The financial landscape for digital assets in the United States has just witnessed a significant evolution with the ETF ProShares Ultra XRP securing approval from the U.S. Securities and Exchange Commission (SEC) for listing on NYSE Arca. This landmark decision not only broadens the spectrum of regulated cryptocurrency investment vehicles but also marks a pivotal moment for leveraged crypto products in the highly regulated American market. For years, crypto enthusiasts and institutional investors alike have clamored for more accessible and compliant ways to gain exposure to the volatile yet potentially lucrative digital asset space. This new offering from ProShares represents a major stride in that direction, bridging the gap between traditional finance and the burgeoning world of decentralized currencies.

Understanding the ProShares Ultra XRP ETF (UXRP)

The newly approved ProShares Ultra XRP ETF, set to trade under the ticker UXRP, is poised to become a notable addition to NYSE Arca’s growing roster of futures-based crypto offerings. What sets this fund apart is its unique approach to providing exposure to XRP. Unlike direct ownership of the underlying digital asset, UXRP offers investors 2x daily leveraged exposure to XRP through a sophisticated structure primarily utilizing futures contracts and swaps. This mechanism allows the fund to replicate the price behavior of XRP, amplifying daily returns (or losses) without requiring investors to directly hold or manage the intricacies of owning XRP tokens themselves. This distinction is crucial for many traditional investors who may be deterred by the complexities of digital wallets, exchanges, and the associated security risks of direct crypto custodianship.

The methodology behind futures-based ETFs has become increasingly common, particularly following the successful introductions of similar products linked to Bitcoin and Ethereum. However, the approval of UXRP significantly expands the leveraged futures market to XRP, which currently stands as the world’s sixth-largest digital asset by market capitalization. This move is indicative of a maturing regulatory environment and a growing acceptance of a broader range of cryptocurrencies within established financial frameworks. For many active traders and institutional strategists, the UXRP offers an attractive new avenue to amplify their XRP-centric strategies within a regulated and familiar investment structure. It provides a means to capitalize on short-term price movements, either bullish or bearish, without the operational overhead associated with spot trading.

XRP’s Market Dynamics and Regulatory Context

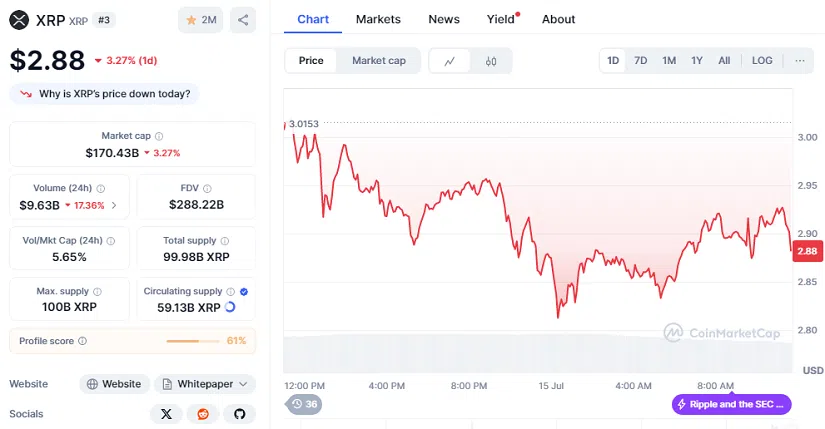

Despite the considerable buzz surrounding the launch of the ETF ProShares Ultra XRP, XRP’s price experienced a slight dip, falling 3.27% in the last 24 hours to $2.88 at the time of reporting. This momentary decline left its total market capitalization at approximately $170.43 billion. Market analysts attribute this short-term price fluctuation to a combination of factors, including typical profit-taking maneuvers by traders anticipating the ETF launch and broader crypto market volatility. This volatility is often influenced by macroeconomic factors and, significantly, by ongoing regulatory developments in Washington, D.C., which continue to reshape the legislative landscape for digital assets. The crypto market often reacts sensitively to perceived shifts in regulatory sentiment, and the current period is no exception.

The timing of the UXRP launch is particularly interesting as it coincides with “Crypto Week” in the U.S. capital, a period during which American lawmakers are actively engaged in deliberations over key legislative measures pertinent to the digital asset space. Bills such as the Clarity Act and the Anti-CBDC Surveillance State Act are under consideration, underscoring the government’s efforts to establish a comprehensive regulatory framework for cryptocurrencies. As these policy debates continue, interest in regulated crypto investment products remains robust. Many industry observers and participants anticipate that new ETFs, like the ETF ProShares Ultra XRP, will act as catalysts, driving fresh trading volume to XRP futures markets and injecting much-needed liquidity for traders seeking leveraged exposure in a compliant and regulated manner. The confluence of regulatory discussions and new product launches creates a dynamic environment, setting the stage for potentially significant shifts in how digital assets are integrated into mainstream finance.

The Future of Leveraged Crypto ETFs

ProShares, a pioneer in the ETF space, is not stopping with UXRP. The firm has publicly signaled its intention to follow up this initial offering with two additional XRP-focused products, further expanding the array of choices for sophisticated traders. These include the Short XRP ETF (XRPS), designed to deliver -1x daily returns, and the UltraShort XRP ETF (RIPS), which targets -2x exposure to XRP’s price movements. Both XRPS and RIPS are strategically designed for traders who aim to profit from downward price trends in XRP, offering tools for hedging or speculating on market downturns. While neither of these inverse or ultra-inverse funds has cleared final listing hurdles yet, July 18 has been floated as a potential debut date, indicating ProShares’ aggressive push into this specialized market segment.

The increasing popularity of leveraged and inverse ETFs among active traders is undeniable, driven by the allure of amplified short-term gains. These instruments provide powerful tools for market participants who possess a deep understanding of market dynamics and are comfortable with heightened risk. However, it is crucial to emphasize that these funds inherently carry elevated risks due to mechanisms like daily rebalancing and compounding effects. Daily rebalancing means that the fund resets its leveraged exposure each day, which can lead to significant divergence from the underlying asset’s cumulative performance over longer periods, especially in volatile markets. Compounding effects can further amplify both gains and losses. Consequently, these products are generally better suited for experienced market participants with short-term trading horizons and robust risk management strategies, rather than passive or long-term investors. They are complex financial instruments that require careful consideration and a thorough understanding of their mechanics.

Implications for the XRP Ecosystem and Broader Crypto Market

The launch of the UXRP is expected to have multifaceted implications for the XRP ecosystem. Firstly, it provides enhanced visibility and legitimacy to XRP by bringing it into the fold of regulated U.S. financial products. This could attract a new wave of institutional investors who have previously been hesitant to engage directly with cryptocurrencies due to regulatory uncertainties. Secondly, by offering leveraged exposure, the ETF can significantly increase trading activity and liquidity in the XRP futures market, potentially leading to more efficient price discovery. This increased liquidity can benefit all market participants, from individual traders to large institutions.

Furthermore, the approval of the ETF ProShares Ultra XRP sets a precedent for other altcoins and specialized crypto products. As regulators become more familiar with and confident in the structures of futures-based crypto ETFs, it paves the way for similar offerings for other digital assets. This gradual integration of cryptocurrencies into traditional financial products could accelerate the mainstream adoption of digital assets and decentralize finance (DeFi) in general. However, it also underscores the growing need for investor education regarding the risks associated with these complex instruments, particularly leveraged products.

Stay informed, read the latest crypto news in real time!

For now, all eyes remain fixed on NYSE Arca as the financial world eagerly awaits the official “green light” for UXRP’s inaugural day of trading, which is widely anticipated to occur later this week. Its performance and the subsequent regulatory and market reactions will undoubtedly offer valuable insights into the evolving relationship between traditional finance and the dynamic world of digital assets. This moment signifies not just the launch of a new product, but a step forward in the maturation and institutionalization of the cryptocurrency market.

📩 Subscribe Now

Join thousands of crypto readers who stay ahead of the market. 100% Free. No Spam. Unsubscribe anytime.

2 thoughts on “ETF ProShares Ultra XRP: Ushering in a New Era for Leveraged Crypto Investments”