Ethena Labs’ USDe Stablecoin Surges Past $6 Billion, Bolstering DeFi Confidence

CryptoQuorum

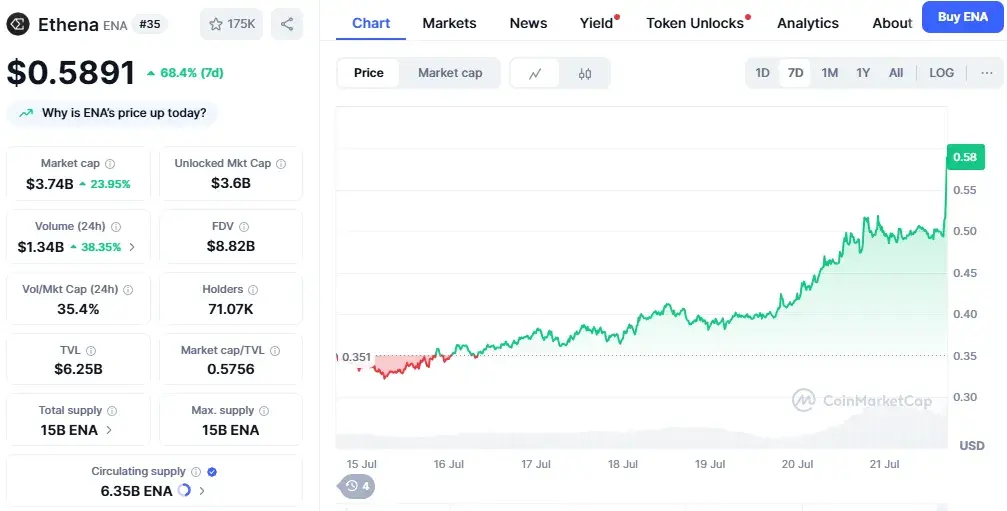

The decentralized finance (DeFi) landscape is witnessing a significant milestone as Ethena Labs’ flagship stablecoin, USDe, has officially crossed the $6 billion mark in circulation. This rapid expansion, confirmed by Etherscan data on July 20th, solidifies USDe’s growing relevance for traders and protocols actively seeking flexible, yield-generating instruments within the decentralized ecosystem. Simultaneously, the ENA token, Ethena Labs’ governance and utility asset, has surged impressively by 41.6% in just seven days, now trading at approximately $0.5891 with a market capitalization of $3.68 billion. This dual growth fuels optimism among crypto enthusiasts who view synthetic stablecoins as increasingly vital for on-chain liquidity and innovative yield strategies.

The journey of synthetic dollar alternatives, particularly USDe, in gaining trust across decentralized ecosystems worldwide has been remarkable this year. This latest milestone serves as a robust testament to their growing acceptance and utility, significantly boosting confidence among users and liquidity providers alike. The ability of Ethena Labs to scale its synthetic dollar offering so rapidly underscores the market’s appetite for stable, yet flexible, digital assets that operate outside traditional banking structures.

ENA Token’s Surge Signals Growing DeFi Appetite

The impressive ascent of Ethena Labs’ governance and utility token, ENA, mirrors the robust performance of its USDe stablecoin. Climbing an impressive 41.6% over the past week and posting a modest 1.4% gain in the last 24 hours alone, ENA’s rally reflects strong investor conviction in Ethena Labs’ unique approach to on-chain liquidity and synthetic dollar exposure. Its current market capitalization of $3.17 billion places it firmly among the significant players in the DeFi space, signaling a renewed confidence in decentralized stablecoins that can maintain dollar parity without relying on typical collateral models.

Market watchers attribute this significant uptick in ENA’s price to a confluence of factors. Synthetic designs like USDe offer more flexible liquidity provisioning and enhanced capital efficiency, a combination that has proven highly attractive to both risk-tolerant yield farmers seeking outsized returns and larger institutional players beginning to explore DeFi rails. These participants are increasingly recognizing the potential of Ethena Labs to deliver a scalable and censorship-resistant digital dollar solution.

The consistent upward movement of the ENA token also highlights how participants are strategically positioning themselves ahead of anticipated governance upgrades and expanded use cases within the Ethena Labs ecosystem. As the protocol matures, ENA holders are expected to play an increasingly pivotal role in shaping its future direction, further incentivizing long-term commitment.

A broader macro-economic sentiment also seems to be playing a role. When influential figures like Janet Yellen remark that the “dollar is going on-chain,” many in the crypto community interpret this as an indirect nod to the inevitable role that synthetic stablecoins will play alongside traditional banking structures. This high-level acknowledgment, even if indirect, can significantly boost market sentiment and validate innovative approaches like that taken by Ethena Labs.

The Unique Mechanism of USDe: A Deeper Dive

Unlike traditional fiat-backed stablecoins that rely on centralized reserves held in bank accounts (like USDC or USDT), USDe by Ethena Labs is a synthetic dollar. Its peg stability is maintained through a delta-neutral hedging strategy. This involves combining spot positions of crypto assets (primarily liquid staked Ethereum, such as stETH) with an equal and offsetting short position in perpetual futures markets on derivatives exchanges.

Here’s a simplified breakdown:

- Minting USDe: When a user mints USDe, they provide crypto collateral (e.g., stETH). Ethena Labs simultaneously opens a corresponding short perpetual futures position for the same notional dollar value. This hedging minimizes the price change risk of the backing asset, as the change in value of the backing asset is generally offset by the change in value of the hedge.

- Off-Exchange Settlement: Crucially, the backing assets for USDe are held off-exchange, in transparent and auditable custody accounts with partners like Fireblocks and Copper. This minimizes counterparty risk and ensures censorship resistance, a core tenet of decentralized finance. Ethena Labs delegates, but never transfers custody of, these backing assets to derivatives exchanges for margin.

- Yield Generation: The Ethena Labs protocol generates revenue from three primary sources:

- Funding and Basis Spread: Earnings from the delta-hedging derivatives positions.

- Liquid Staking Rewards: Rewards earned from the underlying liquid staked ETH assets (e.g., stETH yields).

- Stablecoin Rewards: Yields generated from the underlying stablecoin collateral (if used).

This multi-faceted revenue generation allows Ethena Labs to offer a crypto-native, reward-accruing asset, sUSDe (staked USDe), providing users with an “Internet Bond” that delivers competitive yields. This innovative approach distinguishes USDe from other stablecoins and positions it as a highly attractive instrument for DeFi participants.

Regulation and Innovation Shape Synthetic Dollar Future

The rapid ascent of synthetic assets like USDe naturally brings questions about their regulatory future. As policymakers worldwide grapple with the complexities of digital assets, recent trends suggest that regulators will maintain a close watch on liquidity flows and potential systemic risks associated with rapid supply growth. The lessons learned from previous stablecoin de-pegging events, particularly with algorithmic stablecoins, are fresh in their minds.

However, this increased regulatory attention is not necessarily a negative. A more defined and clearer legal framework could, paradoxically, open doors for mainstream capital to enter the DeFi space with greater confidence. Clear regulations could provide the necessary certainty for large institutions to onboard significant capital, pushing DeFi further into everyday financial activity. The balance between fostering innovation and ensuring financial stability will be key for regulators.

Investors are also keenly observing the potential for new partnerships with major protocols, which could further fuel integrations and create fresh incentives for developers and liquidity providers to engage with Ethena Labs. The strength of an ecosystem is often measured by its network effects and interoperability. With daily trading volumes for USDe spiking and more protocols actively integrating it, Ethena Labs appears well-positioned to capture a growing slice of the decentralized dollar market in the coming months. This expansion will not only enhance USDe’s utility but also strengthen the overall resilience and adoption of the Ethena Labs ecosystem.

Stay informed, read the latest crypto news in real time!

The journey of Ethena Labs and its USDe stablecoin epitomizes the dynamic and innovative spirit of decentralized finance. By addressing core needs for liquidity and yield generation with a novel approach, Ethena Labs is not just responding to market demand but actively shaping the future of on-chain money. As the digital asset landscape continues to evolve, the role of synthetic stablecoins like USDe will undoubtedly remain a focal point for both innovators and regulators.