The narrative of unending institutional enthusiasm for digital assets took an unexpected turn on a recent Friday, as US crypto ETFs experienced their most significant combined outflows in months. Following a July that saw a seemingly unstoppable flood of capital into the market, a sudden reversal saw U.S. spot Bitcoin and Ethereum ETFs shed nearly $1 billion in combined value, shaking market confidence and prompting a fresh round of analysis. This abrupt downturn, particularly after a record-breaking month, has left many in the crypto community wondering whether the institutional bull run is losing momentum or if this is simply a temporary correction.

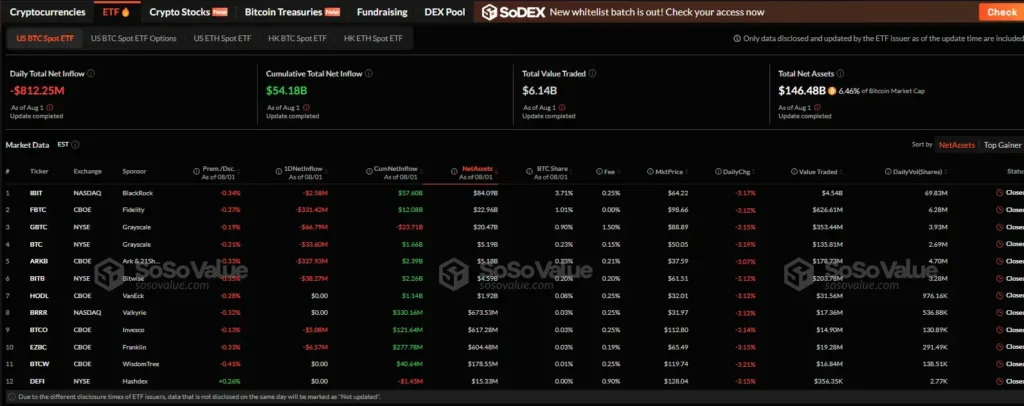

According to data from market analysis firms like SoSoValue, the outflow was not evenly distributed. A detailed look at the numbers shows a market that is not monolithic, with some funds proving more resilient than others. The divergent performance of different ETF offerings highlights the nuanced nature of institutional investment in this nascent asset class and suggests that brand recognition, size, and investor trust continue to play a crucial role. This article will delve into the specifics of the outflows, exploring the figures for both Bitcoin and Ethereum funds, examining the intriguing distinction between BlackRock’s funds and the competition, and contextualizing these movements within the broader market and regulatory landscape.

The recent outflows present a fascinating case study in market dynamics, especially when contrasted with the euphoria of July. That month saw an average of $600 million in inflows per day, setting a new benchmark for institutional adoption. To see such a rapid and dramatic reversal is a powerful reminder of the volatility inherent in cryptocurrency markets, even when packaged within a traditional financial vehicle like an ETF. As analysts and investors parse the data, we’ll explore what this reversal might signal for the future of Bitcoin, Ethereum, and the broader digital asset ecosystem.

The Bitcoin Exodus: A Closer Look at the $812 Million Outflow

The spot Bitcoin ETFs bore the brunt of the capital flight, hemorrhaging a combined $812.3 million. This marked the worst day for these funds since February 24, a day which saw over $1.1 billion in outflows, and stands as the second-worst day of outflows since their inception. The sheer scale of this single-day reversal is a sobering wake-up call after a period of sustained, record-setting inflows.

While the total figure is staggering, the story becomes more complex when individual funds are examined. Notably, the industry leader, BlackRock’s IBIT fund, weathered the storm with remarkable resilience. Its outflows were a paltry $2.6 million, an almost negligible amount in the context of the total market. In stark contrast, other major players faced significant redemptions. Fidelity’s FBTC and Ark & 21 Shares’ ARKB each saw outflows of around $330 million, accounting for a large majority of the day’s total. Grayscale’s converted GBTC and Bitwise’s BITB also saw outflows in the tens of millions. The data shows a clear pattern: while the market as a whole experienced a sell-off, a flight to quality was evident, with investors seemingly consolidating their positions into the perceived safety and liquidity of BlackRock’s offering.

BlackRock’s IBIT fund continues to hold a dominant position in the market, with its assets under management (AUM) being more than double that of its closest competitor, Fidelity’s FBTC. This market dominance, built on brand trust, scale, and deep relationships with institutional clients, appears to be a major factor in its ability to withstand market downturns better than its rivals. The fact that not a single spot Bitcoin fund attracted inflows on this particular Friday underscores the widespread nature of the negative sentiment, even as BlackRock’s fund demonstrated its robustness in the face of it.

Ethereum ETFs Feel the Pinch, Ending a Historic Streak

The momentum reversal wasn’t limited to Bitcoin. The nascent spot Ethereum ETF market, which had been on a historic run of its own, also suffered a significant blow. The funds recorded total outflows of $152.3 million, ending an impressive streak of 20 consecutive days of inflows. This was the funds’ worst single-day performance since January 7 and the fourth-worst day of outflows in their short history.

Similar to the Bitcoin side of the market, BlackRock’s Ethereum fund, ETHA, stood out as an outlier. It recorded no significant inflows or outflows, remaining largely neutral while every other fund on the market logged redemptions. Bitwise’s ETHW fund was hit the hardest, with $40.3 million in outflows, followed closely by Grayscale’s ETHE, which shed $37.2 million. The parallel between the Bitcoin and Ethereum ETF markets on this day is striking: in both cases, BlackRock’s funds demonstrated a stability that was absent in the wider market. This pattern of a “BlackRock exception” suggests that for a certain segment of investors, the name on the fund matters as much as the underlying asset, a powerful testament to the financial giant’s influence.

What Triggered the Reversal?

The sudden outflow of capital from US crypto ETFs raises an important question: what changed so drastically to cause this reversal? While the provided text doesn’t explicitly state the cause, we can infer several potential factors based on the context of the broader financial landscape. Market volatility in the underlying assets, Bitcoin and Ethereum, likely played a role, as a dip in prices could have triggered redemptions from investors looking to take profits after a strong July. Nate Geraci, the president of NovaDius Wealth, commented on the peculiar timing, stating on X that it was an “odd way to end what was perhaps most important week ever for crypto… At least from a regulatory perspective.”

This quote points to a key factor: the regulatory environment. While the article notes that fund issuers are now looking to gain approval for spot Solana ETFs and that a flurry of amended filings arrived last week, the regulatory journey for crypto remains complex and unpredictable. Any perceived change in the SEC’s stance or even a lack of new, positive news could be enough to spook investors, particularly those who are newer to the market. The mention of Rex-Osprey’s staked crypto ETF, which used a “clever regulatory workaround,” also highlights the ongoing struggle to innovate within the confines of existing regulations, a tension that can lead to market uncertainty.

The larger macroeconomic picture also likely contributed. Factors such as the Federal Reserve’s monetary policy, inflation data, and global economic sentiment can all impact risk appetite. When traditional markets show signs of stress, investors often pull capital from riskier assets, and cryptocurrencies, even in the form of ETFs, are still considered a high-risk investment by many. The combination of profit-taking, market-wide price dips, and lingering regulatory uncertainty likely created a perfect storm for the observed outflows.

Looking Ahead: The Future of US Crypto ETFs

Despite the recent setback, the long-term trend for US crypto ETFs remains overwhelmingly positive. The record-breaking inflows of July demonstrate a powerful and growing appetite for these products from a wide range of investors. The market is maturing, and with that maturity comes both increased liquidity and the kind of volatility seen in traditional markets. The consolidation of capital into funds like BlackRock’s IBIT and ETHA is a natural market dynamic, as investors tend to favor larger, more liquid, and more trusted vehicles.

The ongoing push for new products, such as spot Solana ETFs, is a strong signal that the industry is not slowing down. These new filings show that issuers believe there is a market for a wider range of digital asset exposure, and they are willing to navigate the regulatory hurdles to bring these products to market. The success of the initial US crypto ETFs has paved the way for this expansion, and their long-term performance will be a key determinant for the approval and success of future offerings.

Stay informed, read the latest crypto news in real time!

While the Friday outflows were a stark reminder of the market’s inherent risks, they are a single data point in a much larger, ongoing trend. The institutionalization of crypto is a marathon, not a sprint, and this recent dip is more likely a minor speed bump on the road to a more mature, and ultimately more stable, digital asset market. For now, all eyes will be on the flow data for the coming weeks to see if the market can recover its momentum and continue the journey of integrating digital assets into the mainstream financial world.

One thought on “US Crypto ETFs Hit a Rough Patch: What’s Behind the Sudden $1 Billion Outflow?”