Binance Labs is investing in seven new infrastructure projects

Binance Labs, venture capital arm of the Binance exchange, with investable assets of approximately $10 billion, invested in seven projects: Ethena Labs, Derived, Shogun, UXUY, Cellula, NFPrompt and QnA3. The diversification shows how differently Binance is committed to considering each sector that can drive long-term sustainable growth. T he investments are “bets on startups” that were featured in the Binance Incubation Season 6 campaign.

Binance Labs Projects

Ethena Labs is a developer of synthetic dollar protocols that aims to strengthen internet bonds. As tokenization of assets becomes more popular, Ethena Labs could be an instant hit in the industry. Derivio is a decentralized derivatives exchange based on zkSync. Aiming to bring improved scalability and low costs to the DEX world, Derivio hopes to make a real difference as a beneficiary of Binance Labs’ investment.

Shogun describes itself as an intent-centric DeFi engine that can help traders maximize extractable value. The UXUY Protocol is also a decentralized exchange platform that shows the growing demand for a DeFi alternative to centralized trading platforms.

The variety of Binance Labs cash infusion also extended to Cellulia, a life simulation strategy game, NFPrompt, an artificial intelligence-powered user-generated content portal, and QnA3, an AI-powered learning platform.

Binance Labs takes a strategic approach to its investments. As previously reported , the venture capital firm also invested in Babylon, a protocol that allows users to stake Bitcoin on proof-of-stake blockchains and earn returns without handing over their BTC to third-party custodians.

Babylon was backed by Binance Labs for its diverse features, including granting Proof-of-Stake (PoS) protocols such as Cardano (ADA) and Ethereum (ETH) to increase security while ensuring Bitcoin holders get higher benefits and higher profitability.

Positioning for the future of Web3

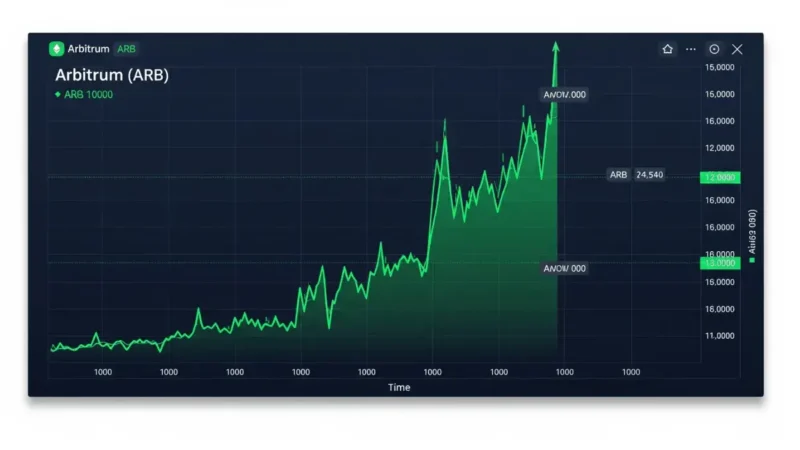

Binance Labs’ strategic investments come at a time when the broader digital currency ecosystem is in a bull phase, driven by Bitcoin, which has risen to a new ATH of over $70,000 .

Stay informed, read the latest updates now!

With the market launch of Bitcoin spot ETFs in January, digital currencies are becoming more of a focus for institutional investors. According to market observers, this has created a new opportunity for infrastructure providers in the industry. With funding from Binance Labs, the seven newly funded projects can build for the future and prepare for the massive influx of new customers into the industry.