In a significant move set to redefine decentralized finance (DeFi) lending, Jupiter, a leading decentralized exchange (DEX) aggregator on the Solana blockchain, has announced a substantial allocation of $150 million in USDC to its new lending feature within the JLP system. This innovative mechanism empowers users to leverage their liquidity provider (LP) tokens as collateral to access credit, opening up new avenues for capital efficiency within the Solana ecosystem.

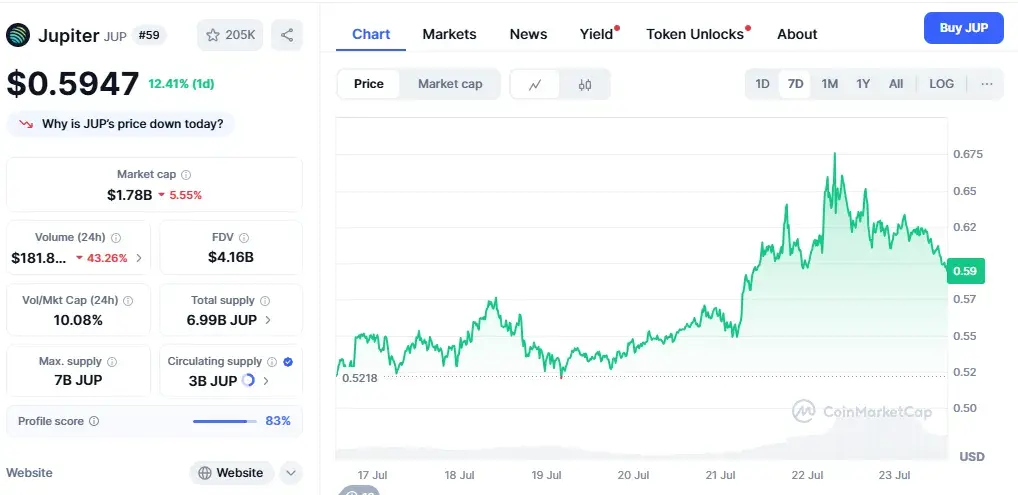

The announcement has sent ripples through the market, notably boosting the price and trading volume of Jupiter’s native token, JUP. Following the news, the price of JUP surged by approximately 3% in a single day, with the token currently trading around $0.59. Over the past week, JUP has seen an impressive gain of 19.65% to over 31% (depending on the exact reporting source), while its daily trading volume nearly tripled in 24 hours, jumping by 175% to surpass $342 million. This robust market reaction underscores the community’s positive reception to Jupiter’s latest innovation and its potential impact on the broader DeFi landscape.

A New Paradigm for DeFi Lending: Avoiding Forced Liquidations

The core innovation of JLP Loans lies in its unique approach to handling liquidations, setting it apart from many existing DeFi lending protocols. Unlike traditional systems that often resort to selling off a user’s collateral on the open market when its value drops below a certain threshold, Jupiter employs a distinct mechanism.

Instead of triggering market-impacting forced liquidations, the protocol holds an internal reserve of assets that directly backs the loans. When collateral value declines, the JLP tokens provided as collateral are burned to redeem the locked assets. This sophisticated technical design significantly reduces market pressure and prevents large-scale liquidations from causing cascading impacts on broader token prices. This “no-forced-liquidation” model, in the traditional sense, offers a more user-friendly and stable lending experience, which has been particularly well-received by users and has boosted broader interest in the JUP token and its vibrant ecosystem. This innovative solution addresses a major pain point in DeFi lending, offering greater predictability and risk mitigation for participants.

JUP’s Price Recovery and Technical Outlook

Since hitting a low of approximately $0.30 in April, JUP has demonstrated a remarkable recovery, gaining over 110% from its bottom. While still trading considerably below its all-time high of $2.04 reached in January 2024, technical indicators suggest a favorable outlook for the token’s continued ascent.

Market analysts are closely watching key price levels. If JUP’s price manages to decisively break above the $0.70 resistance level, it could pave the way for a push towards $0.85, with an eventual target of $1.00—a level with strong psychological resistance that could signal a significant milestone in its recovery. The sustained upward momentum, coupled with the positive developments in the Jupiter ecosystem, provides a strong foundation for potential future gains. The growing total value locked (TVL) on the platform further reinforces this bullish sentiment.

Strong Q2 Metrics and Ecosystem Growth

Jupiter closed the second quarter of the year with impressive metrics, showcasing steady and robust growth across its platform. In recent months, the protocol surpassed a significant milestone of over 8 million active wallets, demonstrating its widespread adoption and user engagement within the Solana network. Furthermore, Jupiter facilitated a staggering $142 billion in transaction volume, solidifying its position as a dominant player in the Solana DeFi space. This immense activity also translated into substantial revenue, with the platform collecting an impressive $82.4 million in fees.

Alongside the launch of its innovative lending feature, Jupiter has also continued to expand its core offerings, integrating advanced trading functionalities and streamlined liquidity provision tools. This comprehensive suite of services makes Jupiter an increasingly appealing platform for users seeking diversified returns across multiple fronts within the high-speed and low-cost Solana ecosystem. The platform’s commitment to continuous innovation and user-centric development is clearly reflected in its surging metrics and expanding functionalities.

The Total Value Locked (TVL) on Jupiter has also seen a sharp and rapid increase, jumping from approximately $2.1 billion to an impressive $3 billion in just one month. This significant surge in TVL highlights the growing confidence of liquidity providers and users in the platform’s security, efficiency, and yield-generating potential. In a market where major cryptocurrencies like Ethereum are eyeing the $4,000 mark and Solana is approaching $300, Jupiter is demonstrating standout performance, carving out a unique and influential niche within the competitive DeFi landscape. Its ability to attract and retain significant liquidity is a testament to its robust infrastructure and innovative offerings.

Stay informed, read the latest crypto news in real time!

Jupiter’s strategic focus on capital efficiency, combined with its unique liquidation mechanism, positions it as a frontrunner in the next generation of DeFi lending. By providing users with a safer and more predictable way to leverage their assets, Jupiter is not only enhancing its own ecosystem but also contributing to the overall maturity and stability of the decentralized finance industry. As the platform continues to build out its suite of tools and attract more users, its influence within the Solana blockchain and the broader crypto market is expected to grow significantly.

📩 Subscribe Now

Join thousands of crypto readers who stay ahead of the market. 100% Free. No Spam. Unsubscribe anytime.