The Global Financial Arena: A Showdown Between Tradition and Innovation

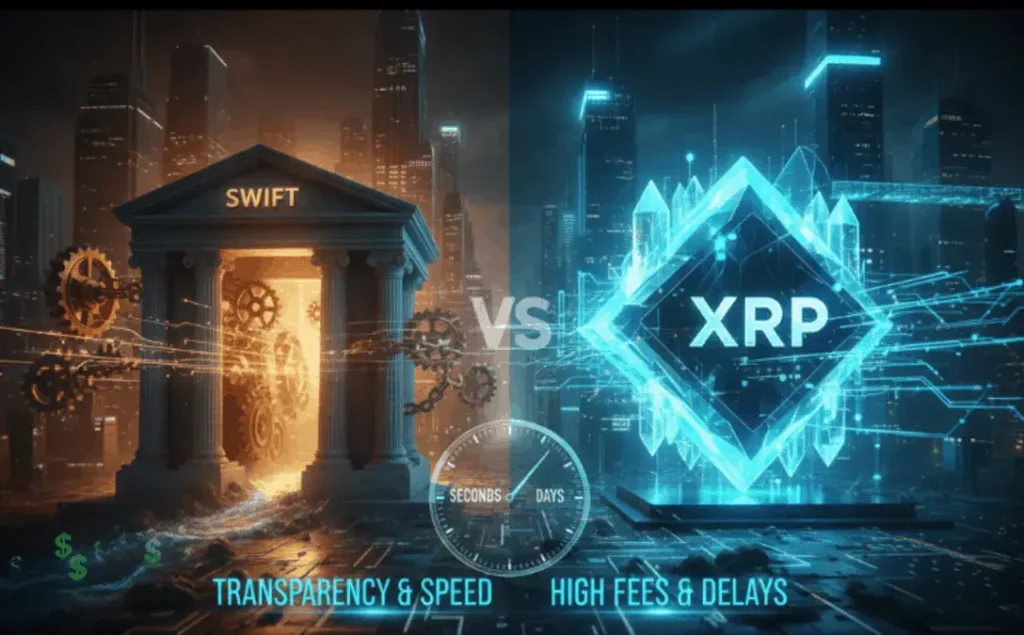

For decades, the global financial system has been dominated by a single, powerful network for international payments: the Society for Worldwide Interbank Financial Telecommunication, better known as SWIFT. This messaging system has been the backbone of cross-border transactions for nearly fifty years, enabling banks to send and receive information about financial transfers securely. But in the age of digital disruption, a new challenger has emerged from the world of cryptocurrency: Ripple, with its native digital asset XRP. This is a battle for the future of money itself, a high-stakes showdown of innovation against a deeply entrenched legacy system. The narrative of XRP vs SWIFT is more than just a technical comparison; it’s a story about efficiency, transparency, and a fundamental shift in how we think about moving value across borders.

SWIFT’s dominance is undeniable. With over 53 million messages processed daily and a network spanning more than 220 countries and territories, it remains the gold standard for global financial communication. Its sheer scale and institutional trust have made it indispensable to the world’s banks. However, this long-standing authority has come with significant drawbacks that have become increasingly glaring in a digital-first economy. The system is often criticized for being slow, expensive, and opaque, plagued by transaction failures and delays that can last for days. As global trade and e-commerce accelerate, the need for a more agile and efficient solution has never been more urgent. This is precisely the void that Ripple aims to fill.

The Legacy Giant: SWIFT’s Strengths and Stumbling Blocks

Founded in 1973, SWIFT was a revolutionary step forward for its time, replacing the telex as the primary method for secure interbank messaging. Its primary function is not to transfer money itself but to act as a secure communication platform that tells banks how to move it. This is done through a correspondent banking network, where a series of intermediary banks facilitate a transfer from one country to another. For example, a transfer from a bank in Brazil to one in Australia might pass through multiple banks in different jurisdictions, each taking a cut and adding to the time of the transaction.

Strengths of the SWIFT System

- Established Trust: SWIFT is a universally accepted and trusted system, with deep-seated relationships with virtually every major financial institution in the world.

- Unmatched Scale: Its network is massive and has a proven track record of handling a staggering volume of daily messages, ensuring it is a reliable tool for global finance.

- Security: The system provides a secure and standardized messaging format for financial data, which has been its core value proposition for decades.

SWIFT’s Critical Weaknesses

Despite its strengths, the system is fundamentally an analog-era solution in a digital world. Its process is inherently slow, with international payments often taking 3 to 5 business days to clear. This slowness is due to the sequential nature of the correspondent banking network, where each intermediary bank must verify and process the transaction. Furthermore, the fees are notoriously high and often unpredictable. Each intermediary bank charges its own fee, which can result in the final recipient receiving a much smaller amount than what was initially sent. Transaction failures are also a common problem due to errors in messaging or currency exchange issues along the chain. This lack of transparency means that once a transaction is initiated, the sender has little to no visibility into its status, creating frustration and uncertainty.

The Digital Challenger: Ripple’s Value Proposition

Ripple, a blockchain-based financial technology company, is seeking to overhaul this system from the ground up. Instead of a slow and costly chain of correspondent banks, Ripple offers a suite of products designed to facilitate instant, low-cost, and transparent cross-border payments. The key to this is its native digital asset, XRP, which serves as a bridge currency between different fiat currencies.

How Ripple’s Solution Works

Imagine a company in Japan wants to pay a supplier in Mexico. Using Ripple’s platform, the Japanese yen is converted into XRP on one side of the transaction, and the XRP is then almost instantly converted into Mexican pesos on the other. This process bypasses the slow and expensive correspondent banking network entirely. The transaction takes just seconds to complete, and the fees are a fraction of what they would be through SWIFT. This is the core of the XRP vs SWIFT argument: a move from a multi-day, multi-fee system to a nearly instant, single-fee transaction.

The Direct Comparison: XRP vs SWIFT on Key Metrics

The battle of XRP vs SWIFT can be broken down into a few critical performance metrics.

- Speed: SWIFT transactions take an average of 3-5 days. Ripple’s transactions take seconds. This speed is a game-changer for businesses that rely on fast settlement, such as those in the e-commerce and gig economies.

- Cost: SWIFT fees are high and often unpredictable, with multiple intermediary banks taking a cut. Ripple transactions cost a fraction of a cent and are fully transparent, with a single fee charged per transaction. This massive cost reduction is a huge incentive for businesses.

- Transparency: SWIFT offers no real-time tracking for transactions. Ripple’s solution is built on a public ledger, allowing both the sender and receiver to monitor the transaction’s status from start to finish.

- Efficiency: SWIFT’s system is prone to errors and transaction failures. Ripple’s use of XRP as a bridge asset eliminates the need for pre-funding foreign accounts, which is a major source of friction and cost in the traditional system.

The Future of Global Payments: Coexistence or Replacement?

The question of whether Ripple will ultimately replace SWIFT is complex. While the benefits of Ripple’s technology are clear, SWIFT’s institutional trust and vast network are powerful advantages that cannot be ignored. The battle of XRP vs SWIFT is less a winner-take-all fight and more a story of a legacy system being forced to adapt to a new paradigm. SWIFT has been developing its own solutions to address some of its weaknesses, such as its Global Payments Innovation (GPI) service, which offers faster, more transparent payments. However, these are still incremental improvements to a decades-old infrastructure, while Ripple represents a fundamental change in how the system works.

Stay informed, read the latest crypto news in real time!

Some experts believe the future of global payments will involve both systems coexisting. SWIFT could continue to serve the large-scale, traditional banking sector, while Ripple’s solution could find its niche in the high-volume, low-value remittance market and for smaller businesses. The growing demand for digital currencies and the increasing adoption of blockchain technology by financial institutions suggest that the momentum is with innovators like Ripple. The ongoing saga of XRP vs SWIFT is a testament to the powerful forces of innovation at play, and its outcome will shape the global financial landscape for years to come.