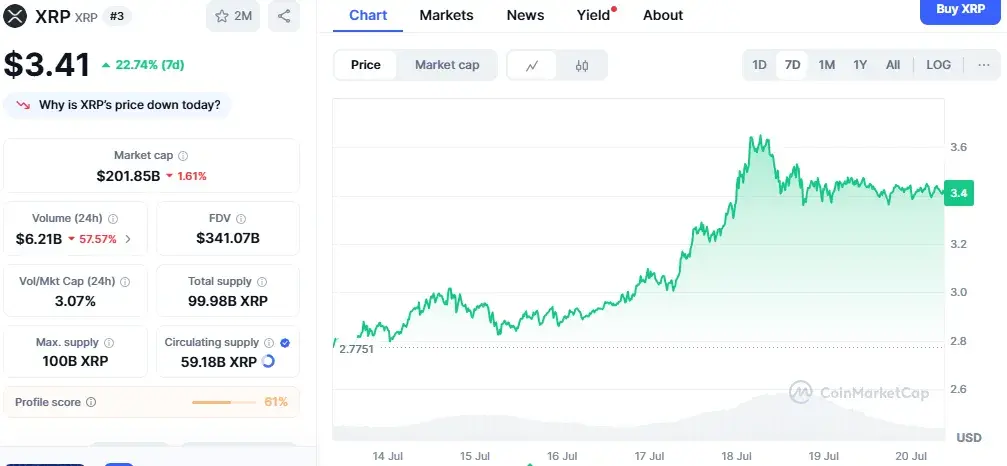

The cryptocurrency market is abuzz with the unprecedented performance of XRP, which has demonstrated a staggering ascent, captivating investors and analysts alike. In a remarkable seven-day period, Ripple price soared by an impressive 21.9%, ultimately reaching a valuation of $3.41. This surge wasn’t merely a fleeting spike; it was accompanied by a cascade of record-breaking achievements across various metrics, signaling a profound shift in the token’s market dynamics. We’re witnessing all-time highs in market capitalization, unprecedented spot and derivatives trading volumes, and a colossal $10.98 billion in open interest, painting a picture of robust and growing institutional and retail confidence in XRP.

This monumental upward trajectory of the Ripple price is not without significant fundamental backing. The recent passage of new stablecoin regulations by the U.S. Congress has injected a palpable sense of optimism into the digital asset space, specifically bolstering investor sentiment around Ripple and its ecosystem. Furthermore, Ripple’s strategic move to apply for a banking license underscores its ambition to tightly integrate with traditional financial systems, a development that could revolutionize its utility and adoption on a global scale.

Ripple price the Catalysts Behind the Surge: A Confluence of Factors

The past week has been nothing short of extraordinary for XRP. Beyond the 21.9% weekly gain, the token also advanced 5.1% in the last 24 hours alone, solidifying its position at $3.42. The statistics speak volumes: its market capitalization has now eclipsed an astonishing $210 billion, firmly placing XRP among the elite in the crypto sphere. Spot trading volume has surged past $23.5 billion, while derivatives volume more than doubled to a staggering $48 billion. This intense trading activity highlights heightened interest and liquidity, indicating strong market participation. Adding to this fervor, open interest in futures contracts reached an unprecedented $10.98 billion, a testament to the increasing speculative and hedging activities surrounding XRP.

A significant portion of this bullish momentum can be attributed to pivotal legislative developments in the United States. The U.S. House of Representatives recently passed three crucial bills, including the landmark GENIUS Act, aimed at providing a comprehensive regulatory framework for stablecoins. This legislative clarity has been a game-changer, fostering a more secure and predictable environment for digital assets, which in turn has dramatically boosted investor confidence. For Ripple, this regulatory progress is particularly impactful, as it significantly strengthens the company’s legal standing and paves the way for greater mainstream adoption.

Ripple’s proactive engagement with the traditional financial system further underscores its long-term vision. The company’s application for a banking license and a master account with the Federal Reserve are strategic maneuvers designed to streamline its integration into established financial infrastructures. These tools are crucial for enabling Ripple to offer more traditional banking services and to facilitate seamless cross-border payments, leveraging the efficiency and cost-effectiveness of XRP.

Beyond these institutional advancements, the corporate sector is also taking note. Recent disclosures from VivoPower and Webus revealing $421 million in token purchases for their treasuries are a clear indication of growing corporate interest in holding digital assets, particularly XRP, as part of their balance sheets. This influx of corporate capital provides another layer of validation for XRP’s perceived value and future potential. Speculation regarding an XRP spot ETF in the U.S. is also gaining traction, with Polymarket indicating an 85% probability of approval. Such an ETF would undoubtedly open the floodgates for institutional investment, further cementing XRP’s position in the financial landscape.

Price Discovery Mode: Breaking All-Time Highs

The recent market movements have also been heavily influenced by significant liquidation events. In the past few hours alone, $73.17 million in short positions and $29 million in long positions were liquidated. This aggressive deleveraging, particularly from short sellers, generated immense buying pressure. This surge in demand propelled XRP beyond its previous all-time high of $3.65, a resistance level that had stubbornly held for over seven years.

The breach of this long-standing resistance barrier is a critical technical development. It has triggered “price discovery mode,” a phenomenon where an asset trades above all historical price levels, with no immediate overhead resistance to limit further upside. In such a scenario, the price is no longer constrained by past performance but is driven purely by current supply and demand dynamics, opening the door for potentially explosive gains.

Technical Indicators Pointing to $14

From a technical analysis perspective, the future looks exceptionally bright for XRP. The Moving Average Convergence Divergence (MACD) indicator has flashed a strong bullish signal, confirming a continuation triangle pattern on the weekly chart. This particular pattern is highly significant, suggesting a potential 305% upward movement, which could propel the Ripple price towards an ambitious target of $14.

Furthermore, the Relative Strength Index (RSI) on the weekly chart remains notably far from overbought territory. This indicates that despite the recent rapid appreciation, XRP still has considerable room for further gains without immediately facing exhaustion or a significant pullback due to overheating. The confluence of these bullish technical signals provides a compelling case for continued upward momentum.

Regulatory Landscape and Future Prospects

While the market celebrates XRP’s incredible performance, the ongoing legal discussions between Ripple and the U.S. Securities and Exchange Commission (SEC) remain a key consideration. Ripple currently holds $150 million worth of XRP in escrow, earmarked as collateral for a pending settlement that awaits approval from Judge Analisa Torres. This proposed settlement includes a $50 million fine for past unregistered sales. The resolution of this legal saga is expected to provide even greater clarity and could remove a lingering uncertainty that has, at times, weighed on the Ripple price.

Stay informed, read the latest crypto news in real time!

As XRP continues its journey in price discovery mode, each trading session amplifies the prevailing question in the market: just how high can Ripple’s token truly ascend in the coming months? The combination of strong market fundamentals, positive regulatory developments, increasing institutional adoption, and robust technical indicators suggests that XRP may indeed be poised for even greater heights, potentially reshaping its standing in the global financial ecosystem.

📩 Subscribe Now

Join thousands of crypto readers who stay ahead of the market. 100% Free. No Spam. Unsubscribe anytime.