The Shiba Inu ecosystem is currently at a pivotal juncture, with its passionate community eagerly awaiting potential involvement from lead developer Shytoshi Kusama in a crucial proposal. This initiative is designed to significantly boost SHIB token burns, a move that could reshape the deflationary dynamics of the popular meme coin and influence its long-term market trajectory. The ongoing vote centers on a critical decision: how best to utilize the BONE gas fees generated on the Shibarium network. The core debate revolves around whether these fees should be used to burn BONE directly, or primarily allocated towards increasing SHIB token burns.

The air within the Shiba Inu community is thick with anticipation and speculation following hints that Shytoshi Kusama, the enigmatic pseudonymous lead developer, might cast his vote in this significant community decision. If these rumors hold true, Kusama’s participation could exert considerable influence, potentially steering the outcome towards a strategy that dramatically enhances the deflationary pressure on SHIB. Such a development would undoubtedly be a boon for the token’s scarcity model and could, in turn, contribute positively to its price outlook over the long haul.

The genesis of this excitement can be traced back to a recent post from the official Bone meme coin X account. This post celebrated “huge progress” on the ongoing vote and, crucially, tagged Kusama. Many within the community immediately interpreted this as a clear signal of his support for the burn proposal, fueling widespread discussion and renewed optimism among SHIB holders.

Decoding the Vote: BONE Gas Fees and Their Destiny

At the heart of the current community discourse is the question of how BONE gas fees, accrued on the Shibarium network, should be strategically deployed. The community is actively engaged in a lively debate, considering several approaches:

- Direct BONE Burn: Utilizing the fees to destroy BONE tokens.

- Exclusive SHIB Burn: Dedicating all fees to burning SHIB tokens.

- Flexible Hybrid Model: A dynamic approach that adjusts contributions based on prevailing market conditions, specifically BONE’s price.

The Leading Proposal: A Flexible Burn Strategy

Currently, one proposal has emerged as a frontrunner, garnering substantial support from the community, evidenced by over 234,000 BONE tokens committed in its favor. This leading proposition advocates for a nuanced, flexible approach to SHIB token burns. It suggests a two-tiered strategy:

- When the price of BONE is below $2, 100% of the BONE gas fees would be allocated to burning BONE directly.

- Conversely, should BONE trade above the $2 threshold, the entire contribution would pivot, focusing entirely on SHIB token burns.

Kusama’s Potential Influence: A Simpler Path to SHIB Deflation?

Despite the popularity of the flexible burn model, Shytoshi Kusama’s expected involvement could introduce a significant shift in community sentiment. His participation might sway voters towards a more straightforward, flat 100% SHIB burn model. This alternative, while seemingly simpler and potentially more impactful for SHIB’s deflationary goals, currently trails significantly in the vote count, with just under 11,500 votes. The very possibility of Kusama’s engagement has transcended typical governance discussions, attracting considerable attention from outside observers and the broader crypto community.

Why Enhanced SHIB Token Burns Matter for SHIB’s Future

A complete allocation of BONE gas fees towards burning SHIB tokens could provide a monumental boost to the token’s existing deflationary mechanisms. This is particularly critical given SHIB’s massive circulating supply, which stands at nearly 584.6 trillion tokens. Reducing this supply through consistent SHIB token burns is seen as a vital step towards enhancing scarcity and, consequently, long-term value.

The impact of such burning initiatives is already evident. In a remarkable display of community effort, the SHIB burn rate recently surged by an astonishing 16,717% within a single 24-hour period. This dramatic increase has pushed the total supply of SHIB sent to the “dead wallet”—tokens permanently removed from circulation—to over 410.7 trillion. These figures underscore the community’s commitment to reducing supply and highlight the tangible effects of focused burn strategies.

Jamie Rogozinski, the visionary founder of WallStreetBets, weighed in on Shiba Inu’s recent token burn activities, eloquently capturing the sentiment. He remarked, “SHIB just burned enough tokens to make even a pyromaniac proud, rallying 3% to a seven-week high. Nothing like deflationary tokenomics to turn FOMO into ‘burn baby burn’ mania and remind us why scarcity still sells.” His comments encapsulate the excitement and the fundamental economic principle driving the community’s focus on SHIB token burns: scarcity often equates to value in the crypto markets.

Whale Holdings and Long-Term Conviction

Further reinforcing the strong conviction within the Shiba Inu community is the significant proportion of SHIB held by large “whale” wallets. According to data from IntoTheBlock, approximately 61.5% of SHIB’s total supply is concentrated in these large holdings. This high concentration among major investors is frequently interpreted as a strong signal of long-term positioning and a deep belief in the token’s future potential. While a definitive shift to a 100% SHIB burn model from BONE gas fees may not instantly propel SHIB’s price to new highs, it unequivocally strengthens its long-term outlook. This optimistic perspective has even ignited ambitious discussions within the community, with some envisioning targets as high as $10. However, it is crucial to acknowledge that achieving such a price point would represent a monumental stretch, considering SHIB’s current market capitalization of $8 billion.

A History of Significant Burns

The emphasis on token burning is not a novel concept within the Shiba Inu narrative. A pivotal moment in SHIB’s history occurred in May 2021 when Ethereum co-founder Vitalik Buterin famously sent more than 410 trillion SHIB tokens to a dead wallet. This extraordinary act not only captured widespread investor attention but also played a significant role in catapulting SHIB to its all-time high of $0.00008845 in October 2021. This historical precedent serves as a powerful reminder of the profound impact that large-scale SHIB token burns can have on market perception and price action.

Current Market Dynamics and Future Outlook

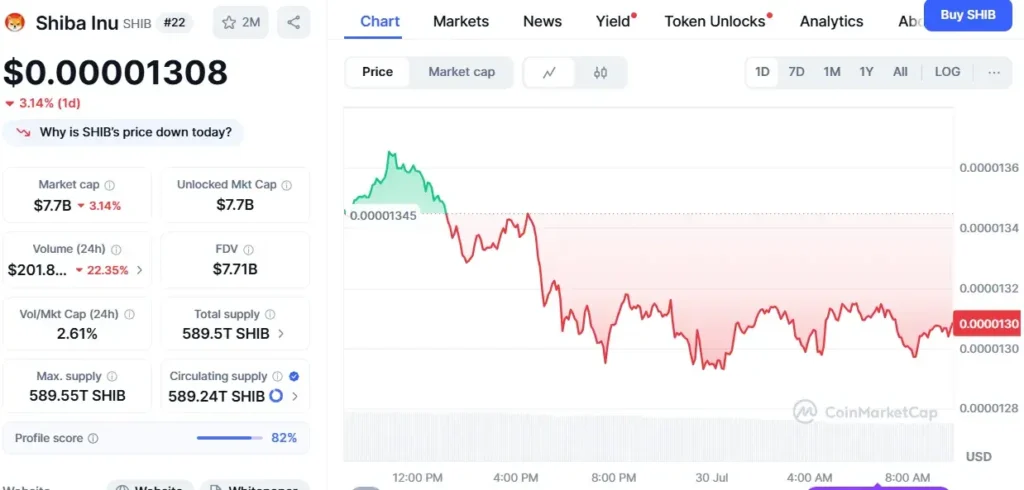

Despite the excitement surrounding the potential for increased SHIB token burns and the long-term bullish sentiment, SHIB’s short-term price action has been somewhat muted. After reaching a recent peak of $0.000016, the token experienced a phase of profit-taking, leading to a downward correction. Buyers have shown a degree of hesitancy in returning to the market with the same vigor.

Technical indicators corroborate this cooling phase. The Relative Strength Index (RSI), a momentum oscillator, has dipped towards the 30 mark, often interpreted as a sign of seller exhaustion. This could suggest that the selling pressure is waning and a potential rebound might be on the horizon. However, the Moving Average Convergence Divergence (MACD) shows a bearish crossover, which typically signals potential short-term weakness and could indicate further downside or consolidation before a clear upward trend resumes.

As of recent data, SHIB is trading at approximately $0.00001308, representing a 12% decline over the past week. Despite this short-term dip, there is a silver lining in the form of a slight uptick in momentum, evidenced by a 21% increase in trading volume, reaching $256 million. This rise in volume alongside a price dip can sometimes indicate accumulation at lower levels or increased interest.

Stay informed, read the latest crypto news in real time!

Key Support and Resistance Levels

For investors and traders closely monitoring SHIB, the immediate key support level to watch is $0.0000131. A sustained presence above this level could act as a crucial foundation, potentially triggering a rebound if renewed buying pressure materializes. On the upside, the nearest resistance level is identified at $0.00001407. A decisive break above this barrier could pave the way for a more substantial rally, with potential targets extending towards $0.000025. The outcome of the ongoing community vote, particularly regarding the allocation of BONE gas fees towards SHIB token burns, will undoubtedly be a significant factor influencing these price movements in the coming weeks and months. The community remains hopeful that increased burns will provide the necessary impetus for a strong bullish reversal.

One thought on “Shiba Inu Community on Edge: Will Lead Developer Shitoshi Kusama Influence SHIB Token Burns Vote?”