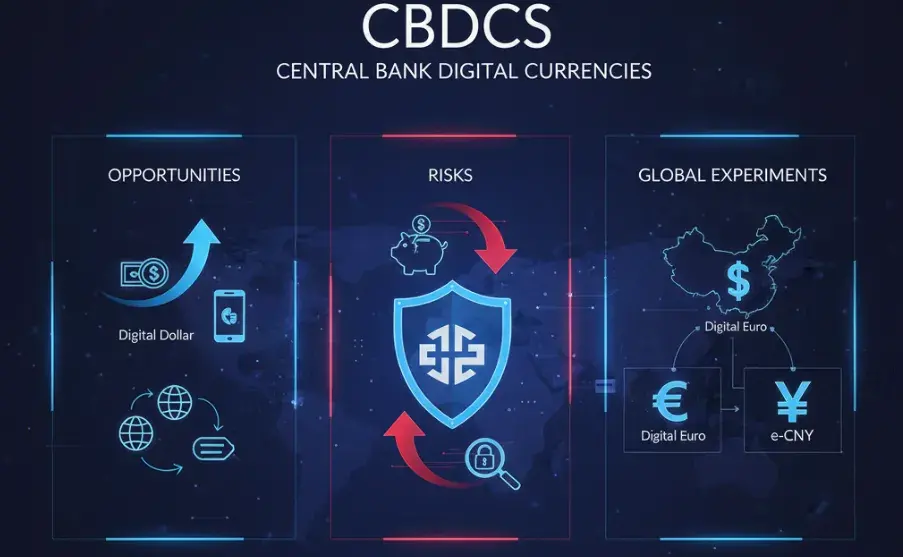

CBDCs: Opportunities, Risks, & Global Experiments

The world of finance is on the cusp of a potential revolution, one that seeks to marry the age-old trust of state-backed currency with the efficiency and innovation of digital technology. At the heart of this transformation lies the Central Bank Digital Currency (CBDC). As cash use declines and digital payments dominate, central banks globally are exploring a new form of money, a digital equivalent of physical banknotes, a liability directly of the central bank, rather than commercial bank money.

But what are central bank digital currencies, and why has the topic exploded from a niche academic discussion into a global policy priority? This article delves into what CBDCs are, their potential upsides and downsides, and the varied approaches being taken by major economic blocs—the United States, the European Union, and Asia—in their digital currency experiments.

Understanding Central Bank Digital Currencies

A Central Bank Digital Currency is a digital form of a country’s fiat currency, issued and backed by the nation’s central bank. Crucially, a CBDC is fundamentally different from commercial bank digital money (the balance you see in your current bank account) and decentralized cryptocurrencies like Bitcoin.

CBDCs Explained: The Digital Evolution of Money

At its core, a CBDC is central bank money—the safest form of money—available to the public in a digital format. Here is how it differs from other digital money:

- Commercial Bank Money: This is the digital money you hold in your bank account. It is a liability of the commercial bank, and while insured up to a certain limit in most countries, it carries a degree of counterparty risk.

- Cryptocurrency: Assets like Bitcoin and Ethereum are decentralized, not backed by any government, and their value can be highly volatile. They are not the liability of a central authority.

- CBDC: This is a direct liability of the central bank, carrying no credit or liquidity risk. It’s essentially a digital banknote.

CBDCs are generally classified into two types:

- Retail CBDCs (rCBDC): Intended for use by the general public for daily transactions, much like digital cash.

- Wholesale CBDCs (wCBDC): Restricted to financial institutions for interbank payments and the settlement of financial market transactions. Wholesale CBDCs are often the focus of advanced economies seeking to increase efficiency in their financial markets.

The Opportunities: Why Central Banks Are Acting

Central banks aren’t exploring CBDCs out of technological curiosity alone. Several powerful economic and social drivers have accelerated global efforts. When considering the benefits of CBDCs explained, proponents point to several key areas of improvement:

Enhanced Payment Systems

CBDCs have the potential to modernize and streamline domestic and international payment systems. They can offer:

- Increased Efficiency and Lower Costs: By reducing the number of intermediaries required for transactions, a CBDC can lower payment processing costs and increase transaction speed, especially for cross-border payments, which are notoriously slow and expensive.

- Payment Resilience: A CBDC can serve as a backup to the existing private payment infrastructure, ensuring that a system is in place even if a major commercial payment network fails.

- Innovation: A CBDCs platform could provide a secure, standardized base layer for the private sector to build innovative financial products and services.

Bolstering Financial Inclusion

In many developing and even some developed nations, a significant portion of the population remains unbanked. A well-designed CBDCs could act as a bridge to the formal financial system.

- Access for the Unbanked: CBDCs could provide a universally accessible, low-cost digital payment method that doesn’t require a traditional bank account, providing a safe store of value for those currently excluded.

Maintaining Monetary Sovereignty

The rise of private digital currencies, especially stablecoins and global private payment networks, has raised concerns among policymakers about maintaining control over the monetary system.

- Monetary Policy Effectiveness: A CBDC ensures that the central bank’s money remains central to the economy, supporting the effectiveness of monetary policy in a future where cash is no longer dominant.

- Competition: It introduces competition to private payment providers, potentially leading to better and cheaper services for consumers.

The Risks: Navigating the Potential Pitfalls

While the promise is great, central bank digital currencies present significant challenges that cannot be ignored. The potential drawbacks are complex and have become a major part of the public debate over CBDCs explained.

Financial Stability and Bank Disintermediation

Perhaps the most significant financial risk is bank disintermediation. If a CBDC is too attractive, the public might shift large amounts of deposits from commercial banks to the central bank’s digital currency, especially during times of financial stress (a digital bank run).

- Impact on Lending: Commercial banks rely on customer deposits to fund loans. A mass migration of deposits could reduce the funds available for commercial lending, potentially curtailing credit creation and impacting economic growth.

- Mitigation: To address this, many central banks are exploring design features like holding limits (caps on the amount of CBDC an individual can hold) and implementing a two-tiered system where commercial banks still manage customer accounts.

Privacy and Data Security Concerns

Unlike anonymous cash, a CBDCs would leave a digital trace. This raises serious privacy concerns about government surveillance of citizens’ financial transactions.

- Surveillance Risk: A centralized ledger of all transactions, even if held by the central bank, creates the theoretical risk of governmental monitoring or even control over how money is spent (e.g., programmed money).

- Cybersecurity Vulnerability: A CBDC system would be a prime, high-value target for cyberattacks, potentially leading to systemic financial disruption and a massive loss of public trust. Central banks must build highly resilient and secure infrastructure.

- Privacy-Enhancing Technology: To counter these concerns, design proposals often involve strong privacy safeguards, including pseudonymity features and the use of technologies like zero-knowledge proofs (a concept already revolutionizing blockchain scaling) to verify transactions without revealing sensitive data.

Geopolitical and Cross-Border Spillovers

The design and adoption of a major CBDC by a leading global economy could have significant international implications.

- Internationalization Risk: A highly successful CBDC could be adopted for cross-border payments by non-residents, potentially increasing its international use and impacting other countries’ monetary sovereignty.

- Interoperability: Without international cooperation, different CBDCs might not be able to “talk” to each other, undermining the goal of improving cross-border payments.

Global CBDC Experiments: US, EU, and Asia

The global landscape for central bank digital currencies is characterized by varied speeds and strategic objectives.

Asia: The Pioneer and the Testbed

Asia is arguably the global leader in CBDC development, with many countries already in advanced pilot phases.

China’s e-CNY

The People’s Bank of China (PBOC) has been the most aggressive, piloting the digital yuan (e-CNY) since 2020. This is the largest retail CBDC trial globally, rolled out across multiple cities and used for millions of transactions.

- Focus: Domestic retail payments, replacing cash, and improving financial inclusion.

- Status: Advanced pilot, with increasing integration into daily life, including salary payments and public transport.

India’s Digital Rupee

The Reserve Bank of India (RBI) is running a phased pilot of the e-Rupee (or Digital Rupee) for both retail and wholesale use.

- Focus: Improving the efficiency of interbank settlements (wholesale) and providing a safe digital alternative to cash in a country with a high volume of digital transactions (retail).

- Status: Active pilot, testing various use cases and technologies in select cities.

European Union: The Digital Euro Project

The European Central Bank (ECB) and the European Commission have been methodically working on the Digital Euro project. The European approach prioritizes legal, political, and design considerations before moving to a potential launch.

- Focus: Preserving the role of public money in a digital age, supporting EU sovereignty, and ensuring a seamless, pan-European digital payment instrument.

- Status: Currently in a “preparation phase” (following a two-year investigation phase), focusing on finalizing the rulebook and selecting external providers to develop the technical platform. The ECB has stressed that it is an option to complement cash, not replace it, and that privacy is a paramount concern.

United States: Caution and Deep Analysis

The Federal Reserve in the United States has adopted a more cautious, research-intensive approach, emphasizing that no decision has been made on whether to issue a Digital Dollar.

- Focus: Studying the potential impact on monetary policy, financial stability, and the role of the dollar in the global economy. The U.S. priority is to improve its already robust, safe, and efficient domestic payment system.

- Status: Remains in the research and discussion phase. The Federal Reserve has conducted deep analysis, notably through the Boston Fed and MIT’s “Project Hamilton,” which explored the technical feasibility of a high-speed wholesale CBDC system. Any move toward a Digital Dollar would require broad political and legislative support.

The Road Ahead

Central bank digital currencies are not just a technological upgrade; they represent a fundamental rethinking of how money works in the digital era. The debate over CBDCs explained centers on balancing the clear efficiency and inclusion benefits with the profound risks to financial stability and personal privacy.

Stay informed, read the latest crypto news in real time!

As global experiments continue, the lessons learned from China’s mass adoption tests, the EU’s careful deliberation, and the US’s rigorous analysis will collectively shape the future of money. For citizens and businesses, the coming years will determine if a CBDC truly delivers on its promise of a safer, more efficient, and inclusive digital financial system while safeguarding fundamental freedoms.