Could upcoming halving boost Litecoin (LTC) price? In this article, we take a look at the impact of the halving on Litecoin price and what technical analysis predicts for Litecoin’s future.

Litecoin (LTC) shortly before halving: Current status at LTC

Litecoin, one of the oldest and most well-known cryptocurrencies, is facing an important event: the halving. This event occurs roughly every four years and halves the rewards miners receive for adding new blocks to the Litecoin blockchain. The next halving is scheduled for August 2, 2023.

Historically, the halving has had a significant impact on the Litecoin price. After the last halving in 2019, the LTC price rose by almost 300 percent. It peaked at $410 during the 2021 bull run, which meant a 1300 percent return for investors who got in before the halving.

The halving is an event built into cryptocurrencies like Litecoin and Bitcoin to control inflation. Essentially, the block reward that miners receive for validating transactions on the blockchain is halved on each halving. With Litecoin, this happens every 840,000 blocks, which is roughly every four years.

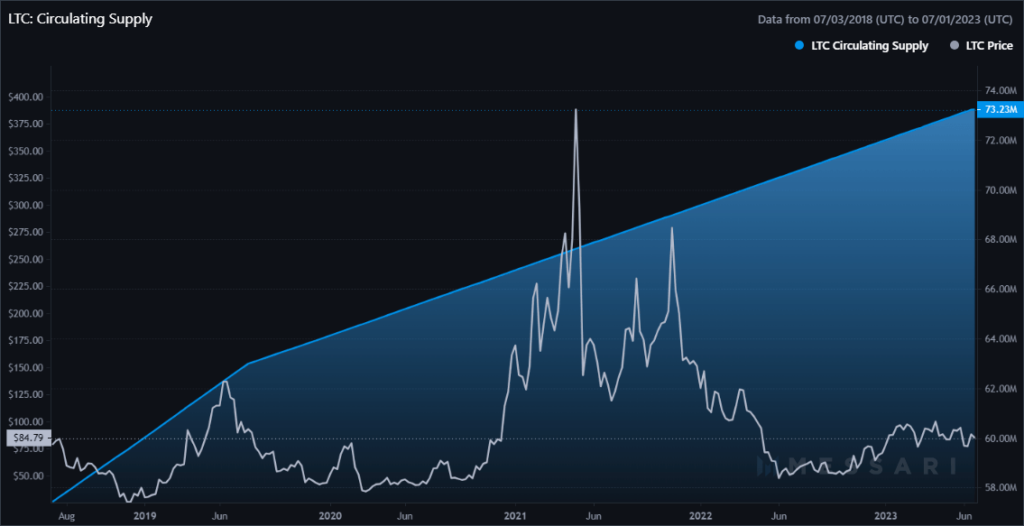

The main goal of halving is to limit the supply of Litecoin. Unlike traditional fiat currencies, which can be issued by central banks as needed, Litecoin has a fixed maximum supply of 84 million coins. Halving slows the rate at which new Litecoins are mined. This creates scarcity, reflecting the value of available Litecoins

Litecoin (LTC) Latest Technical Analysis

In the past few months, Litecoin has managed to establish a valid upward trend, starting from the price low of 43 US dollars in June 2022. Overall, however, this must be placed in the context of an overriding downward trend . This dominates the Litecoin price starting from the all-time high in May 2021 at just under USD 400. Litecoin’s current rate is around $105.

An important aspect that we want to look at in the context of the upcoming Litecoin Halving is the LTC total circulation amount. This has increased steadily and is currently around 400 million coins. An increasing amount in circulation may indicate increased demand and acceptance of Litecoin, which is generally positive for the price. In terms of price levels, Litecoin has key support around $100 and resistance around $130 . These levels could serve as key markers for further price action in the coming days and weeks.

Average price indicators for Litecoin chart analysis

In order to be able to better classify the Litecoin price in the context of its historical development, it is helpful to look at the exponential moving average (EMA). The EMA is a technical indicator that gives a heavier weight to the average price of an asset over a period of time, taking into account recent price movements.

We use two EMAs that are commonly used in technical analysis: the 50 EMA and the 200 EMA . The EMA 50 calculates the average price over the last 50 days, while the EMA 200 calculates the average price over the last 200 days.

When an asset’s price trades above the EMA 50, it is often seen as a positive signal as it suggests that the asset’s near-term trend is up. When the price breaks above the 200 EMA, it is seen as an even stronger positive signal. It suggests that the long-term trend of the asset is also up.

In the case of Litecoin, the price is currently above both the 50 EMA and the 200 EMA. This is a very positive signal and could indicate that the Litecoin price is in a strong bullish move . It shows that both the short-term and long-term trends of Litecoin are positive. These developments can be seen as an encouraging sign for investors.

We can summarize that the development of the Litecoin price since June 2022 has been consistently positive. The price action coupled with technical indicators like the EMA 50 and EMA 200 are pointing to a strong bullish move.

Conclusion and forecast for the Litecoin (LTC) course

The upcoming halving event could further amplify Litecoin’s (LTC) positive trend. Halvings are important events in the lifecycle of cryptocurrencies. They serve to control inflation and ensure the longevity of the cryptocurrency. Historically, halvings have often resulted in an increase in the price of the affected cryptocurrency. The reason for this is the reduced supply with constant or increasing demand drives the price up.

Additionally, the halving could result in more investors being encouraged to buy the cryptocurrency . The prospect of reduced supply and potentially higher prices could present an attractive investment opportunity for many.