PayPal’s Strategic Leap: Expanding PYUSD to Arbitrum for a Seamless Multichain Future

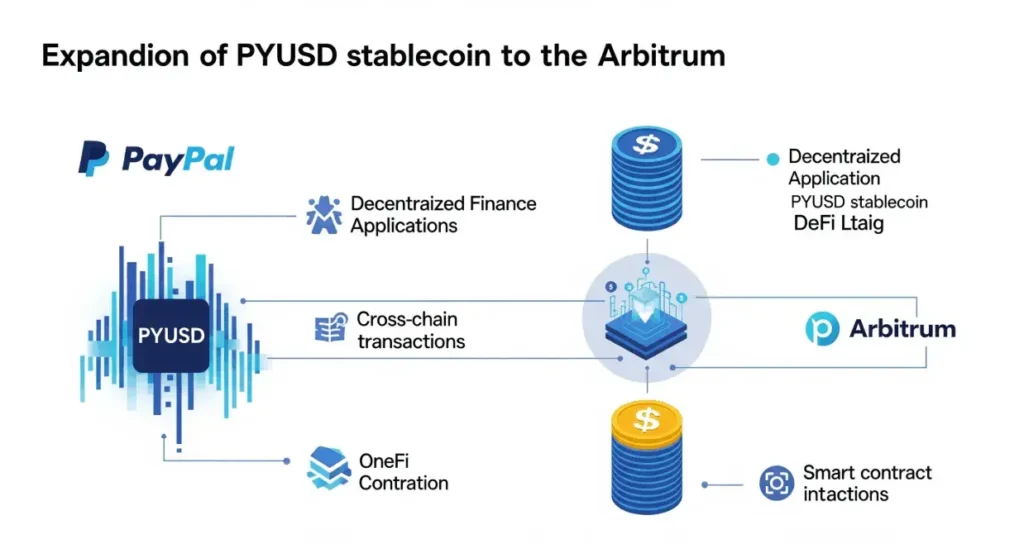

In a significant move poised to redefine digital commerce, PayPal is expanding its U.S. dollar-pegged stablecoin, PYUSD, to the Arbitrum network. This integration marks a pivotal step in PayPal’s strategy, adding a third foundational blockchain after its initial rollout on Ethereum and subsequent expansion to Solana. The strategic inclusion of Arbitrum, a leading Layer 2 solution, aims to dramatically lower transaction costs and enhance speed, further solidifying PayPal’s commitment to a more efficient, interconnected financial ecosystem.

The Evolution of PayPal’s Digital Ambition

Launched in August 2023, PYUSD was initially introduced on the Ethereum blockchain as an ERC-20 token, leveraging Ethereum’s robust infrastructure and widespread adoption within the Web3 space. This foundational step was followed by an expansion to the Solana blockchain in May 2024. Solana, known for its high transaction throughput and low fees, offered a crucial avenue for increased speed and scalability, aligning with PayPal’s vision for a stable digital currency designed for commerce and everyday payments.

The latest integration with Arbitrum is a testament to PayPal’s adaptive approach to the evolving landscape of digital finance. Arbitrum, an Ethereum Layer 2 scaling solution, inherits the security of the Ethereum mainnet while providing significantly faster transaction finality and substantially reduced gas fees. This makes it an increasingly attractive choice for projects seeking scalability and efficiency without compromising decentralization or exiting the Ethereum ecosystem. By incorporating Arbitrum, PayPal directly addresses the growing user demand for a stable digital asset that facilitates swift, cost-effective transfers and transactions.

Unifying the User Experience Across Disparate Networks

One of the most compelling aspects of this multichain expansion is PayPal’s commitment to a unified user experience. Regardless of the underlying blockchain – be it Ethereum, Solana, or Arbitrum – users will manage their PYUSD holdings from a single, cohesive balance within their PayPal and Venmo accounts. This eliminates the complexities often associated with navigating separate blockchain networks, such as managing multiple wallets or grappling with different network tokens for gas fees. This streamlined approach underscores PayPal’s dedication to making digital currencies accessible and straightforward for the mainstream user.

The ability to operate across three distinct networks with a unified balance democratizes access to decentralized finance (DeFi) functionalities and broadens the utility of PYUSD. For merchants, this means a more versatile payment tool that can adapt to varying network conditions and user preferences, potentially lowering operational overheads and increasing adoption. For individual users, it translates into greater flexibility, enabling them to choose the most efficient network for their specific needs, whether it’s a high-value transfer requiring Ethereum’s robust security or a micro-transaction benefiting from Arbitrum’s low costs.

The Backbone of Stability: Paxos and Regulatory Assurance

PYUSD is issued by Paxos Trust Company, a regulated financial institution that holds a charter from the New York State Department of Financial Services (NYDFS). This regulatory oversight is paramount, providing a layer of trust and assurance critical for a digital asset aiming for widespread adoption. Paxos ensures that PYUSD is fully backed 1:1 by U.S. dollar deposits, short-term U.S. Treasuries, and similar cash equivalents. This transparent backing mechanism, coupled with monthly reserve reports and independent third-party attestations published by Paxos, reinforces the stability and reliability of the digital dollar.

The rigorous regulatory framework under which Paxos operates, including adherence to NYDFS guidelines for stablecoin management, means that the assets backing PYUSD cannot be re-hypothecated, borrowed against, or invested in anything other than specified low-risk assets. This stringent approach is designed to maintain the 1:1 peg to the U.S. dollar, providing users with the confidence that their digital holdings are as stable and secure as traditional fiat currency.

Driving Digital Commerce and Financial Inclusion

Since its launch, PayPal has strategically positioned PYUSD as a tool for digital commerce. Its seamless integration into PayPal and Venmo wallets signifies a significant step toward bridging the traditional financial system with the burgeoning Web3 economy. The expansion to Arbitrum further enhances this objective by enabling faster and cheaper transactions, which are crucial for high-frequency digital payments and transfers.

Beyond traditional e-commerce, PYUSD offers profound implications for financial inclusion, particularly in regions where access to the U.S. dollar is either restricted or costly through conventional channels. By providing a readily accessible, stable digital dollar, PayPal empowers individuals and businesses in emerging markets to participate more effectively in the global digital economy. The programmability of stablecoins also opens doors for developers to build innovative financial applications, further integrating traditional fiat with blockchain capabilities.

Moreover, PayPal has introduced a rewards program to incentivize holding PYUSD, offering eligible users daily yields based on their average balances. This initiative further enhances the utility and attractiveness of holding the digital asset within the PayPal ecosystem, driving adoption and engagement.

The Broader Vision: Adapting to a Fragmented Financial World

The multichain expansion of PayPal’s digital asset reflects a broader industry trend and an acknowledgement of an increasingly fragmented financial system. In this evolving landscape, users and businesses demand not only speed and lower costs but also interoperability across diverse blockchain environments. By supporting Ethereum, Solana, and now Arbitrum, PayPal is building a robust infrastructure that caters to these demands, positioning itself as a key player in the future of global digital payments.

While PayPal has yet to make a formal public announcement regarding the Arbitrum integration, the changes are already live and visible within the service’s legal documentation, including adjustments to transaction limits. This quiet rollout indicates a measured and strategic approach, underscoring the technical and regulatory readiness of this significant expansion. Looking ahead, the potential future integration with networks like Stellar, which is optimized for cross-border payments, further highlights PayPal’s ambitious roadmap to transform how money moves globally.

Stay informed, read the latest crypto news in real time!

The journey of PYUSD, from its Ethereum debut to its expansion across Solana and Arbitrum, illustrates a clear trajectory toward a more versatile, efficient, and user-friendly digital finance landscape. This strategic adaptation to financial fragmentation is not just about leveraging new technologies; it’s about empowering users with greater choice, flexibility, and a seamless experience in an increasingly digital world.