Cryptocurrency Mining: A Comprehensive Guide

In the evolving world of digital finance, cryptocurrencies have emerged as a prominent player, revolutionizing the traditional concepts of money and transactions. Built on a technology called blockchain, cryptocurrencies like Bitcoin and Ethereum offer a decentralized method of trading and investing. But what keeps the integrity of these systems? What ensures that each transaction is valid and traceable? The answer lies in a complex, yet fascinating process known as cryptocurrency mining. This process, densely technological at its core, plays a crucial role in maintaining the transparency, security, and smooth functioning of cryptocurrencies.

Understanding Cryptocurrencies

What is Cryptocurrency?

Cryptocurrency is a type of virtual or digital currency used for secure financial transactions online. Bitcoin, invented in 2009, was the first cryptocurrency and remains the most well-known and valuable. Since then, many other cryptocurrencies have come into existence such as Ethereum, Ripple, and Litecoin. These digital currencies use a technology called blockchain, a decentralized system that records transactions across multiple computers to ensure the security and integrity of the records.

Blockchain Technology

Blockchain technology is the backbone of cryptocurrency. Blockchain works like a public ledger, recording all transactions made with a particular cryptocurrency. This decentralized ledger is maintained over various nodes (computers or servers) that participate in the network. All recent transactions are bundled together into a ‘block,’ and each block is added to the ‘chain’ in a linear, chronological order. The ledger is not controlled by any central authority, which increases security and decreases the probability of fraud or double spending.

Role of Cryptocurrencies in the Digital World

In the digital world, cryptocurrencies offer a way to carry out transactions quickly, with low fees, and without the need for a central banking system or currency exchange. This makes cryptocurrencies appealing for international transactions or transactions that want to bypass traditional banking systems. Cryptocurrencies also offer a degree of anonymity since identities are often concealed behind cryptographic codes. However, every transaction made with cryptocurrencies is transparent and can be viewed on the blockchain, providing a balance between privacy and transparency.

Understanding Cryptocurrency Mining

Cryptocurrency mining is the process by which transactions for various forms of cryptocurrency are verified and added to the blockchain digital ledger. In the context of mining, the term “mining” refers to the process of solving complex mathematical problems that are integral to the functioning of the underlying cryptocurrency network.

Mining Process and Security

Cryptocurrency miners use high-powered computers to solve complex mathematical problems. When these problems are solved, the miner verifies the transaction, adds it to the ledger (or blockchain), and is rewarded with a small amount of cryptocurrency. This mining process is what creates more units of the cryptocurrency.

The complexity of these problems and the power required to solve them is what makes cryptocurrencies secure. It is computationally unfeasible for a fraudulent actor to alter transactions on the blockchain because they would need to control more than 50% of the entire network’s computing power, a feat that is almost impossible given the vast and decentralized nature of most cryptocurrency networks.

Why is Cryptocurrency Mining Crucial?

Cryptocurrency mining goes beyond simply accruing digital currencies. It operates as the backbone of the cryptocurrency mechanism. Without the miners’ efforts, the processing of transactions and generation of new coins cease to occur. The entire cryptocurrency sphere relies heavily on mining for its proper operation, security, and integrity. Alongside its indispensable role in maintaining the system, cryptomining can also be a lucrative endeavor for miners, especially when the value of the crypto coin sees a surge.

What is Cryptocurrency Mining

Deciphering the Process of Cryptocurrency Mining

Mining a cryptocurrency isn’t a straightforward task; it rather entails two essential objectives: injecting new cryptocurrency into circulation and verifying and recording transactions onto the blockchain – a digital ledger. This intricate process demands solving hard mathematical problems with cryptographic hash functions that pertain to a block encompassing transaction information.

Transaction Validation and the Role of Miners

Miners play a crucial role in maintaining the integrity of transaction data. They fulfill this role by verifying transaction data and ensuring it’s accurate before adding it to the blockchain. These transactions are bundled into blocks, which miners then confirm by solving the computational problem associated with the block.

Proof of Work and Proof of Stake

A significant part of understanding cryptocurrency mining involves analyzing the two main mechanisms by which validation is achieved: Proof of Work (PoW) and Proof of Stake (PoS).

Proof of Work requires miners to prove that they have done work to solve the block’s puzzle. It demands significant computational power and is energy-intensive, but it ensures a high level of security on the network. Bitcoin—the very first cryptocurrency—uses a PoW protocol.

On the other hand, Proof of Stake is a different kind of protocol that demands users to show ownership of a certain number of cryptocurrency units to validate new transactions. In the PoS model, the creator of a new block is chosen in a deterministic way, depending on its wealth, also defined as ‘stake.’ Though less energy-intensive than PoW, the PoS model is used by cryptocurrencies like Peercoin and Ethereum.

Cryptocurrency Mining Overview

Cryptocurrency mining is an intricate process that ensures the seamless functioning of cryptocurrencies. Although it consumes substantial resources, this process contributes to maintaining the decentralization, robustness, and security of the cryptocurrency networks.

The Mining Process

Digging Deeper into Cryptocurrency Mining

Delving into its complexities, cryptocurrency mining involves the verification and recording of transactions to the public ledger, also referred to as the blockchain. Additionally, mining introduces new coins into the system, a crucial aspect for the operation of cryptocurrencies like Bitcoin and Ethereum.

Hardware Requirements for Mining

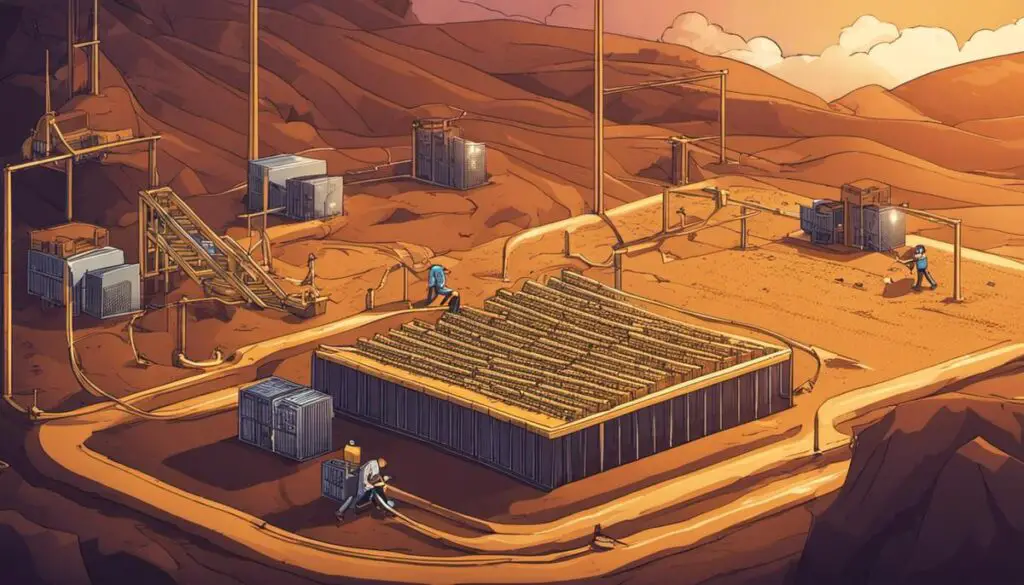

To begin mining cryptocurrencies, you will first need specialized hardware. In the early days of Bitcoin, it was possible to mine with ordinary computers. However, as the difficulty of the mining process has increased, so has the computational power required. Today, most miners use specially designed hardware known as ASIC (Application Specific Integrated Circuit) miners, which are specifically designed for the task of mining. These devices can be expensive, and they also consume a considerable amount of electricity, which must be factored into any calculations of profitability.

Hash Power and Its Importance

Hash power or hash rate is a critical aspect to understand when discussing cryptocurrency mining. In simple terms, it represents the computational power that a miner is contributing to the network. The more hash power a miner has, the more likely they are to solve the mathematical problem that results in mining rewards. Thus, hash power directly impacts the miner’s probability of earning rewards.

The Role of Mining Software

Once your hardware setup is in place, you’ll need mining software. This software is what connects your mining equipment to the blockchain and the mining pool if you are part of one. It also instructs the hardware on what to mine, where to mine, and who to send the mined coins to. The software also communicates with the blockchain to track any transactions and updates within the blockchain.

Mining Operations

The actual operation of mining involves a process of solving complex mathematical problems. These problems require a great deal of computing power to solve, and the first miner who solves each problem gets to add a new block to the blockchain. In return for this work, the miner is rewarded with a certain number of coins. This process is known as proof-of-work.

The process begins with the collection of recent transactions into a block. The miners then attempt to solve a complex mathematical problem related to the block, a process that requires intensive computation. The first miner to solve the problem gets to add the block to the blockchain. The new block, containing a record of recent transactions, is then appended to the existing blockchain.

Rewards Structure for Successful Miners

Miners are rewarded for their efforts in two ways: block rewards and transaction fees. The block reward is a set amount of cryptocurrency that is awarded to the miner who successfully adds a new block to the blockchain. This reward decreases over time in a process known as halving.

In addition to the block reward, miners can also be paid in transaction fees. Each transaction that is included in a block can include a small fee that is paid to the miner. As the block reward decreases over time, these transaction fees become an increasingly important source of income for miners.

Undertaking the task of cryptocurrency mining is a complex, yet potentially lucrative venture. With the right mixture of hardware and software, coupled with an in-depth understanding of the process, you could turn a profit, given you’re willing to invest time and effort.

The Economics of Mining

Grasping the Profit Potential in Cryptocurrency Mining

The key to a successful mining operation lies in its profitability. Crucial variables that will influence your potential earnings include the price of the required equipment, the cost of electricity, and the potential financial return from the mined cryptocurrency.

Equipment Costs

One of the most significant initial costs related to cryptocurrency mining is the purchase of specialized mining equipment. These machines, often referred to as mining rigs, carry out the complex calculations required to mine, or ‘solve’ blocks of transactions within a blockchain. The level of computational power required to mine most currencies effectively has risen exponentially over the years, leading to the creation of more powerful but more expensive, mining rigs. While a basic setup might cost a few thousand dollars, a top-tier rig equipped with multiple high-powered graphics cards can cost upwards of $30,000.

Electricity Costs

Arguably the most significant long-term expense in cryptocurrency mining is electricity. Mining rigs consume significant amounts of power when running 24/7. The amount of electricity used varies depending on the Mining Hardware, complexity of the math problems, and the quantity of mined cryptocurrency. It’s often advisable for miners to consider their location’s electricity rates critically. In regions where the cost of electricity is high, the profitability of crypto mining takes a hit.

Potential Payout

The potential payout from mining operations often acts as the primary motivator for miners. The more computational power a miner has, the greater their chances of solving the next block and earning the related crypto reward. However, given the high operational costs and extreme competition involved, many mining operations may still struggle to turn a profit.

Solo versus Pool Mining

There are two common approaches to crypto mining: solo mining and pool mining. Solo mining involves operating a personal mining rig independently. The miner takes on all operational costs but also keeps all profits generated. This route, although potentially lucrative, involves a high risk as mining depends highly on computational power and luck.

On the other hand, pool mining involves joining a group of other miners and sharing computational power. The profits are split according to each member’s contribution to the pool. Compared to solo mining, pool mining greatly increases the chances of earning a steady income. However, joining fees for mining pools and revenue splits may reduce overall earnings.

Understanding the Dynamics of Crypto Mining

To fully comprehend the gains and risks involved in cryptocurrency mining, it is important to delve into the complexities of its influencing factors. These include the initial cost of hardware, the ongoing expenditure on electricity, the likelihood and potential of earnings, and the decision whether to mine solo or join a pool. This understanding will equip those interested in crypto mining with the necessary insight to make well-informed decisions about venturing into such a field.

Legal and Ethical Implications

The Environmental Impact of Cryptocurrency Mining

Consideration for the environment is becoming a key issue in the discourse of cryptocurrency mining. Bitcoin mining, in particular, has been scrutinized for its immense energy consumption. Given that this process involves solving computationally intense mathematical problems using high-powered computers, it naturally burns large amounts of electricity. As a consequence, debates regarding the carbon footprint of such endeavors have surfaced. Comparative studies suggest that the energy consumed by Bitcoin mining even outpaces what certain nations use on a yearly basis. This vast energy consumption may contribute to the exacerbation of environmental pollution through increased carbon outputs, placing undue stress on local power grids. These factors combined could even lead to a surge in energy prices.

Legal Landscape for Cryptocurrency Mining

The legal aspect of cryptocurrency mining varies worldwide. In some countries, like China, it is thoroughly illegal, while in others, like the USA, it’s legal and regulated at different levels. As governments try to catch up with the fast-evolving crypto world, the legality of cryptocurrency mining is subject to change. Over the years, countries like Iran and China have imposed severe regulations due to the activity’s high energy use and its perceived threat to financial stability.

Even in countries where it is legal, there exist inherent risks. Many legal systems are yet to define the exact nature of digital currency, debating if it should be treated as an asset, security, or currency. Depending on these classifications, different laws apply, including those governing taxation.

Ethical Implications of Cryptocurrency Mining

Beyond the legal and environmental implications, the ethical aspect of cryptocurrency mining is equally contentious. The use of cryptocurrencies for illicit activities such as money laundering or terrorist financing raises ethical concerns. Since cryptocurrency transactions can be virtually anonymous, they can potentially facilitate illegal movements of money across borders.

Moreover, ‘cryptojacking’ has become a prominent ethical issue. This act involves hackers using a person’s computer resources to mine cryptocurrencies without their consent, leading to slow computer operating speeds and higher energy costs for the unsuspecting user.

Future Scenarios for the Industry

Looking into the future, several possible scenarios for the cryptocurrency mining industry are emerging. Increased regulatory oversight seems inevitable as governments seek to manage the impacts of this industry on energy use, financial systems, and societal well-being. Countries might introduce novel regulations regarding the location of mining farms, taking into account their renewable energy sources.

Additionally, sustainable alternatives to power cryptocurrency mining processes are on the rise. ‘Green’ crypto mining is becoming a buzzword, with certain companies investing in renewable energy sources to lessen the environmental implications. Meanwhile, consensus mechanisms like Proof-of-Stake (PoS) offer more energy-efficient processes compared to the traditionally used Proof-of-Work (PoW).

The future may also bring further developments in blockchain technology that could potentially render current mining processes obsolete. As this industry evolves, it’s essential for miners, investors, and regulators to stay abreast of the rapid changes in the digital currency realm.

As the curtain falls on our exploration of cryptocurrency mining, it becomes clear that this intriguing technological process holds immense economic potential and heralds a new era of digital finance. However, the environmental implications and regulatory concerns associated with it underline the importance of responsible and ethical practices. All in all, while the future of cryptocurrency mining promises exciting developments, the sustainability of this process remains a crucial consideration. The power of technology must not undermine the obligation towards our planet and ethical norms. In the endless race of progress, may we not forget to pause, ponder and pursue the path that ensures a balance between prosperity and sustainability.