The Unstoppable Vector: El Salvador’s Ambitious Plan for the First Bitcoin Bank

El Salvador, the country that once stunned the world by making Bitcoin legal tender, is now on the cusp of another groundbreaking financial innovation. Its official Bitcoin Office has confirmed plans to establish a “Bitcoin Bank,” a state-backed institution dedicated exclusively to the world’s leading cryptocurrency. This bold move, slated for a 2025 launch, would mark a historic first, positioning the Central American nation not just as a pioneer in crypto adoption but as a leader in building a parallel, tech-powered financial system.

The announcement, though light on specific timelines, has sent ripples of excitement through the global crypto community. It represents a deepening of President Nayib Bukele’s vision to weave Bitcoin into the very fabric of the Salvadoran economy, offering solutions to age-old financial challenges and attracting a new wave of digital-native investment. This new financial lifeline promises to empower citizens and businesses alike, transforming how they save, transact, and access capital.

The Promise of the Bitcoin Bank: A Dual-Currency Future

The core concept behind the Bitcoin Bank is elegantly simple yet profoundly transformative. It seeks to create a seamless financial environment where Salvadorans can hold both the U.S. dollar, the country’s official fiat currency, and Bitcoin in a single, unified account. This innovative approach would allow for instant swaps between the two currencies, effectively bridging the gap between traditional finance and the decentralized crypto world.

For individual citizens, particularly those with family working abroad, the benefits are immediate and substantial. The pain of remittance fees, which often eat into the hard-earned money sent home, would become a thing of the past. Using Bitcoin, Salvadorans could receive money from family members overseas in seconds, with negligible transaction costs, freeing up capital for essential needs. This single feature alone addresses a critical economic artery for a nation where remittances account for a significant portion of the GDP.

Businesses, too, stand to gain immensely. Imagine a local shop owner in a tourist hotspot. They could accept Bitcoin from foreign visitors, but have it converted to dollars on the spot, shielding their business from Bitcoin’s notorious price volatility. This protects their bottom line while simultaneously opening up a new payment channel to a global audience of Bitcoin holders. Farmers and small-scale entrepreneurs could also leverage their Bitcoin savings as collateral for small loans, unlocking access to credit that may have been out of reach in the traditional banking system.

Beyond individual and business empowerment, the Bitcoin Bank would serve as a powerful engine for national economic development. It could attract a torrent of foreign direct investment from international crypto ventures, eager to operate in a nation with a clear, crypto-friendly regulatory framework. The bank could also fuel Bitcoin-backed infrastructure projects, from new roads to schools, leveraging the country’s growing Bitcoin reserves to build a better future.

The Architect of the Bitcoin Vision: Max Keiser’s Influence

The narrative of El Salvador’s Bitcoin journey is inextricably linked with one man: Max Keiser, President Bukele’s senior Bitcoin advisor. Keiser’s influence and unwavering advocacy for Bitcoin have been instrumental in shaping the country’s pioneering policy. His presence at key historical moments, from the initial announcement at the Bitcoin 2021 conference to the first 200 Bitcoin purchase, symbolizes the deep-seated conviction driving the nation’s strategy.

In a recent interview, Keiser encapsulated this sentiment perfectly, stating that “Bitcoin continues its unstoppable vector in EL Salvador.” He sees Bitcoin not just as a financial asset but as a revolutionary force, one that is “beating all the world’s $400 trillion in stored value while rendering inert all the central banks & doomed, archaic, 3-letter agency helpers.” This impassioned rhetoric highlights the ideological underpinnings of El Salvador’s experiment—a challenge to the global financial status quo and a testament to the belief in a decentralized future.

Keiser and his wife, Stacy Herbert, also play a crucial role in the country’s National Bitcoin Office, acting as a bridge between the government and the global Bitcoin community. They have been key in promoting the country’s vision, including ambitious proposals like installing a Bitcoin node in every home to decentralize the network further. This dedicated team ensures that the government’s Bitcoin strategy is not just a passing phase, but a deeply considered and actively managed national project.

The Geopolitical Chess Match: Navigating the IMF and Global Powers

El Salvador’s audacious crypto policy is not without its significant challenges, a reality acknowledged by both its proponents and critics. The journey is fraught with potential pitfalls, including the inherent price volatility of Bitcoin and the ever-present threat of hacking. However, the most formidable obstacle comes not from the digital realm, but from the corridors of traditional global finance.

The International Monetary Fund (IMF), a powerful institution that represents the traditional financial system, has been a persistent source of pressure. In December 2024, El Salvador signed a $1.4 billion loan deal with the IMF, a critical agreement to address the country’s debt and stabilize its economy. Buried within the fine print were demands to scale back much of its Bitcoin policy, specifically targeting the government’s daily Bitcoin buying strategy.

Officially, the government’s plan to buy “one BTC every day” was slated to end by July 2025. Unofficially, President Bukele has held his ground, demonstrating a steadfast commitment to the strategy. Reports from late February and early March showed that the country had actually accelerated its Bitcoin purchasing, picking up 40 BTC in just 30 days, a direct defiance of the IMF’s recommendations. This defiance highlights the delicate balance El Salvador is attempting to strike—securing critical traditional loans while doubling down on its innovative Bitcoin strategy.

The country’s official Bitcoin stash now stands at an impressive 6,262 BTC, valued at over $720 million. This portfolio is a national asset, a strategic reserve that reinforces El Salvador’s image as a crypto-friendly destination and serves as a financial buffer.

The Global Context: El Salvador’s Symbolic Stand

In the grand scheme of global Bitcoin adoption, El Salvador’s holdings may seem small compared to the rumored giants. The UAE is said to hold a staggering 420,000 BTC, with the United States holding 198,012, and China with 190,000. Public companies like MicroStrategy also hold significantly larger treasuries.

Stay informed, read the latest crypto news in real time!

However, El Salvador’s place in this story is not defined by sheer volume, but by its symbolic significance. It is the first nation to take the leap, making a definitive statement about the future of money. Its journey is a test case for the world, an experiment that could either validate the power of decentralized finance or serve as a cautionary tale.

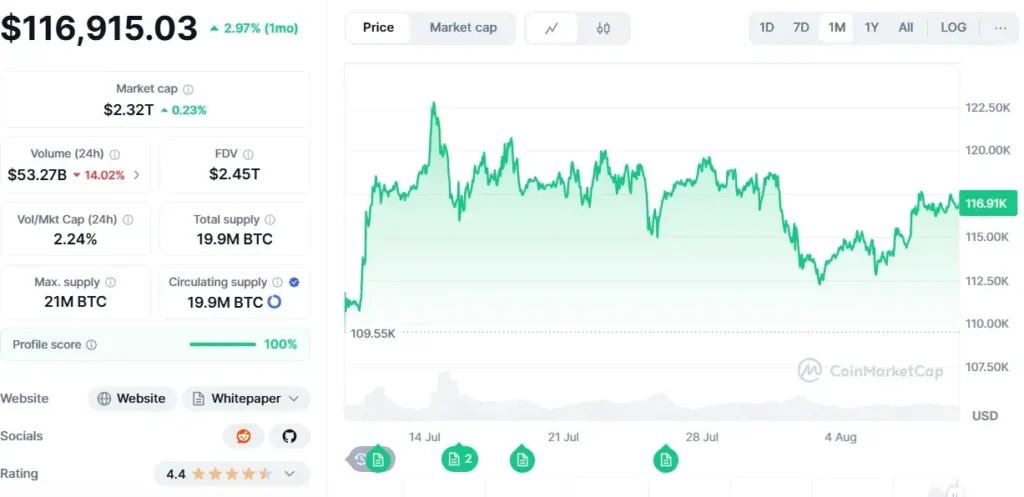

As of today, Bitcoin trades at a price of approximately $116,962, with a daily volume of around $56 billion and a market cap of $2.33 trillion. El Salvador’s unwavering commitment in the face of immense pressure from international financial institutions underscores its belief in Bitcoin as a second, tech-powered financial lifeline. The successful launch of the Bitcoin Bank would not only fulfill a key component of this vision but also solidify El Salvador’s place in history as the country that dared to build the future of finance.