Gold-Backed Tokens Shine as Digital Safe Havens Amidst Global Turmoil

The year 2025 has unfolded with a stark divergence in the cryptocurrency market, highlighting the growing importance of stable assets in an increasingly unpredictable global landscape. While flagship cryptocurrencies like Bitcoin and Ethereum have weathered significant declines, a niche but rapidly expanding sector – gold-backed tokens such as Tether Gold and PAX Gold – has not only defied the downturn but has thrived, registering impressive gains of over 30% year-to-date. This remarkable performance underscores their emerging role as a critical refuge, particularly in the wake of renewed geopolitical tensions, most notably the Israel-Iran conflict.

The allure of these crypto assets, intrinsically tied to a tangible commodity like gold, has been significantly amplified by the prevailing market conditions. As global markets reacted swiftly to Israel’s recent military strike on Iranian targets, a palpable shift in capital flows became evident. Investors, seeking to shield their portfolios from the prevailing uncertainty and volatility, gravitated towards assets traditionally perceived as safer havens. This phenomenon wasn’t confined to physical gold; its digital equivalents, powered by blockchain technology, experienced a parallel surge, solidifying their position as vital tools for capital preservation in today’s volatile environment.

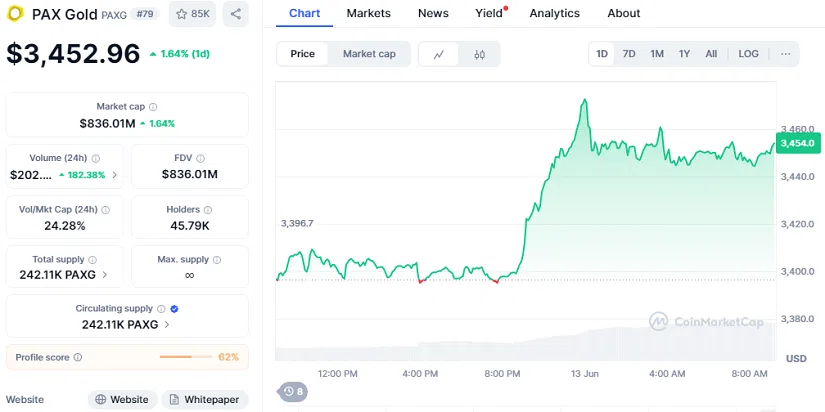

Currently, PAX Gold stands at a robust $3,452.96, showcasing a healthy 24-hour gain of +1.64% and boasting a substantial market capitalization of $836.01 million. Meanwhile, Tether Gold is priced at $3,430.01, marking a +1.44% increase on the day, with its market cap closely following at $845.58 million. These figures are not merely impressive in isolation; they represent a significant outperformance against Bitcoin and Ethereum in year-to-date metrics, firmly establishing PAX Gold and Tether Gold as some of the top crypto investments of 2025. Their resilience and upward trajectory stand in stark contrast to the broader crypto market, which has been grappling with considerable selling pressure and investor anxiety.

Gold-Backed Tokens: A Beacon of Stability in Crypto

The fundamental strength of gold-backed tokens lies in their unique hybrid nature. They ingeniously combine the time-honored solidity and intrinsic value of a physical commodity – gold – with the cutting-edge efficiency, transparency, and accessibility afforded by blockchain technology. This potent synergy creates an asset class that mitigates the extreme volatility often associated with unbacked cryptocurrencies, offering a more stable and predictable investment vehicle. So far in 2025, PAX Gold has garnered an impressive gain of over 31.4%, while Tether Gold has appreciated by more than 30.9%. These robust returns cement their status as two of the most profitable and secure crypto options available this year, especially when viewed against the backdrop of a declining broader market.

In stark contrast to the upward trajectory of gold-backed tokens, the cryptocurrency giants have faced a challenging period. Bitcoin, after nearing a new all-time high, experienced a sharp descent, dropping to $102,953 and losing considerable momentum. Ethereum, the second-largest cryptocurrency by market capitalization, endured an even steeper decline, reflecting the widespread selling pressure gripping the market. The extent of this pressure was clearly illustrated by key on-chain metrics, such as negative net taker volume on Binance and a Taker Buy/Sell Ratio falling below one, indicating a predominance of sell orders. The market witnessed over $450 million in liquidations as panic selling cascaded through the ecosystem, leaving many investors reeling.

This dramatic market divergence has led some analysts to predict a continued migration of investors towards backed assets in the coming weeks, especially if geopolitical instability persists. The appeal of these tokens is not limited to institutional players or seasoned crypto investors; retail investors are also increasingly recognizing their value for portfolio diversification and risk reduction. In an environment where traditional safe havens are increasingly intertwined with global political dynamics, the digital rendition of gold offers a novel and effective means to preserve capital and maintain liquidity. Tether Gold, in particular, has become a focal point for those seeking stability.

The inherent benefits of gold-backed tokens go beyond mere price appreciation. Their blockchain-based nature ensures high liquidity, allowing investors to buy and sell with ease, almost instantaneously, without the complexities and delays often associated with transacting in physical gold. Furthermore, the transparency of blockchain technology provides an auditable trail for the gold reserves backing these tokens, instilling greater trust and confidence among investors. The ability to fractionalize ownership of gold, a feature inherent in these tokens, also democratizes access to gold investment, making it accessible to a wider range of investors, irrespective of their capital size. Tether Gold exemplifies this accessibility, opening up new avenues for investors.

Solid Crypto Investing Amid Geopolitical Uncertainty

The exceptional performance of gold-backed tokens, including Tether Gold, serves as a compelling testament to how financial innovation can seamlessly merge with traditional assets to deliver tangible, real-world value. In periods of heightened global stress and economic uncertainty, these instruments prove invaluable in helping investors protect their purchasing power while simultaneously preserving the critical liquidity and autonomy that define digital currencies. They offer a compelling alternative to traditional financial instruments, which can sometimes be cumbersome or susceptible to centralized control.

Moreover, the rising tide of institutional adoption of gold-backed tokens signals a broader market recognition of their intrinsic value beyond mere speculative trading. Both traditional financial investors, long accustomed to established asset classes, and crypto natives, deeply embedded in the decentralized finance (DeFi) ecosystem, are increasingly perceiving these tokens as reliable, programmable, and accessible tools for capital protection. This growing embrace by diverse investor groups speaks volumes about the maturity and evolving perception of these assets within the financial landscape. The cross-platform compatibility of Tether Gold and its counterparts is also fostering new opportunities within the expansive DeFi ecosystem, paving the way for innovative financial products and services built around these stable assets.

The events of 2025 have undoubtedly reshaped investor perspectives, highlighting the unpredictable nature of global events and their profound impact on financial markets. In this context, the stability offered by gold-backed tokens, and specifically Tether Gold, has become a beacon for those seeking refuge from market turbulence. The conflict in the Middle East served as a stark reminder of how quickly geopolitical events can trigger widespread market apprehension and capital reallocation. In such scenarios, the traditional flight to quality assets intensifies, and gold, in both its physical and digital forms, emerges as a primary beneficiary.

The technological underpinnings of these tokens further enhance their appeal. The immutable and transparent nature of blockchain records ensures that the ownership and backing of each token are verifiable, mitigating concerns about trust and counterparty risk. This inherent transparency is a significant advantage over some traditional financial products where the underlying assets may be less accessible for scrutiny. The ease of transfer and settlement, characteristic of blockchain transactions, also adds to their efficiency and attractiveness, especially for investors looking for rapid deployment and repatriation of capital. Tether Gold, built on robust blockchain infrastructure, embodies these advantages.

Looking ahead, the role of gold-backed tokens is only expected to grow. As the world continues to grapple with complex geopolitical dynamics, economic shifts, and technological advancements, the demand for stable, liquid, and accessible assets will undoubtedly persist. The ability of Tether Gold and similar tokens to bridge the gap between the traditional financial world and the burgeoning digital asset space positions them uniquely for sustained growth and adoption. They offer a sophisticated yet straightforward solution for investors seeking to diversify their portfolios, mitigate risk, and secure their wealth against the backdrop of an ever-evolving global financial landscape.

The narrative of gold-backed tokens in 2025 is a compelling one of resilience, innovation, and strategic advantage. While the broader cryptocurrency market experienced significant headwinds, Tether Gold and PAX Gold demonstrated their mettle, proving their worth as indispensable components of a well-diversified investment strategy. Their performance serves as a powerful reminder that in times of uncertainty, the fundamental principles of value preservation and risk management remain paramount, and that new technologies can offer innovative solutions to age-old financial challenges. The future of finance, it seems, will increasingly involve the harmonious integration of traditional assets with the transformative power of blockchain technology, with gold-backed tokens leading the charge. The continued interest in and performance of Tether Gold will be a key indicator of this trend.

The Mechanism Behind Gold-Backed Tokens

To truly appreciate the value proposition of Tether Gold and other gold-backed tokens, it’s essential to understand the underlying mechanism that makes them work. Each token is typically backed by a specific quantity of physical gold, held in secure vaults by reputable custodians. For instance, Tether Gold (XAUT) represents ownership of one troy ounce of physical gold held in a Swiss vault. This direct linkage to a tangible asset is what provides their inherent stability and distinguishes them from unbacked cryptocurrencies. Investors essentially own a digital representation of physical gold, without the logistical challenges and costs associated with storing and insuring physical bullion.

The process typically involves independent audits and attestations to verify that the amount of physical gold held in reserve accurately matches the number of tokens in circulation. This transparency builds trust and assures investors that their digital holdings are genuinely backed. For example, Tether Gold provides daily reports on its gold reserves, ensuring a high level of accountability. This auditability is a significant advantage over some traditional gold investment vehicles, where the transparency of the underlying assets might be less clear. The blockchain technology ensures that every transaction is recorded and verifiable, adding another layer of security and trust.

Furthermore, the “programmability” aspect of these tokens opens up new possibilities within the decentralized finance (DeFi) ecosystem. Unlike physical gold, which is difficult to fractionalize and use in smart contracts, gold-backed tokens can be easily integrated into various DeFi protocols. This allows for new financial products, such as collateralized lending using gold tokens, or participation in liquidity pools. The cross-platform compatibility of tokens like Tether Gold means they can be easily moved across different blockchain networks, increasing their utility and reach within the broader crypto landscape. This interoperability is crucial for fostering a robust and interconnected digital economy.

Expanding Appeal: Beyond Speculation

The narrative around cryptocurrencies has historically been dominated by stories of volatile price swings and speculative trading. However, the emergence and success of gold-backed tokens, particularly Tether Gold, are actively reshaping this perception. Their appeal is extending beyond the realm of pure speculation, attracting a new cohort of investors who prioritize stability and capital preservation. This includes institutional investors, who are increasingly allocating portions of their portfolios to these assets as a hedge against inflation and market downturns. Their rigorous due diligence and risk assessment processes underscore the credibility of these tokens as legitimate investment vehicles.

Retail investors, too, are discovering the benefits of incorporating gold-backed tokens into their portfolios. For those new to the crypto space, the stability offered by an asset like Tether Gold provides a less intimidating entry point compared to the more volatile cryptocurrencies. It allows them to participate in the digital asset revolution while mitigating some of the associated risks. Furthermore, for seasoned investors, these tokens offer a convenient way to diversify their existing crypto holdings, balancing higher-risk assets with more stable alternatives. This blend of traditional asset stability with digital efficiency is proving to be a winning combination in the current market environment.

The current geopolitical climate, characterized by ongoing conflicts and economic uncertainties, further solidifies the role of gold-backed tokens as essential tools for wealth protection. As traditional financial markets react to every geopolitical tremor, the ability to rapidly deploy and retrieve capital into and out of stable digital assets like Tether Gold becomes increasingly valuable. They offer a responsive and efficient mechanism to navigate turbulent times, providing a sense of security that is often elusive in conventional markets.

The Future of Gold and Digital Assets

The symbiotic relationship between gold and digital assets, exemplified by the rise of Tether Gold, is likely to deepen in the years to come. As blockchain technology continues to evolve and gain wider acceptance, the integration of real-world assets into the digital realm will become more sophisticated and seamless. This trend signifies a broader shift in how value is stored, transferred, and managed globally. Gold-backed tokens represent a vanguard in this transformation, demonstrating the immense potential of marrying ancient stores of value with cutting-edge digital innovation.

The increasing regulatory clarity around digital assets will also play a crucial role in their continued growth. As governments and financial institutions develop frameworks for the governance of cryptocurrencies and stablecoins, the legitimacy and adoption of gold-backed tokens will only strengthen. This regulatory evolution will pave the way for broader institutional participation and enhance investor confidence, further cementing the position of assets like Tether Gold as integral components of the global financial system.

Stay informed, read the latest crypto news in real time!

In conclusion, the exceptional performance of Tether Gold and PAX Gold in 2025 is not just a fleeting market anomaly but a significant indicator of a fundamental shift in investor preferences and the evolving landscape of digital finance. As global uncertainties persist, the demand for stable, transparent, and accessible digital assets backed by tangible commodities will undoubtedly continue to grow. These tokens offer a compelling synthesis of traditional financial security and modern technological efficiency, proving to be invaluable in protecting purchasing power and providing a refuge in an increasingly volatile world. Their journey from niche assets to prominent players in the crypto market underscores their undeniable utility and potential for sustained growth, making them a crucial consideration for any forward-thinking investor.