In a move that has sent ripples across both the cryptocurrency and traditional finance sectors, Nasdaq-listed Wellgistics Health has filed an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) on July 25, 2025, outlining an ambitious plan to weave Ripple‘s XRP technology into the very fabric of its business operations. This isn’t just a tentative foray into crypto; it represents a comprehensive, full-stack deployment of XRP and the XRP Ledger (XRPL) across the Wellgistics Company’s payment and treasury functions.

The healthcare logistics firm, which boasts an extensive network reaching approximately 6,000 pharmacies and 150 drug manufacturers, intends to revolutionize its operations by deploying the XRP Ledger for real-time B2B invoicing, automating rebate processes, and facilitating cross-border vendor payouts. The compelling advantage lies in the fractional cost compared to traditional Automated Clearing House (ACH) or SWIFT rails, promising substantial efficiency gains for the Wellgistics Company.

Beyond Payments: XRP as a Multi-Purpose Corporate Asset

What truly distinguishes Wellgistics Health’s strategy is its intention to treat XRP as a multi-purpose corporate asset, extending far beyond day-to-day settlements. The S-1 filing reveals a vision where XRP will function as:

- A Liquidity Reserve: Providing a readily available pool of funds to meet operational demands.

- Pledgeable Collateral Base: Enabling the company to secure working-capital credit lines against its XRP holdings, unlocking liquidity without needing to sell the asset.

- Yield-Bearing Instrument: With an eye on future regulatory clarity, the company plans to utilize on-chain staking opportunities for XRP, transforming it into an income-generating asset.

Crucially, the filing explicitly states that tranches from the recently secured US$50 million equity line from LDA Capital “will be drawn explicitly to acquire XRP and to fund middleware linking our ERP stack to XRPL smart contracts.” This demonstrates a direct and intentional financial commitment to building out the necessary infrastructure for this XRP-centric strategy.

This blueprint has garnered significant attention, with prominent crypto attorney Bill Morgan hailing it as “more than just a treasury dabble”—a profound, full-stack deployment that could establish a compelling template for other low-margin industries striving for faster cash cycles and enhanced operational efficiency. The strategic use of XRP to address core business challenges rather than merely for speculative purposes highlights a maturing institutional perspective on digital assets. The Wellgistics Company is showcasing a tangible real-world utility that could inspire similar integrations across diverse sectors.

Market Ripples, Regulatory Cross-Currents, and Diverging Opinions

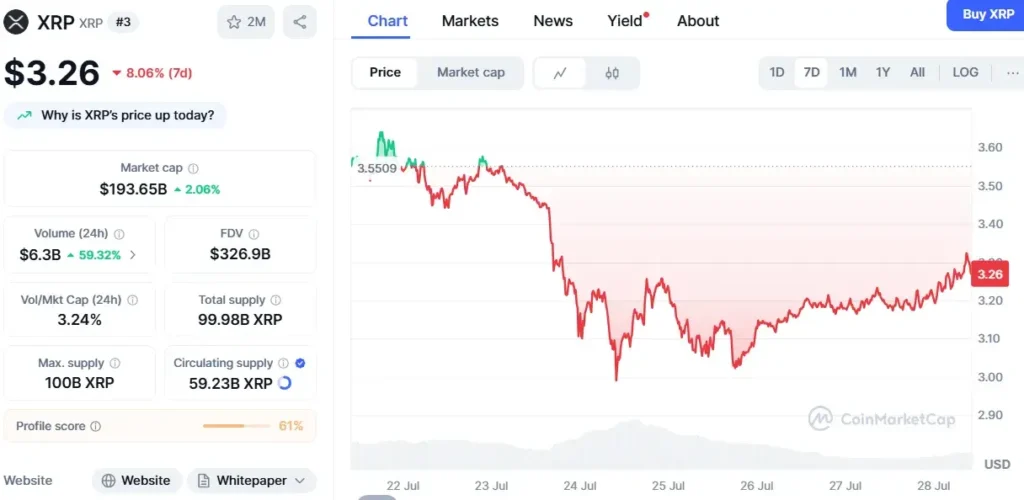

The Wellgistics news certainly sent positive momentum through the XRP market. On Saturday, July 26, 2025, XRP was trading around $3.16, down slightly from its weekly peak of $3.56 but still reflecting a sharp gain since the start of the year. Traders largely attributed the gains to a combination of factors, including the Wellgistics news, the July 15 debut of the ProShares Ultra XRP Credit ETF (ticker: UXRP), and growing speculation around the potential approval of an XRP-based spot exchange-traded fund (ETF) by the Securities and Exchange Commission.

The SEC has already initiated proceedings on Cboe BZX’s proposal to list the Franklin XRP ETF, with the next decision window anticipated in mid-August. A green light from the SEC would provide a regulated liquidity sink, a critical development that would allow companies like the Wellgistics Company, and any other corporate accumulators, to make large-scale XRP purchases without causing significant disruption to the underlying market. This regulatory clarity is seen as a key enabler for broader institutional adoption and integration of XRP.

However, not everyone in the financial and legal communities is entirely convinced. Some securities lawyers have questioned the optics of a healthcare distributor, which is still largely pre-revenue (though showing strong Q1 2025 revenue growth and actively converting debt to equity), amassing a sizable crypto treasury. They caution that the inherent volatility of cryptocurrency could complicate financial reporting and introduce unforeseen risks. Others view this audacious move more as investor marketing cleverly masquerading as genuine innovation, aiming to attract capital by riding the crypto wave rather than focusing solely on core business fundamentals.

For now, regardless of the differing opinions, the S-1 filing from the Wellgistics Company has injected fresh energy into a long-running debate: can XRP’s real-world utility truly translate into durable market value and establish it as a widely adopted asset beyond its traditional remittance use cases? The commitment shown by Wellgistics Health, backed by substantial financing, offers a compelling case study that will be closely watched by industries worldwide as they consider their own paths to digital transformation.

Wellgistics’ Financial Context and Future Outlook

While some critics point to the Wellgistics Company’s pre-revenue status, it’s important to note the context from their recent financial reports. For instance, Wellgistics Health reported Q1 2025 revenue of $10.86 million, representing a significant increase and indicating growing operational activity. The company has also been proactive in strengthening its balance sheet, recently converting $8.1 million in debt to equity. This suggests a strategic effort to improve financial health and secure capital for growth initiatives, including the ambitious XRPL integration.

The CEO, Brian Norton, has consistently emphasized a focus on infrastructure-led innovation over traditional expansion, viewing the integration of blockchain payment systems as the “next logical step in the evolution of healthcare.” This long-term vision positions the Wellgistics Company at the intersection of healthcare and fintech, aiming for increased efficiency, data transparency, and reduced costs across its extensive network of pharmacies and manufacturers. The $50 million line from LDA Capital is a testament to investor confidence in this strategic direction, directly earmarking funds for XRP acquisition and the necessary technological middleware.

Stay informed, read the latest crypto news in real time!

The success of Wellgistics Company’s full-stack XRP deployment could indeed set a precedent, particularly for industries with complex supply chains and high transaction volumes where even small cost reductions can lead to significant savings. It highlights a growing trend where businesses are moving beyond simply holding digital assets as a treasury reserve and are actively integrating them into their operational and financial infrastructure to gain a competitive edge. The unfolding story of Wellgistics Health will be a critical barometer for the broader adoption of XRP and the XRPL in enterprise solutions.

📩 Subscribe Now

Join thousands of crypto readers who stay ahead of the market. 100% Free. No Spam. Unsubscribe anytime.