contract into minting unbacked assets or releasing locked funds without proper authorization.

- Case Study: The Wormhole Hack: In February 2022, a hacker exploited a smart contract vulnerability in the Wormhole bridge, allowing them to mint 120,000 wETH on the Solana network without locking any corresponding Ether on the Ethereum side. The loss totaled $325 million, though the parent company later stepped in to replenish the funds.

3. Economic and Custodial Risk

Bridges hold the “backing” assets that give wrapped tokens their value. If the bridge’s vault is compromised, the wrapped tokens on the destination chain instantly become unbacked and effectively worthless, causing an economic collapse for all users holding those tokens. This is the inherent custodial risk of the lock-and-mint model.

Fortifying the Future: Cross Chain Security Measures

The frequency of bridge hacks blockchain has forced the industry to rapidly innovate its cross chain security posture. The goal is to move from “trusted” bridges (which rely on external validators) to “trustless” solutions (which rely purely on cryptography and immutable code).

Moving to Trustless Verification

The future of secure interoperability lies in removing the human element and centralized trust assumptions.

Zero-Knowledge Proofs (ZK-Bridges)

ZK-Bridges use advanced cryptography to verify that a state change (like a lock or a burn) has occurred on one chain without needing external validators to see the underlying data. This provides a mathematically certain, trustless form of verification, significantly shrinking the attack surface.

Decentralized Validator/Relayer Systems

Protocols are increasing the number of independent validators and implementing more robust key management systems like Multi-Party Computation (MPC). MPC distributes the private key shards among numerous parties, ensuring that no single compromised entity can authorize a fraudulent transaction. This is a crucial step for improving cross chain bridges crypto security.

Mitigating Risk through Architecture

Beyond cryptography, architectural improvements are being deployed to prevent catastrophic losses.

Circuit Breakers and Time-Locks

Circuit breakers are an essential safety mechanism that automatically pause bridge operations when abnormal activity (like a massive, unauthorized withdrawal) is detected. Similarly, time-locks for large transfers introduce a mandatory waiting period, giving developers a window of opportunity to intervene and prevent fund theft.

Formal Verification and Audits

With the complexity of multi-chain logic, rigorous security is paramount. Formal verification—a mathematical proof that a system’s code correctly meets its specifications—is becoming a standard practice, alongside continuous, in-depth third-party security audits.

Stay informed, read the latest crypto news in real time!

Conclusion: Bridging to a Secure Multi-Chain World

Cross chain bridges crypto are a necessary evil—a piece of infrastructure that is both essential for innovation and fraught with significant risk. The vision of a truly interconnected, multi-chain Web3 cannot be realized without them.

While the history of bridge hacks blockchain is a costly reminder of the industry’s growing pains, it has served as a powerful catalyst for change. As developers transition from easily compromised trusted models to robust, trustless, and mathematically verifiable cross chain security architectures, the bridges of the future will be less like makeshift pontoons and more like fortified, high-speed tunnels, safely connecting the diverse ecosystems of the decentralized world. Users must, however, remain vigilant, always prioritizing bridges that are audited, highly decentralized, and have proven security track records.