The world of digital finance is rapidly evolving, and at its core, Chainlink and stablecoins are becoming increasingly intertwined. This growing connection is rooted in Chainlink’s fundamental role in providing critical infrastructure that stablecoin issuers and users need to foster trust and ensure seamless operations. As the digital asset landscape matures, the demand for robust, transparent, and compliant solutions for digital currencies, particularly stablecoins, has never been more pressing.

A significant catalyst for this evolution is the recent legislative development in the United States. This month, President Donald Trump signed the GENIUS Act into law, a landmark moment marking the first comprehensive federal framework for stablecoins in U.S. history. This legislation is a game-changer, establishing clear licensing rules, stringent reserve disclosure requirements, and robust oversight mechanisms. The primary aim of the GENIUS Act is to make payment stablecoins safe, transparent, and reliable for broader adoption. This historic legislation also paves the way for U.S. banks to legally custody and even issue dollar-backed stablecoins, thereby opening the door to unprecedented institutional participation on a stable regulatory footing. This move alone is expected to inject significant capital and credibility into the stablecoin ecosystem, transforming it from a niche financial instrument into a mainstream component of global finance.

Meeting Regulatory Demands with Chainlink’s Infrastructure

With this newfound regulatory certainty, platforms issuing compliance-ready stablecoins are now faced with the imperative to meet strict reserve backing and audit requirements. This is precisely where Chainlink’s comprehensive suite of tools becomes indispensable. Chainlink’s offerings, including its widely acclaimed Proof of Reserves (PoR) system, secure Data Feeds, and its Cross-Chain Interoperability Protocol (CCIP), provide issuers with the essential infrastructure needed to meet these stringent obligations mandated by the GENIUS Act.

For instance, Chainlink Proof of Reserves allows issuers to publicly demonstrate and attest on a monthly basis that their stablecoins are fully backed by liquid assets, such as U.S. Treasuries. This real-time, transparent verification mechanism is crucial for building and maintaining user confidence, as it eliminates speculative doubts about the solvency and backing of stablecoins. It represents a significant leap forward in financial transparency within the digital asset space, offering a level of audibility that rivals traditional financial instruments.

Chainlink and Stablecoins

The new legislation places a strong and unambiguous focus on two critical aspects: interoperability and transparent data sharing across diverse blockchain networks. These requirements are not merely technical specifications but foundational principles designed to foster a more integrated and trustworthy digital financial system. Chainlink is exceptionally well-positioned to address these demands, thanks to its pioneering technologies.

Cross-Chain Interoperability with CCIP and ACE

The Cross‑Chain Interoperability Protocol (CCIP) is one of Chainlink’s standout innovations, ensuring the network is always part of the conversation whenever blockchain interoperability comes up. The CCIP, coupled with Chainlink’s Automated Compliance Engine (ACE), enables the secure and auditable movement of assets, including stablecoins, between different blockchains. This secure bridging capability is expected to be increasingly relied upon by stablecoin issuers and banks as regulations continue to tighten and the need for seamless, compliant asset transfers grows. The ability to move value and data across disparate blockchain environments without compromising security or regulatory adherence is a cornerstone of a truly interconnected digital economy.

Boosting Liquidity and Circulation

Chainlink highlights on its website how its technology plays a crucial role in supporting stablecoins across multiple use cases. First, it ensures reliable and seamless transfers. This enables stablecoins to move effortlessly between different blockchains with guaranteed execution, effectively preventing fragmented liquidity that often plagues nascent digital markets. This capability allows stablecoins to truly function as a single, borderless financial asset while simultaneously accessing liquidity pools across various networks, thereby maximizing their utility and reach.

Furthermore, Chainlink significantly boosts liquidity and overall circulation for stablecoins. Many leading DeFi protocols and institutions have already adopted stablecoins built on the Chainlink standard. This widespread adoption is simply because Chainlink’s infrastructure unifies liquidity, accelerates organic Total Value Locked (TVL) growth, and drives faster adoption through improved trust and efficiency. By providing a common, secure framework for these digital assets, Chainlink reduces the friction associated with cross-chain transactions and enhances the overall stability of the DeFi ecosystem.

Near-Instant Cross-Chain Settlements

Another key feature that Chainlink facilitates is near-instant cross-chain settlements. Stablecoins can securely transfer between public and private blockchains, making real-world applications like cross-border payroll and low-friction foreign exchange (FX) conversions significantly easier. This capability not only streamlines complex financial operations but also ensures that these transactions meet regulatory compliance and eliminate settlement risks, which are often a major hurdle in traditional finance. The speed and security offered by Chainlink’s solutions are vital for the widespread integration of stablecoins into global commerce.

Strengthening Transparency with Proof of Reserves

Finally, Chainlink strengthens transparency and trust with its Proof of Reserve (PoR) system, which verifies that every stablecoin is fully backed by reserves. By integrating PoR into their minting processes, issuers can prevent critical risks such as “infinite mint attacks,” where unbacked stablecoins could be fraudulently created. This offers users greater confidence and security as stablecoin adoption continues to scale, assuring them that their digital assets are indeed backed by tangible reserves.

Institutional Adoption and the Future Outlook

The regulatory clarity provided by the GENIUS Act and similar frameworks has spurred institutional heavyweights like JPMorgan, Circle, and Coinbase to quickly expand their stablecoin operations. This increased institutional interest signals a turning point for the adoption of digital assets in mainstream finance.

In a notable development, JPMorgan completed its first financial transaction on a public blockchain, leveraging Chainlink and Ondo Finance as key partners. This transaction utilized a cross-chain Delivery versus Payment (DvP) model, highlighting how rapidly blockchain-based financial infrastructure is evolving and the crucial role Chainlink is playing in this transformation. Such high-profile adoptions underscore the growing confidence in blockchain technology and its ability to revolutionize traditional financial systems.

Stay informed, read the latest crypto news in real time!

LINK Token Performance

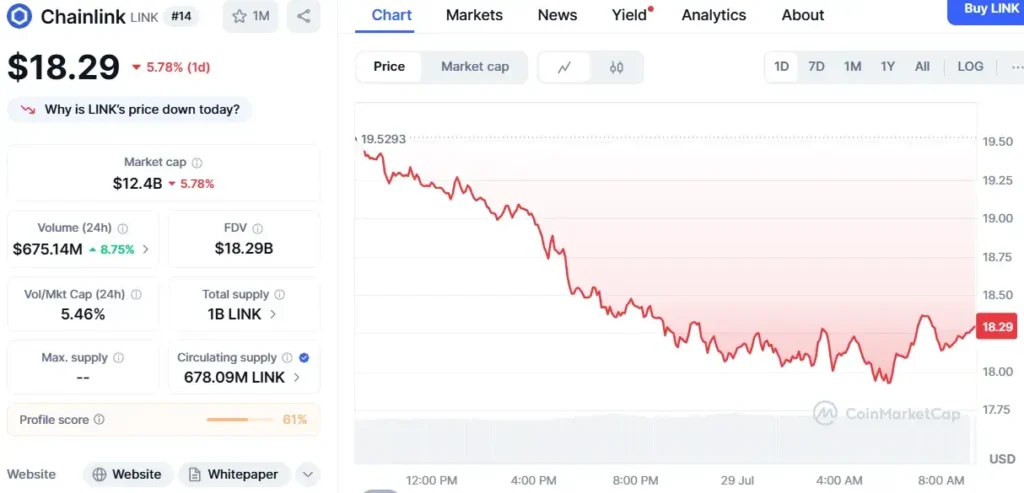

While the underlying technology and regulatory landscape are robust, Chainlink’s native token, LINK, has faced some price pressure. The token has dropped nearly 10% over the past week and slipped another 1.23% in the last 24 hours to trade at $18.29. Analysts note that the token’s next key resistance level sits near $18.81, which could determine its short-term trajectory. It is important to remember that token price movements are often influenced by broader market trends and investor sentiment, distinct from the fundamental utility and adoption of the underlying technology.

Conclusion

The convergence of evolving regulatory frameworks like the GENIUS Act and Chainlink’s innovative infrastructure is setting the stage for a new era of trust, transparency, and widespread adoption for chainlink stablecoins. As institutions increasingly embrace digital assets, the demand for secure, interoperable, and auditable solutions will only grow. Chainlink’s foundational role in providing these critical components positions it as a key enabler for the future of finance, where digital currencies can seamlessly integrate into the global economic landscape. The ongoing developments promise a future where digital assets are not just an alternative but a preferred method for secure and efficient value transfer across borders.

Steven Andros is a crypto enthusiast whose main goal is to tell everyone about the prospects of Web 3.0. His love for cryptocurrencies began in his student years, when he realized the obvious advantages of decentralized money over traditional payments. Email: [email protected]