Fear and Greed Index Explained: How Crypto Investors Use It to Master the Market

The cryptocurrency market is often described as a digital Wild West—volatile, fast-paced, and driven by intense emotion. Unlike traditional stocks, where earnings reports and dividends anchor valuations, crypto prices are frequently pushed to extremes by human psychology.

To navigate this chaos, savvy traders rely on a vital tool: the Crypto Fear and Greed Index. But what exactly does this index measure, and how can you use market sentiment crypto data to make better investment decisions?

What is the Crypto Fear and Greed Index?

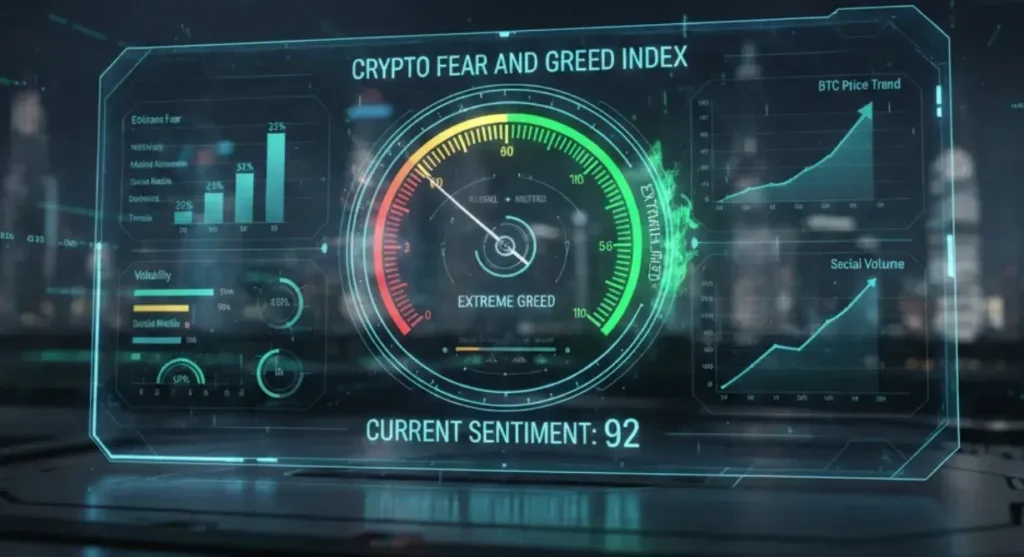

The Crypto Fear and Greed Index is a technical tool that analyzes the current sentiment of the Bitcoin and broader crypto market. It condenses complex data points into a single score ranging from 0 to 100:

- 0–24: Extreme Fear (Orange/Red)

- 25–46: Fear (Yellow/Amber)

- 47–54: Neutral (Grey)

- 55–75: Greed (Light Green)

- 76–100: Extreme Greed (Bright Green)

The logic is simple: when the market is rising, people get “FOMO” (Fear Of Missing Out) and become greedy. Conversely, when prices drop, investors often sell in a “FUD” (Fear, Uncertainty, and Doubt) driven panic.

Understanding Investor Psychology

At its core, the index is a window into investor psychology. Markets are driven by two primary emotions:

- Fear: When investors are worried, they tend to sell, often driving prices below their intrinsic value. This can create “oversold” conditions.

- Greed: When investors are overly optimistic, they buy aggressively, pushing prices higher than they should be. This creates “overbought” conditions or “bubbles.”

How is the Index Calculated?

The index (most famously provided by Alternative.me) gathers data from five key sources:

- Volatility (25%): Comparing current volatility to the averages of the last 30 and 90 days.

- Market Momentum/Volume (25%): High buying volume in a positive market indicates the market is getting too greedy.

- Social Media (15%): Twitter sentiment analysis and hashtag speed.

- Dominance (10%): A rise in Bitcoin dominance often suggests a “fearful” market as investors move funds from risky altcoins to the “safe haven” of BTC.

- Trends (10%): Google Trends data for various Bitcoin-related search queries.

How Crypto Investors Use the Index in Market Analysis

Experienced traders don’t just look at the number; they use it as a contrarian indicator. Following the wisdom of Warren Buffett—“Be fearful when others are greedy, and greedy when others are fearful”—investors apply these strategies:

1. Buying the “Blood in the Streets”

When the index hits Extreme Fear (below 20), it often signals a market bottom. For long-term investors, this is frequently viewed as a “Buy the Dip” opportunity because the selling pressure has likely peaked.

2. Taking Profits During Euphoria

When the index enters Extreme Greed (above 80), the market is due for a correction. Professional traders use this as a signal to scale out of positions and take profits before a potential crash.

3. Identifying Trend Strength

If the market is in a steady uptrend but the index remains “Neutral” or moderately “Greedy,” it suggests the move is healthy and not yet a bubble.

Stay informed, read the latest crypto news in real time!

The Bottom Line

While the crypto fear and greed index is a powerful tool for gauging market sentiment crypto, it should never be used in isolation. Successful investors combine sentiment data with technical analysis (like RSI and Moving Averages) and fundamental research.

By understanding the pulse of the market, you can stop reacting to the noise and start acting on the data.