Understanding Bitcoin: A Comprehensive Guide

In a world increasingly dependent on digital advancements, Bitcoin has emerged as a groundbreaking development, pioneering the new era of digital currency. Established by an entity known as Satoshi Nakamoto in 2008, Bitcoin has grown from an obscure form of digital payment to a broad concept that has introduced and combined several innovative financial and technological paradigms. Operating on a decentralized basis, devoid of a central authority and regulation, Bitcoin’s immense potential reaches beyond the conventional banking system towards more diversified and secure financial operations. Scribbling beneath the surface brilliance of BTC, however, are intrinsic complexities that testify to its remarkable ingenuity, while simultaneously posing inherent risks and challenges.

What is Bitcoin?

Understanding Bitcoin

Bitcoin is a type of digital or virtual currency, something that’s often referred to as cryptocurrency. Cryptocurrency is essentially a form of money that exists solely in the digital world, with Bitcoin being the first-ever currency of this type, therefore it’s often considered the standard or flagship model for other cryptocurrencies. BTC was created in the year 2008 by an anonymous person or group using the alias Satoshi Nakamoto.

Bitcoin Purpose and Usage

The main intended purpose of Bitcoin was to provide a new form of money that would be free from control, manipulation, or surveillance by any single authority, providing greater privacy and independence for its users. BTC transactions are irreversible, which can also protect merchants from fraud.

Although BTC was originally invented as an alternative form of currency with a variety of potential uses, it has arguably become most commonly recognized and utilized as a form of “digital gold”. In this sense, it’s not so much used for daily transactions (like buying a cup of coffee or groceries), but more like an investment. People buy and hold Bitcoins betting that they’ll rise in value over time.

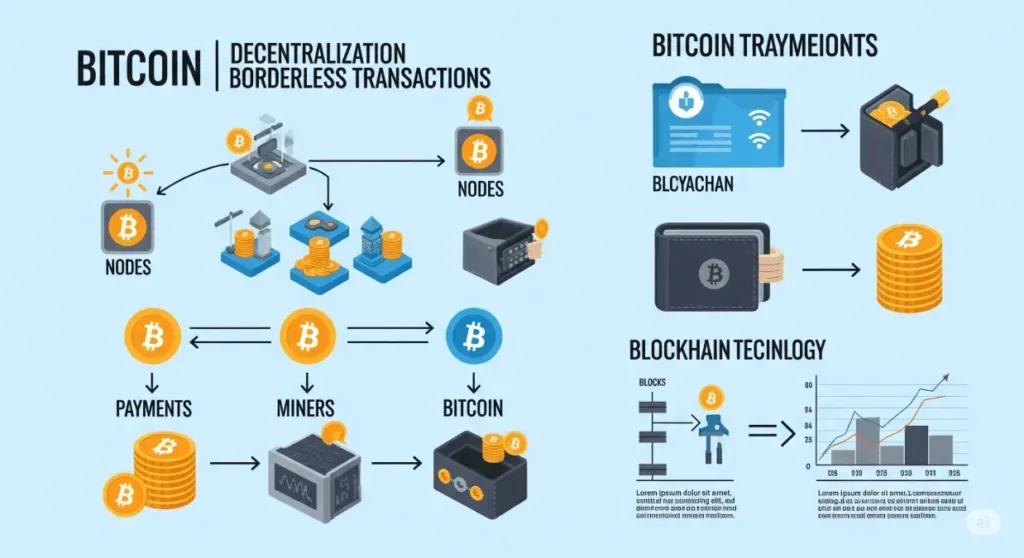

How BTC works

BTC uses a technology called blockchain. It’s a public ledger containing all transaction data from anyone who uses bitcoin. Transactions are added to “blocks” or the links of code that make up the chain, and each transaction must be recorded on a block. BTC cannot be held in a physical form as it is purely digital, and it can be spent or traded like commodities or stocks.

Bitcoin’s Volatility

One main characteristic of BTC is its volatile nature. It is known for its wild price swings that can be unpredictable. While this has drawn some to the high potential for returns, it can also make it a risky investment. The value of Bitcoin can sometimes rise or drop by more than 20% in the span of a few hours.

Furthermore, the legal status of BTC also varies around the world. While some countries have embraced it, others have banned it entirely. So always be aware of the risks and legal implications associated with Bitcoin in your region.

Bitcoin stands as a revolutionary approach to digital transactions, operating independently of traditional banking systems. It’s rapidly attained a significant place in many investment portfolios as an opportunity to speculate, notwithstanding its rather volatile and unpredictable behavior.

How does Bitcoin work?

Demystifying BTC and Blockchain Technology

Regarded as a subset of digital currency, or cryptocurrency, BTC functions separate from centralized banking systems. Introduced in 2008 by an enigmatic entity referred to as Satoshi Nakamoto, Bitcoin’s fundamental operation relies heavily on blockchain technology. This blockchain acts as a decentralized public ledger wherein every Bitcoin transaction is recorded. Essentially a series of transaction-filled blocks, the blockchain’s decentralization ensures that no single authority has control or custody of Bitcoin transactions.

BTC Mining and the Role of Miners

Another important aspect of BTC is the process known as mining. Mining involves validating new transactions and recording them on the global ledger (blockchain). This work is done by a network of powerful computers, referred to as miners. Miners solve complex mathematical problems that involve cryptographic hash functions. It’s a kind of computational race, where the first miner to solve the problem gets to add a new block to the blockchain.

In return for their work, miners are rewarded with new bitcoins. This is how new bitcoins are created, as there’s no central authority or government that issues new coins. Currently, the reward for adding a new block to the blockchain is 6.25 bitcoins. However, this reward gets halved approximately every four years in an event known as a “halving”.

BTC Transactions Verification

Miners also have the responsibility of verifying the authenticity of BTC transactions. BTC transactions are broadcasted to the network by the sender, and all miners in the network collect these transactions and add them to the block they’re trying to solve. A transaction is only considered valid and complete after it’s included in a block on the blockchain.

During the verification process, miners check that the sender has sufficient balance to make the transaction and that they have not attempted to double-spend their bitcoins. Once a block is solved and added to the blockchain, the transactions it contains are considered confirmed.

Purchasing, Trading, and Storing BTC

Bitcoin, a popular cryptocurrency, can be procured and traded on web-based platforms called cryptocurrency exchanges. You can acquire BTC in exchange for traditional currency or other types of cryptocurrencies. In the same way, if you wish to liquidate your Bitcoin, you can do so on these exchanges and receive conventional money or alternate cryptocurrencies in return.

After procurement, BTC can be preserved in digital wallets. This wallet can be an offline hardware device, a printed paper wallet, or an online entity on your computer or mobile device. These wallets contain a couple of essential elements: a public key, necessary to receive Bitcoin into your wallet, and a private key that you need to keep private because it facilitates sending BTC from your wallet.

Uses and benefits of Bitcoin

The Application of Bitcoin

Bitcoin (BTC) is a digital front-runner in the realm of cryptocurrencies, enabling a broad spectrum of transactions and investments. It operates akin to traditional currencies like the Euro or U.S. dollar; however, it is decentralized, meaning that it functions without a government-operated central bank. Bitcoins are primarily used to buy goods and services online, with an increasing number of establishments ranging from small businesses to large companies accepting it as legitimate currency payment. Numerous websites highlight tens of thousands of vendors that accept BTC, from online shopping sites, service providers, as well as physical restaurants and stores.

Beyond just purchasing, BTC has gained popularity as an effective instrument for investment. Like investing in bonds or stocks, individuals can trade Bitcoin on various exchanges, predicting and betting on its price increment or decrement. It does carry an element of risk, much like any investment, but the potential for significant returns is also possible. Moreover, some investment platforms consider Bitcoin as the primary currency making it a pivotal component of the contemporary financial ecosystem.

To those residing or earning abroad, BTC provides a convenient and economical means for transferring money across international borders. Traditional methods of transferring money usually come with high transaction fees and extended waiting periods. In comparison, BTC transactions are quicker to process and often subject to lower fees, regardless of the transaction size or how far it needs to be sent.

Benefits of Bitcoin

Leading the pack of cryptocurrencies, BTC provides multiple advantages over traditional payment methods. User anonymity stands as one of its key benefits. While Bitcoin transactions are transparent and traceable in the blockchain, the identities of the parties involved remain anonymous. This characteristic adds to the security and privacy of the users, insulating them from potential fraud or identity theft.

BTC also offers extremely low transaction fees for international payments, which is a significant advantage over traditional wire transfers or money orders. The absence of a central authority or a bank to process transactions allows Bitcoin to keep costs minimal. This characteristic makes it especially valuable for foreign workers sending remittances back home, enabling more money to reach its intended recipients.

As an investment, Bitcoin shows potential for high returns. Though its value can be volatile, the general trend over the past decade has been upward, with multiple instances of rapid and substantial increases in value. This opportunity for growth has attracted many investors, viewing it as a worthwhile asset to add to their portfolios.

Wrapping Up the BTC User Experience

To encapsulate, BTC has transformed the landscape of modern finance through its multifarious applications, from purchasing goods and services to contributing to international transfers. Additionally, its unique features such as user confidentiality, economical transaction costs, and the potential for significant return on investments are just a few examples of how Bitcoin is revolutionizing commerce and becoming a formidable player in the financial world.

Risks and criticisms of Bitcoin

Understanding the Volatility of BTC

However, it’s crucial to note that alongside its many benefits, BTC comes with its own set of risks, the most notable of which is its infamous volatility. Bitcoin’s value is characteristically unstable, with prices experiencing extreme flux in comparably short durations. A poignant instance would be when Bitcoin’s value soared to nearly $20,000 in December 2017, only to descend to approximately $3,200 a year hence. Such dramatic changes make Bitcoin a potentially risky venture, leading to a debate on its stability and long-term relevance as an alternative form of currency.

Potential Use in Illegal Transactions

Another significant criticism of Bitcoin is its potential use in illegal transactions. This is due to Bitcoin’s partially anonymous nature; while all Bitcoin transactions are publicly recorded in the blockchain, the identities of the individuals involved in the transactions are often not publicly disclosable. This anonymity makes Bitcoin a potentially attractive tool for a variety of illegal activities, including money laundering, tax evasion, and illegal purchasing activities. Such criticism has resulted in increased scrutiny and calls for regulation.

High Energy Consumption

Despite attempts to create a decentralized and environmentally friendly form of currency, Bitcoin’s energy consumption has become a point of criticism. According to the Cambridge Centre for Alternative Finance, the Bitcoin network uses more electricity annually than some countries, leading many to question the environmental viability of Bitcoin’s underlying technology, the blockchain.

Lack of Consumer Protections

BTC also presents risks due to a lack of consumer protections. If a user’s BTC wallet is hacked or if they forget their private keys, their Bitcoins can be irretrievably lost. Unlike traditional banking institutions, which insure deposits, Bitcoin does not provide a safety net for its users. There is no mechanism to recover lost Bitcoins making it risky for users, particularly those who are not technologically savvy.

Market Manipulation Concerns

BTC, in the absence of regulatory oversight, presents a potential for market manipulation. This can manifest in various forms ranging from “pump and dump” strategies to the propagation of misleading or utterly false information. Historically, cases have occurred where certain individuals or groups strategically hike the price of BTC and subsequently sell their holdings. This allows them to make substantial profits while leaving other investors with significant losses. These practices not only concern potential investors but also regulatory authorities, raising doubts regarding Bitcoin’s ethical credibility.

The Future of Bitcoin

Bright Horizons for BTC Adoption

Despite the market manipulation concerns, Bitcoin’s broader adoption over the past decade signals a promising trajectory. The number of individual users has significantly been on the rise, and so has the number of commercial entities recognizing BTC as a payment method. Firms as large as Microsoft and Starbucks are among those who now acknowledge BTC as a payment option, reflecting an increasing acceptance of the cryptocurrency.

Experts believe that Bitcoin could be on the verge of even more widespread adoption in the future. The digital currency presents unique advantages over traditional currencies – faster transactions, lower transaction fees, and bypassing the need for conventional banking systems. As acceptance towards digital transactions accelerates and faith in cryptocurrencies solidifies, we could witness an expanded wave of Bitcoin adoption.

Regulatory Challenges for BTC

However, the path to this widespread adoption isn’t clear and without hurdles. One of the major challenges BTC is facing is regulatory issues. Because BTC is a decentralized currency, it isn’t regulated by a central authority like traditional currencies are. This has led to concerns about its use in illegal activities and has caused some countries to place restrictions on its use.

Experts believe regulatory challenges will continue to be a significant factor in Bitcoin’s future. Different governments will likely continue to grapple with how to regulate Bitcoin, which can impact its adoption and use. Furthermore, these regulations could shape how Bitcoin is used, whether it’s considered legal tender, and how it’s taxed.

Bitcoin’s Impact on Traditional Financial Systems

Many experts believe that the decentralization aspect of BTC could have a major impact on traditional financial systems. By removing the need for intermediaries like banks, BTC could potentially change how we conduct transactions, transfer money, and structure our financial systems. This could lead to more financial inclusion for unbanked populations and could reduce the costs associated with transactions.

However, this disruption also poses challenges. The traditional banking sector and governments may resist this change due to the loss of control over monetary policy. Furthermore, it could destabilize current financial infrastructures if not integrated properly.

The Growth of Other Cryptocurrencies

The growth of other cryptocurrencies could also impact the future of Bitcoin. While Bitcoin was the first cryptocurrency and remains the most popular, thousands of other cryptocurrencies have been created, each with their unique features and use cases. These other cryptocurrencies could potentially rival Bitcoin or shift attention and investment away from it.

Similarly, the introduction of Central Bank Digital Currencies (CBDCs) could also influence the future trajectory of BTC. If major economies launch their digital currencies, it could affect the global landscape of cryptocurrencies and might pose a challenge to Bitcoin’s dominance.

In conclusion

While the potential for Bitcoin’s future is vast, it’s also filled with uncertainty. Its path to widespread adoption faces regulatory challenges and potential resistance from traditional financial infrastructures. Simultaneously, the growth of other cryptocurrencies could also impact Bitcoin’s dominance in the market. However, the possibilities it offers make it a fascinating subject to follow in the coming years.

Despite the apparent volatility and various criticisms surrounding BTC, its influences in shaping the landscape of our financial and technological future is undeniable. As a harbinger of the cryptocurrency evolution, Bitcoin’s possible global acceptance and impact on traditional financial systems remain a highly anticipated yet speculative endeavor. Encrypted within every transaction and blockchain are not just codes, but tokens of a revolution that has the potential to redefine money, privacy, and trust. Coupled with the burgeoning expansion of other cryptocurrencies, the world is embarked on a relentless march towards digitization. The resilience and adaptability of BTC in the face of potential regulatory hurdles and market skepticism suggest an epochal shift in our understanding and use of monetary systems. The revolution has only begun.

2 thoughts on “Understanding Bitcoin: A Comprehensive Guide”