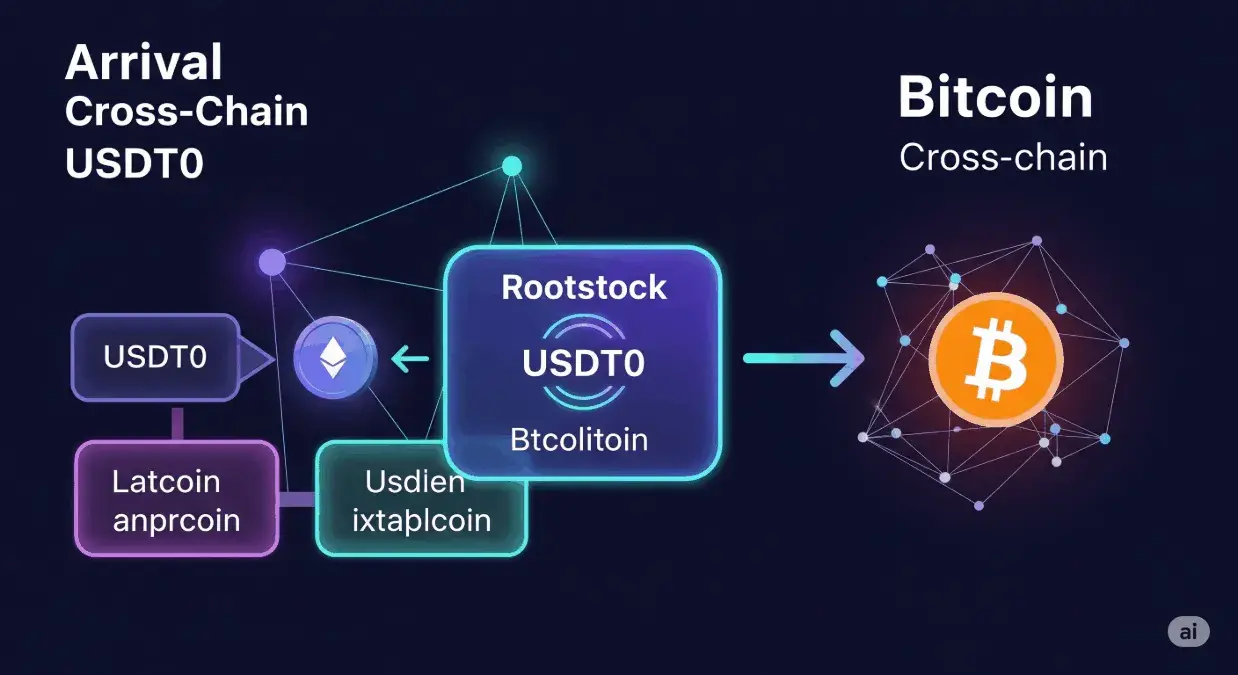

The landscape of decentralized finance (DeFi) is continuously evolving, pushing the boundaries of what’s possible within various blockchain ecosystems. A significant stride in this evolution is the recent launch of USDT0, the omnichain version of Tether’s widely adopted USDT stablecoin, on Rootstock. This integration marks a pivotal moment, poised to profoundly enhance the reach of stablecoins into Bitcoin-powered DeFi, affectionately known as BTCFi.

This strategic expansion is not merely an incremental update; it represents a dedicated effort by Everdawn Labs to foster smoother interblockchain utilization and unlock the vast, untapped potential of Bitcoin’s native liquidity. Already demonstrating its versatility across prominent networks such as Ethereum, Arbitrum, Unichain, and the OP Superchain, USDT0 is meticulously designed to fortify liquidity and introduce unparalleled flexibility for a diverse range of participants – from BTCFi developers and institutional investors to everyday users across the globe.

Understanding Rootstock: Bitcoin’s DeFi Powerhouse

Rootstock has been an integral player in the blockchain space since its inception in 2018. It stands as a groundbreaking Layer 2 network for Bitcoin, ingeniously bridging Bitcoin’s unparalleled security and decentralization with the robust smart contract capabilities typically associated with platforms like Ethereum. At its core, Rootstock operates through a merge-mining mechanism with Bitcoin, inheriting the same proof-of-work security that underpins the world’s leading cryptocurrency. When Bitcoin (BTC) is transferred to Rootstock, it transforms into rBTC, a 1:1 Bitcoin-pegged token that is smart contract-enabled, allowing for its seamless use within the Rootstock ecosystem and subsequent transfer back to the Bitcoin blockchain when desired.

The arrival of USDT0 on Rootstock is more than just an addition of another token; it signifies a monumental milestone for Bitcoin’s decentralized finance ambitions. By enabling Tether’s omnichain stablecoin to operate natively within this secure and programmable environment, users can now transfer stablecoins into Bitcoin-based applications with unprecedented efficiency. This bypasses the often prohibitive high fees and slower processing times that have historically plagued cross-chain asset transfers, paving the way for a more fluid and accessible DeFi experience for Bitcoin holders. The EVM compatibility of Rootstock also means that developers familiar with Ethereum’s ecosystem can easily build or migrate decentralized applications (dApps), accelerating innovation within BTCFi.

The Rise of Omnichain Stablecoins and USDT0’s Innovation

The challenge of fragmented liquidity across various blockchain networks has long been a bottleneck for the broader adoption and efficiency of stablecoins. Traditional multi-chain deployments of stablecoins often result in isolated versions on each blockchain, requiring complex and sometimes risky bridging solutions for transfers. USDT0, however, offers a revolutionary approach to this problem.

Built using LayerZero’s Omnichain Fungible Token (OFT) standard, USDT0 is a technical breakthrough in stablecoin design. It creates a unified, cross-chain liquidity layer by locking the original USDT on Ethereum and minting an equivalent amount of USDT0 on the target chain. This mechanism ensures continuous liquidity and interoperability without relying on external bridges or fragmented liquidity pools. For users, this translates to simplified asset movement, reduced transaction costs, and enhanced capital efficiency. Developers benefit from unified liquidity management, allowing dApps to tap into deep pools of dollar liquidity seamlessly, thereby minimizing security risks associated with third-party bridges and fostering a more robust DeFi environment.

Everdawn Labs: Powering Cross-Chain Interoperability

A crucial aspect of USDT0’s integration and functionality on Rootstock is its management by Everdawn Labs, rather than Tether itself. This distinct structural arrangement ensures that USDT0 maintains its full 1:1 backing with the original USDT on Ethereum, while simultaneously freeing it from the constraints of single-chain operation. Everdawn Labs’ role in operating the non-custodial smart contract system that backs USDT0 underscores a commitment to decentralization and transparency. This setup not only facilitates the token’s seamless cross-chain movement but also provides a layer of operational independence that contributes to its overall reliability and security within the rapidly expanding multi-chain ecosystem.

Unlocking Bitcoin’s DeFi Potential

As Bitcoin’s DeFi, or BTCFi, gains considerable momentum, the presence of a reliable, dollar-pegged token directly connected to Bitcoin’s ecosystem becomes increasingly invaluable. This is true for both seasoned traders seeking arbitrage opportunities and innovative developers aiming to build the next generation of decentralized applications. Rootstock’s unique design marries Bitcoin’s robust proof-of-work security with EVM-compatible smart contracts, offering builders the same familiar and powerful development tools found on Ethereum.

This fertile ground, now enriched by USDT0, opens up a myriad of possibilities for financial innovation. Developers can explore and launch sophisticated lending protocols, create tokenized assets, and deploy other decentralized services that demand predictable and ample liquidity. The ability to seamlessly transfer stablecoins into Bitcoin-based applications directly addresses a critical need within the ecosystem, reducing friction and enhancing the overall user experience. This cross-chain mobility is not merely a convenience; it is a catalyst that could inspire an array of new financial products and significantly broaden stablecoin adoption, particularly among institutional investors looking for secure and efficient avenues for capital deployment within the Bitcoin sphere.

Tether’s Strategic Expansion and Market Impact

With over $160 billion in circulation, Tether’s USDT remains the undisputed dominant stablecoin in the cryptocurrency market. Its strategic expansion through the omnichain version, USDT0, aims to preserve this lead by proactively addressing the challenges of high costs and limited accessibility across disparate blockchain networks. By reducing transactional friction and broadening the stablecoin’s reach, USDT0 fosters an environment conducive to innovation, particularly within the nascent yet rapidly growing BTCFi sector.

This strategic move by Tether and the collaborative efforts with entities like Everdawn Labs demonstrate a forward-thinking approach to stablecoin evolution. It highlights a commitment to enhancing interoperability and user experience, which are crucial for mainstream adoption of decentralized financial instruments. As more Bitcoin-focused projects emerge and mature, tools like USDT0 will undoubtedly play a crucial role in helping Bitcoin evolve beyond its well-established identity as merely a store of value. It facilitates its transformation into a more versatile and programmable financial foundation, lowering barriers to entry for a wider global audience and solidifying its position at the forefront of the decentralized financial revolution.

Stay informed, read the latest crypto news in real time!

Future Outlook for BTCFi

The integration of USDT0 with Rootstock is a testament to the ongoing evolution of the decentralized finance space, particularly the burgeoning BTCFi ecosystem. It signifies a future where Bitcoin’s robust security is seamlessly combined with the programmability and liquidity of stablecoins, unlocking unprecedented opportunities for innovation and economic empowerment. As developers continue to eye BTCFi expansion, driven by the desire for alternatives to congested networks and high fees, stable assets like USDT0 on Rootstock will be instrumental in building a more interconnected, efficient, and accessible global financial system on the backbone of Bitcoin.

📩 Subscribe Now

Join thousands of crypto readers who stay ahead of the market. 100% Free. No Spam. Unsubscribe anytime.