How DAOs Work: Governance, Voting, and the Future of Decentralized Organizations

In the journey of decentralization, the creation of Bitcoin gave us decentralized money, and Ethereum gave us decentralized computing. The next logical step, and arguably one of the most profound innovations of Web3, is the Decentralized Autonomous Organization (DAO).

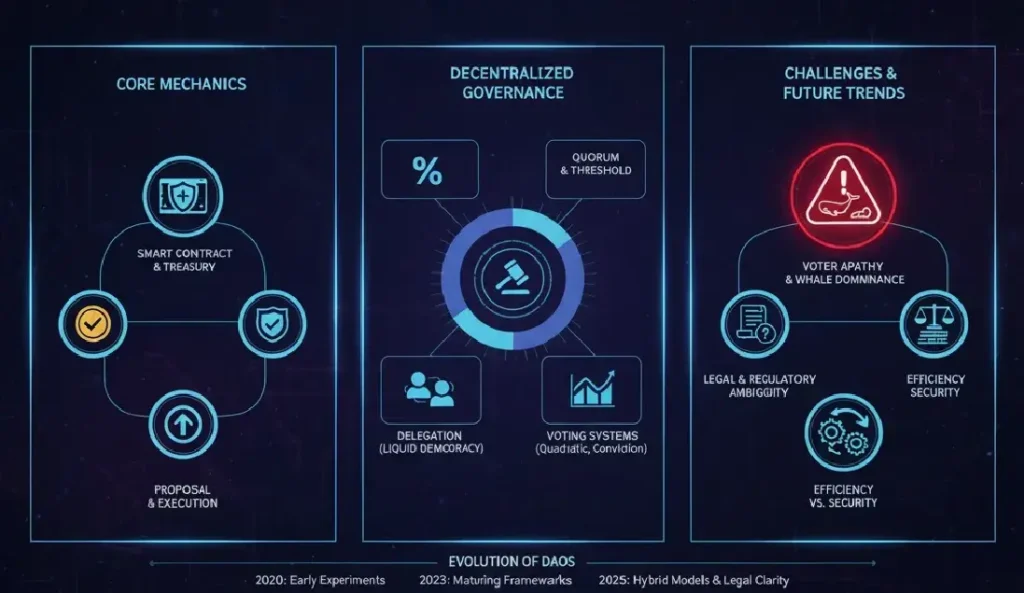

DAOs are an evolutionary leap in organizational structure. Unlike traditional companies—which are governed by a CEO, a board, and legal documentation—a DAO is governed entirely by code, enforced by smart contracts, and directed by its community of token holders. This structure seeks to replace corporate hierarchies with open-source transparency and collective decision-making.

Understanding the mechanics of these organizations—specifically how DAOs work—is essential to grasping the future trajectory of the crypto and Web3 space. They are the engine behind everything from DeFi protocols and investment funds to media collectives and philanthropic groups.

The Foundational Pillars of a DAO

At its core, a DAO is defined by three fundamental, interconnected elements.

The Smart Contract and Treasury

The most critical component of a DAO is its smart contract. This is the autonomous set of rules written onto a blockchain (most often Ethereum) that defines the organization’s constitution. These contracts handle the treasury, manage the token distribution, and, most importantly, execute all accepted proposals automatically.

Because the code is immutable and transparent on the blockchain, no single person can unilaterally access the DAO’s funds or change the rules. The entire organization’s capital—known as the DAO Treasury—is locked and only accessible through successful community-approved votes. This is the “autonomous” part of the DAO, ensuring trust is placed in the code, not in people.

The Governance Token

Membership and voting power within a DAO are typically tied to holding a specific governance token. These tokens represent a stake in the organization, giving the holder the right to propose changes and vote on proposals.

The voting power is almost always weighted by the amount of tokens held: one token equals one vote. This model, often referred to as token-based governance, incentivizes participation from those who have a vested financial interest in the DAO’s long-term success. The value of the tokens often fluctuates based on the health and performance of the DAO’s underlying protocol or assets.

The Proposal Process

The operation of a DAO is dictated by the constant cycle of proposals and votes. The entire lifecycle is a direct expression of how DAOs work in practice:

- Idea Generation: A community member identifies a need or opportunity (e.g., launching a new product, changing fee structure, allocating treasury funds).

- Formal Proposal: The member drafts a formal proposal, often requiring a minimum token threshold to submit it to the voting platform.

- Voting Period: The community reviews the proposal and votes using their governance tokens over a set period (e.g., 3-7 days).

- Execution: If the proposal meets the required quorum (minimum participation) and threshold (minimum majority vote), the smart contract automatically executes the changes, withdrawing funds or deploying new code as specified. No human needs to manually approve the final step.

DAO Governance Explained: Voting Systems and Mechanics

The term DAO governance explained often centers on the practical mechanisms used to aggregate disparate community voices into binding decisions. The chosen voting system directly impacts the efficiency and fairness of the organization.

The Role of Quorum and Threshold

For a proposal to pass, two main conditions must typically be met:

- Quorum: The minimum percentage of the total eligible governance tokens that must participate in the vote for it to be considered valid. A high quorum ensures that only proposals with broad community interest pass, preventing small, motivated groups from making critical changes.

- Threshold: The minimum percentage of participating votes (usually a simple majority, e.g., 51%) that must approve the proposal for it to pass.

The tension between these two requirements dictates the speed and stability of the organization. Setting them too high can lead to governance stagnation, where no proposals can pass. Setting them too low increases the risk of malicious or hastily conceived changes.

Delegation and Liquid Democracy

In large DAOs, not every token holder has the time or expertise to research every proposal. To combat this issue, many protocols implement a delegation system, a cornerstone of effective decentralized governance.

Delegation allows token holders to assign their voting power to a trusted representative—called a Delegate or Representative—without transferring ownership of their underlying tokens. This structure is often referred to as liquid democracy because voting power flows freely to knowledgeable and active community members who act as pseudo-politicians, ensuring that governance decisions are made by informed participants while still representing the collective token wealth. This is a crucial element in understanding how DAOs work at scale.

Different DAO Voting Systems

Not all DAOs use simple one-token, one-vote mechanics. Alternative systems have emerged to address concerns over whale dominance and voter apathy:

- Quadratic Voting: This system aims to give smaller holders more influence by making additional votes exponentially more expensive. For example, casting 1 vote costs 1 token, but casting 4 votes costs 16 tokens. This encourages broader participation over concentrated power.

- Conviction Voting: Used in protocols that focus on sustained change over quick decisions. Tokens contribute to a proposal’s “conviction” (or strength of support) over time. The longer a token is staked to vote for a proposal, the more weight it carries, preventing last-minute whale attacks and rewarding long-term commitment.

- Off-Chain Voting (Snapshot): To save on gas fees, many DAOs use off-chain platforms like Snapshot for initial, non-binding votes. While these votes don’t directly execute smart contracts, they signal community consensus. If an off-chain vote passes, a subsequent, costly on-chain vote is typically executed for final binding approval.

Major Challenges Facing Decentralized Governance

Despite their transparent and innovative structure, DAOs face significant operational, legal, and participation challenges that are actively shaping their evolution.

Voter Apathy and Whale Dominance

One of the most persistent operational hurdles for any DAO voting system is voter apathy. Many token holders, especially those who bought tokens primarily for speculation, are uninterested in governance. This often leads to low voter turnout, which can skew the decision-making process.

Furthermore, the “one token, one vote” model inherently grants disproportionate power to large token holders, often called “whales.” While whales are incentivized to vote for the DAO’s success, their collective power can undermine the principle of distributed decentralized governance, effectively creating an oligarchy rather than a democracy.

Legal and Regulatory Ambiguity

The legal status of DAOs remains highly ambiguous globally. Most legal systems are designed for traditional, geographically located, hierarchical entities. A DAO, with its global membership and autonomous code, doesn’t fit the mold.

Key legal questions include:

- Liability: Who is legally liable if a DAO’s smart contract fails or if the organization violates regulations?

- Taxation: How should DAOs be taxed, and what jurisdiction applies?

- Entity Status: Are DAO members considered partners in a general partnership, making all members liable?

Some jurisdictions, like Wyoming and the Marshall Islands, have begun creating bespoke legal frameworks for DAOs, defining them as Limited Liability Companies (LLCs), providing a legal wrapper that helps mitigate liability risks for individual members.

Efficiency vs. Security

A core philosophical debate within DAOs is the trade-off between efficiency and decentralization. Decentralized governance is slow by design; it requires discussion, proposal, voting, and execution. This slow pace can make DAOs ineffective in fast-moving environments, such as reacting to a sudden protocol exploit or a market crash—a time when quick, centralized decisions are often necessary. Finding the right balance between robust, secure voting and the ability to act swiftly is a constant balancing act that defines how DAOs work in a volatile market.

The Future of Organizational Structure

The mechanisms behind how DAOs work are not static; they are constantly evolving as the community learns from past mistakes and governance failures. The future of decentralized organizations points toward hybrid models that merge the best aspects of decentralization with the need for speed and expertise.

We are seeing a rise in sub-DAOs or working groups—specialized committees (e.g., Marketing, Development, Risk Management) given a small budget and focused autonomy to act quickly within a defined mandate. These groups are supervised by the main DAO but alleviate the burden of micromanagement from the entire token holder community.

Stay informed, read the latest crypto news in real time!

Ultimately, DAOs represent a technological opportunity to solve the age-old “principal-agent” problem in organizational theory—the conflict of interest between a company’s shareholders (principals) and its managers (agents). By collapsing the management structure into transparent, executable code and aligning incentives through the governance token, DAOs are building a more equitable, transparent, and potentially revolutionary form of human organization. The ongoing innovation in the DAO voting system suggests that the world of governance is only just beginning its decentralized transformation.