Curve Finance introduces its own stablecoin, CRV price increases

Curve Finance is a DEX that allows trading of different stablecoins. Now the platform is developing its own stablecoin called crvUSD. According to its presentation, the course of the CRV token will increase by up to 25 percent.

Table of Contents

Curve Finance: own stablecoin is called crvUSD

Various stablecoins are already represented on the DEX Curve Finance. The spectrum ranges from algorithmic stablecoins such as TerraUSD and other decentralized stablecoins such as the DAI to the best-known representatives such as Tether and USDC.

Smaller projects such as FRAX or Magic Internet Money are also represented. Curve will soon be expanding its offering with its own stablecoin. This representative is also said to be linked to the US dollar. It is called crvUSD and is based on an algorithm and overcollateralization.

Two months ago, Curve CEO Michael Egorov presented a white paper . The source code of the project, which Egorov wrote almost entirely by himself, is now also public. Egorov is known as a developer under the name Michwill .

The developer of the data aggregator DefiLlama thinks Egorov’s work is impressive, according to a comment on Twitter .

CrvUSD is based on novel algorithm

The rise of TerraUSD marked a new era in the crypto industry. Many smart contract platforms developed their own algorithmic stablecoin based on this model. After the collapse of the Terra ecosystem, however, doubts arose about the construction method.

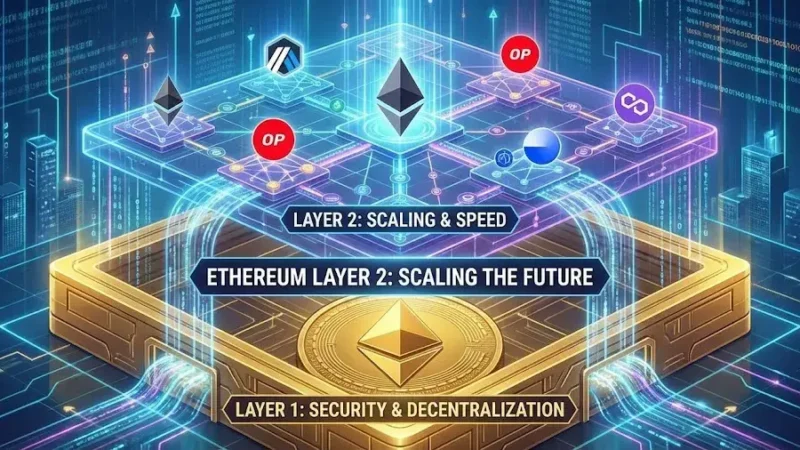

Egorov wants to back his stablecoin with two different covers. On the one hand with a volatile cryptocurrency , for which he cites Ethereum as an example , on the other hand with an ERC-20 stablecoin. Accordingly, it stands to reason that crvUSD is also an ERC-20 token .

He wants to create the stability of the stable coin through an interaction between these two investment types. An underlying stablecoin is designed to act as an anchor, while an algorithm called LLAMMA (Lendings Liquidation Automated Market Maker Algorithm) trades the volatile cryptocurrency and the stablecoin for each other based on market conditions.

Curve DAO Token (CRV) up 25 percent

Large parts of the scene see the new message as positive. The Curve DAO Token (CRV) can gain a full 25 percent after Curve publishes the code of its stablecoin. So far, however, there has been no official announcement about the project.

It is also uncertain when the stablecoin will be released. So far this has not happened. Egorov actually planned to start in September of this year. The decentralized lending provider Aave is also working on a similar project called GHO.

Currently, DAI is the largest algorithmic stablecoin with a circulation supply of 5.7 billion. Until May, the TerraUSD was in first place.