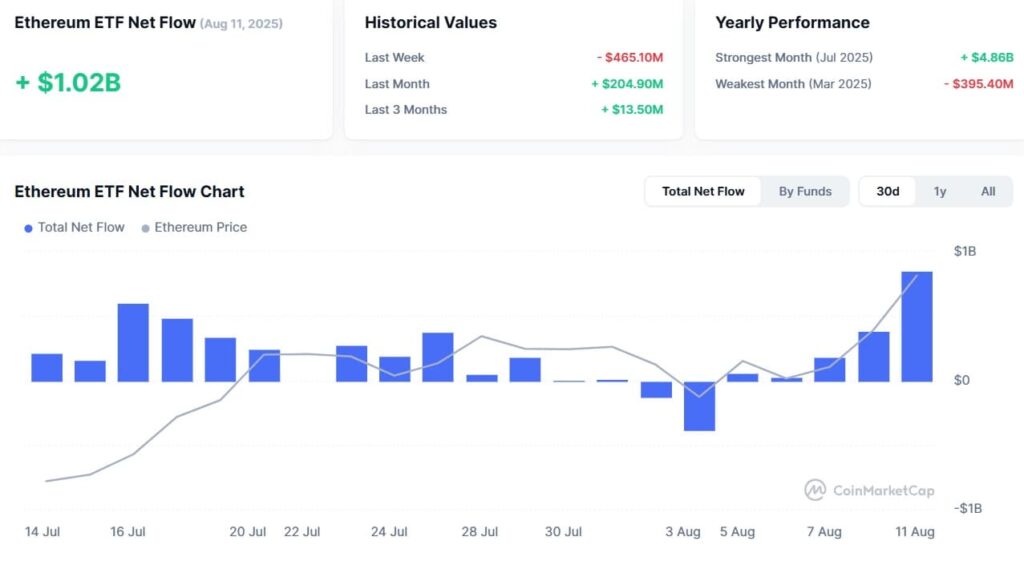

In a landmark moment for the digital asset market, U.S.-listed spot ether ETFs have officially crossed a significant threshold, recording more than $1 billion in daily inflows for the first time. This historic achievement, which comfortably surpassed the previous record of $726.74 million set on July 17, underscores a dramatic surge in institutional and mainstream investor confidence in Ethereum. The cumulative inflows into these funds now stand at an impressive $10.83 billion, with their total assets under management reaching $25.71 billion. This unprecedented flow of capital into these investment vehicles marks a new chapter in the financial acceptance of cryptocurrency.

What Are Spot Ether ETFs and Why Are They a Game-Changer?

To fully appreciate the significance of this milestone, it’s essential to understand what spot ether ETFs are and how they differ from their predecessors. An ETF, or exchange-traded fund, is a type of investment vehicle that tracks the price of an underlying asset. In this case, a spot ether ETF invests directly in the cryptocurrency Ethereum (ETH), holding the actual asset in custody. This stands in contrast to futures-based ETFs, which were the first crypto-related ETFs approved by the SEC. Futures ETFs track the price of futures contracts—agreements to buy or sell an asset at a predetermined price on a future date—rather than the asset itself.

The approval of spot ether ETFs by the U.S. Securities and Exchange Commission (SEC) in May 2024, with trading beginning in July, represented a major regulatory victory. It provided a long-awaited and regulated on-ramp for traditional finance to gain exposure to the Ethereum ecosystem without the complexities and security risks associated with directly buying and storing the cryptocurrency. The ability to invest through a standard brokerage account makes these funds highly accessible to a broad range of investors, including institutions, financial advisors, and individuals with retirement accounts like 401(k)s and IRAs.

The Road to Approval: Paving the Way with Bitcoin

The journey to regulatory approval for spot ether ETFs was built on the foundation of the spot bitcoin ETF market. For years, the SEC had denied applications for spot bitcoin funds, citing concerns over market manipulation and investor protection. However, after a protracted legal battle and increasing pressure from major asset managers, the SEC finally approved 11 spot bitcoin ETFs in January 2024. This landmark decision not only validated bitcoin as a legitimate asset but also created a clear precedent for other cryptocurrencies, paving the way for the eventual approval of spot ether ETFs.

The success of the spot bitcoin funds, which saw tens of billions of dollars in inflows within months of their launch, demonstrated a robust demand from both retail and institutional investors. This provided a compelling case for the approval of Ethereum-based funds. The market and the regulatory bodies now had a roadmap and a proven model for how to safely integrate digital asset investment products into the traditional financial system.

The Inflow Frenzy: A New Era of Institutional Adoption

The latest inflow data confirms that the enthusiasm for digital assets extends well beyond Bitcoin. The record-breaking day, which saw funds like BlackRock’s ETHA and Fidelity’s FETH attract the lion’s share of the inflows, highlights a clear shift in investment strategy. Analysts point to several factors driving this surge. First, there is a growing recognition of Ethereum’s unique value proposition. Unlike Bitcoin, which is primarily a store of value, Ethereum is a foundational layer for decentralized finance (DeFi), NFTs, and other Web3 innovations. This functional utility makes it a more compelling investment for those looking for exposure to the broader digital economy.

Second, the inflows reflect a potential “rotation” of capital within the crypto market. As Bitcoin’s price has soared and stabilized, some investors may be seeking the next opportunity for significant growth, and Ethereum, with its robust ecosystem and the momentum from these new funds, is a natural choice. This capital shift suggests that mainstream investors are becoming more sophisticated in their understanding of the crypto landscape, moving beyond just Bitcoin to explore other high-potential assets.

The Future of Ethereum and the Broader Crypto Market

The massive influx of capital into spot ether ETFs carries profound implications for the future of Ethereum and the entire crypto market. For Ethereum, the inflows provide deep liquidity pools and enhance its legitimacy as a cornerstone of mainstream crypto adoption. This institutional backing can help stabilize the asset’s price and reduce volatility over the long term.

For the broader crypto market, the success of these funds could act as a catalyst for future regulatory approvals of other digital asset-based ETFs. The precedent set by both spot bitcoin ETFs and these new ether funds suggests that regulators are becoming more comfortable with crypto-native assets, which could pave the way for a more diverse range of investment products in the coming years.

Stay informed, read the latest crypto news in real time!

While the new investment vehicles offer significant benefits, it is important to note the distinction between holding an ETF and owning the underlying cryptocurrency directly. For example, investors in these funds do not receive staking rewards, which are a key feature of Ethereum’s proof-of-stake network. However, for a vast segment of the investing public, the convenience, security, and regulatory clarity provided by these funds far outweigh these trade-offs, making them an essential part of the evolving digital finance landscape.

📩 Subscribe Now

Join thousands of crypto readers who stay ahead of the market. 100% Free. No Spam. Unsubscribe anytime.