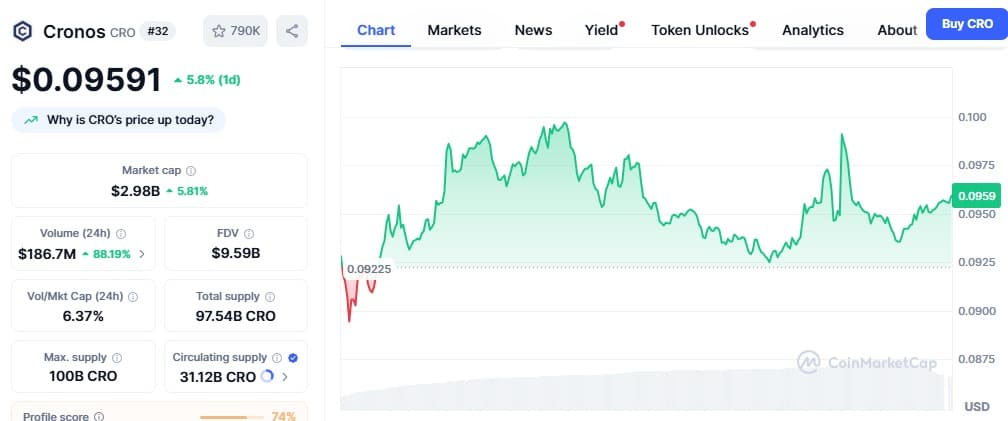

The cryptocurrency market recently witnessed a significant surge from Cronos (CRO), the native token of the blockchain developed by Crypto.com. Its value climbed by nearly 16%, moving from under $0.082 to almost $0.095. This impressive jump was directly attributed to its confirmed inclusion in Truth Social’s much-anticipated Crypto Blue-Chip ETF, particularly its unexpectedly strong 5% allocation within the fund. This development highlights the market’s immediate and positive reaction to structured investment products, especially those that promise a regulated entry point into the diverse world of digital assets.

The Emergence of a Unique Crypto ETF

The proposed Crypto Blue-Chip ETF, a collaborative effort between Truth Social and Trump Media & Technology Group, aims to consolidate leading cryptocurrencies into a single, accessible financial product for listing on NYSE Arca. This initiative is particularly notable because it ventures into a market segment where multi-crypto funds are yet to receive official authorization. While the ETF is still awaiting formal approval from the U.S. Securities and Exchange Commission (SEC), the sheer filing of the proposal has already generated considerable attention and market movement, signaling a strong appetite for such innovative offerings.

The fund’s strategic distribution underscores its ambition to create a balanced yet impactful portfolio. A substantial 70% of the allocation is earmarked for Bitcoin, reflecting its undisputed dominance in the crypto landscape. Ethereum secures the second-largest share at 15%, followed by Solana with 8%. Cronos (CRO) claims a notable 5%, which, as the market’s reaction demonstrated, was a higher proportion than many analysts and investors had anticipated, especially when compared to other cryptocurrencies with larger market capitalizations. The remaining 2% is allocated to XRP, completing a diversified selection of five key digital assets. This composition represents a pioneering step in offering a multi-asset crypto fund to a broad investment audience.

Cronos’s Unprecedented Market Impact

Interestingly, despite Bitcoin holding the largest allocation within the ETF, its price movement remained relatively subdued following the news. While BTC did recover slightly from levels below $108,000, it failed to reclaim its previous day’s high of $109,600. Similarly, Ethereum and XRP recorded modest gains of just over 1% within the last 24 hours, and Solana remained largely flat, hovering just above $150.

In stark contrast, Cronos (CRO) emerged as the undisputed top performer of the day. Its sharp rally was not merely a ripple effect but a direct consequence of its unexpected weighting within the fund and the immediate, robust interest it generated among both traders and investors. This distinct reaction from Cronos underscores a crucial point about market sensitivity: innovative products, particularly those that promise regulatory clarity and access in jurisdictions like the U.S. where multi-asset crypto ETFs are still unapproved, can trigger significant and concentrated price movements. The filing alone, even without full SEC endorsement, proved sufficient to ignite substantial trading activity and investor confidence in Cronos.

Broader Implications for the Crypto Market

The robust performance of Cronos in response to the ETF announcement highlights several key trends and future possibilities within the cryptocurrency ecosystem. Firstly, it reiterates the market’s strong demand for regulated investment vehicles that simplify exposure to digital assets. As institutional interest in cryptocurrencies continues to grow, regulated ETFs represent a critical bridge between traditional finance and the nascent digital asset space.

Secondly, the event underscores the potential for smaller-cap cryptocurrencies, when strategically positioned within such funds, to experience disproportionately large price movements. While Bitcoin often dictates the overall market sentiment, the Cronos surge demonstrates that specific allocations within high-profile, regulated products can act as powerful catalysts for individual altcoins. This could set a precedent for future ETF filings, where investors might scrutinize not just the inclusion of major assets but also the relative weighting of emerging or mid-cap cryptocurrencies.

Finally, the market’s keen observation of this ETF’s regulatory journey signifies the increasing importance of regulatory approvals in validating and legitimizing digital asset classes. The “surprise” element of Cronos’s allocation and the subsequent market reaction illustrate how perceived legitimacy through regulatory processes can significantly impact investor behavior and asset valuation. The fact that the market is closely tracking every regulatory development tied to this ETF, even without further statements from Truth Social or its partners, speaks volumes about the anticipation surrounding structured crypto products in a regulated environment. This sets a precedent for how future filings and approvals of similar products could shape the trajectory of various digital assets.

Stay informed, read the latest crypto news in real time!

In conclusion, the Truth Social Crypto Blue-Chip ETF, with its strategic allocation and pending SEC approval, has already proven to be a significant market mover for Cronos (CRO). Its impact transcends mere price action, offering insights into market demand for regulated products, the catalytic potential for mid-cap assets, and the overarching influence of regulatory processes on cryptocurrency adoption and valuation. As the regulatory landscape evolves, such ETFs are poised to play a crucial role in shaping the future of crypto investments.

📩 Subscribe Now

Join thousands of crypto readers who stay ahead of the market. 100% Free. No Spam. Unsubscribe anytime.