Cardano price prediction for 2025: Why Analysts Expect an Explosive ADA Rally

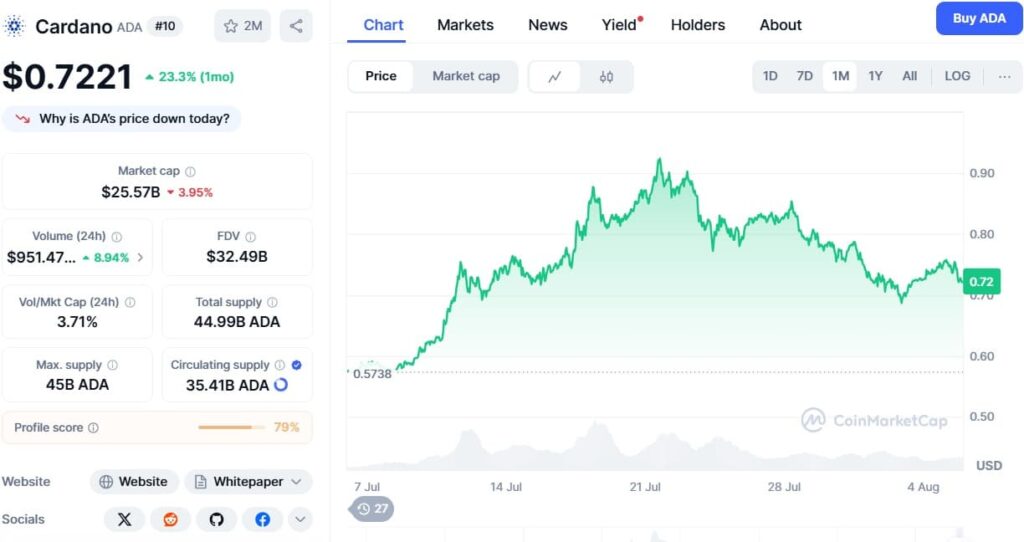

Cardano (ADA) is once again in the spotlight, following a massive ascent by Bitcoin (BTC). After an impressive rally that saw BTC hit a new all-time high, ADA also showed significant growth. However, a recent correction, which saw the price fall from a peak of $0.92 to $0.71, has led many to question the asset’s future. While bearish sentiment temporarily took hold, the latest data from the derivatives market and in-depth technical analysis paint a different picture, supporting a bullish cardano price prediction.

CryptoQuorum offers a detailed analysis of the current market situation, explores key technical and fundamental factors, and presents the forecasts of leading analysts regarding the future of ADA.

Technical Indicators and Market Sentiment: The Foundation for Cardano Price Prediction

To understand what lies ahead for Cardano, we must carefully examine current market data. At the time of writing, the price of ADA is showing signs of recovery, trading around the $0.75 mark after a recent dip. This bounce from the key support level of $0.70 is a critical signal for bulls. Historical data shows that such sharp rebounds after a correction often precede new rallies.

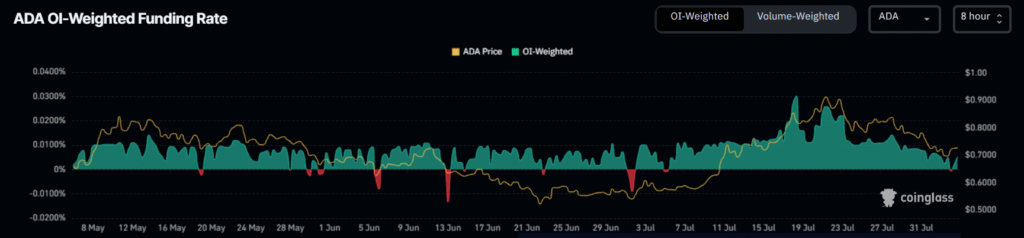

The main argument in favor of a positive cardano price prediction comes from the derivatives market. The OI-Weighted Funding Rate metric from CoinGlass, which reflects the cost of holding a long or short position, has recently made a significant shift. The rate has turned positive, meaning that holders of long positions are paying those with short positions, as the majority of traders are betting on an upswing. This shift in sentiment is a powerful indicator, as it has often preceded significant price movements.

Furthermore, the long-to-short ratio has climbed to 1.13, its highest level in over a month. This indicates that the number of traders anticipating a price increase significantly outweighs those betting on a drop. The combination of these two metrics clearly demonstrates that market sentiment has shifted from bearish to bullish, creating a solid foundation for ADA’s next growth phase.

However, it is important to consider other indicators as well. The Relative Strength Index (RSI) is currently reading around 47. While this still suggests some weakness, the RSI’s movement toward the neutral zone (50) indicates that bearish momentum is fading. For a sustained rally, the RSI must cross this mark. Holding the price above $0.70 and breaking the resistance at $0.84 will be the next crucial steps on the path to a new surge.

Analyst Forecasts: Long-Term Cardano Price Prediction

Analyst forecasts based on this market data support an optimistic cardano price prediction. Noted analyst Master Ananda believes that ADA is “still very cheap” at its current price. According to his analysis, ADA has already completed the first wave of a bullish breakout and is now in a consolidation phase, which is forming a higher low. This will serve as the launchpad for the next major rally. Ananda predicts that in 2025, ADA could reach $4 and then target the $7 and even $8 levels. He asserts that reaching a new ATH of $8.11 is a realistic goal, given the market dynamics and the potential of the Cardano ecosystem.

These ambitious forecasts align with the general consensus that Cardano is on the brink of significant growth. According to analysts, this growth will be driven not only by market trends but also by the project’s continuous ecosystem expansion and fundamental improvements.

The Cardano Ecosystem: Fundamental Drivers of Growth

A positive cardano price prediction is supported not just by technical factors but also by the project’s active development. The Cardano Foundation continues to strengthen its position, making the project more attractive to long-term investors. Recently, the Cardano Foundation, in collaboration with the IOTA Foundation and INATBA, actively participated in a dialogue with the UK’s financial regulator, the Financial Conduct Authority (FCA).

The group pushed back against the FCA’s approach of applying the same regulations to both centralized and decentralized platforms. They called for a more nuanced and tiered regulatory model that accounts for the unique risks associated with different types of cryptoassets. This initiative shows that Cardano is committed not only to technological development but also to fostering a favorable regulatory environment that won’t stifle innovation. Such activity builds trust in the project and is a powerful fundamental factor supporting a long-term cardano price prediction.

In addition to its regulatory work, the Cardano Foundation has also launched a new tool called the “Tool Compass.” This interactive guide for developers helps them choose the most suitable solutions and tools for building decentralized applications in the Cardano ecosystem. It reduces development time and increases accuracy, which encourages the influx of new talent and innovation into the ecosystem. Strengthening the ecosystem with such tools ultimately increases the value of the network itself and, consequently, the ADA token.

Stay informed, read the latest crypto news in real time!

Conclusion: Why You Should Watch ADA

Bold analyst predictions, backed by derivatives market data and positive technical sentiment, point to the potential for significant growth for Cardano. Despite recent volatility, ADA is showing resilience and the ability to recover. The successful holding of key support levels and a strong influx of bulls into the derivatives market are powerful indicators that could lead to the next phase of the rally. Given Cardano’s active role in shaping the regulatory landscape and the launch of new tools for developers, the long-term cardano price prediction looks especially promising.