The time of crypto has finally come? That belief is Dan Morehead, founder of Pantera Capital. As evidence, he provides the price movements of the crypto market, which are increasingly separating from the classic financial sector and have the potential to develop independently in the long term. Therefore, they would become the target of mass investments.

Dan Morehead: Crypto is having its 2003 moment

Dan Morehead is the founder and CEO of Pantera Capital. According to its own statements, the asset manager is the first company of its kind in the USA to invest in cryptocurrencies.

Over the past few months, Morehead has repeatedly stated that the crypto market is in a phase reminiscent of the stock market in 2003. At that time, this recorded extreme losses. The young “dotcom” companies also collapsed and then rose again like a meteor. This refers to well-known companies such as Google, Amazon or eBay.

Morehead is not alone in this assessment. Other financial experts such as Robert Kiyosaki and Harry Dent Junior agree with him. In the issue of his latest newsletter , Morehead now specifically explains the parallels he sees.

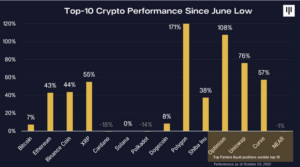

He considers the current phase to be the “2003 moment of the crypto market”. Accordingly, the current bear market would be followed by extreme price gains on the part of the best cryptocurrencies in the future.

Pantera Capital: “The blockchain is decoupling”

In order to substantiate his thesis, Morehead, as the central figure behind Pantera Capital, explains at the beginning: Blockchain technology has the long-term potential to decouple itself from the classic financial market . Profits are also possible, while the shares continue to lose significantly.

However, this is not a novelty. This phenomenon can already be observed in different systems. Morehead cites gold as an example. While the classic financial market is always driven by interest rates, this is not the case with goods such as gold.

Morehead sees blockchain technology in that tradition, he writes. By that he means cryptocurrencies, the best-known representatives of which are Bitcoin and Ethereum .

In the first ten years since Bitcoin was created, Morehead recognized a correlation between the crypto market and the S&P 500. In the past eight months, this has disappeared. Although Bitcoin is similar to Nasdaq in this phase, a closer look reveals more and more deviations.

Crypto is not tied to interest rates?

Morehead’s thesis may come as a surprise at first. Finally, the crypto market experienced repeated losses this year as soon as the key interest rates of the largest economic areas increased. The key US interest rate in particular played a role here. Over the last few days, however, it can also be seen that crypto does not always fall parallel to the classic financial market .

Most normal asset classes are actually linked to interest rates. Bonds are mathematically linked to interest rates, stocks are discounted cash flows, real estate is linked to mortgage rates.

Such a dependency does not exist with cryptocurrencies. This also results in the potential to go your own way – completely independent of the fluctuations in the asset classes mentioned.

There will be a desire to invest in things that don’t need to fall any further while the Fed undoes its mistakes. Blockchain and other commodities are probably the only place to hide in a world of massively rising interest rates.

Explains Morehead. This independence will always convince new investors. Interest will increase, especially during a recession. This will deepen in 2023 in the USA.

He also states: In addition to Bitcoin, other cryptos will also establish themselves as sustainable investments if they have not already done so in the past.