Bitwise Files for Avalanche ETF: A New Era for Mainstream Crypto Investment

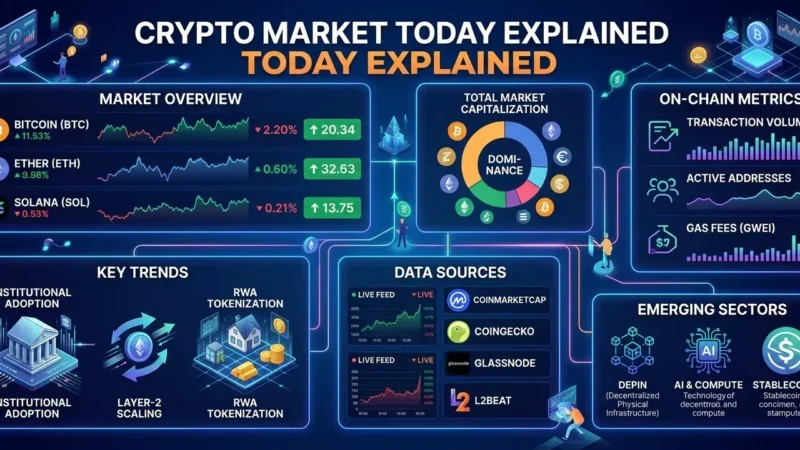

The world of traditional finance and the blockchain ecosystem continue their convergence, a trend defined by the growing acceptance of digital assets as legitimate investment vehicles. The latest and perhaps most significant milestone in this journey is Bitwise Asset Management’s filing of an S-1 registration with the U.S. Securities and Exchange Commission (SEC) to launch a spot exchange-traded fund (ETF) directly tied to Avalanche’s native token, AVAX.

This move marks a pivotal moment, following in the footsteps of landmark Bitcoin and Ethereum ETF approvals. If successful, the Avalanche ETF would not only provide a new avenue for traditional investors to gain exposure to the AVAX token without the complexities of direct ownership but also serve as a powerful validation of the Avalanche network’s growing prominence.

Understanding the Significance of a Spot ETF

To appreciate the gravity of this filing, it’s crucial to understand what a spot ETF is and why it’s a game-changer. An ETF is a type of investment fund that holds a portfolio of assets and trades on a stock exchange, just like a stock. A spot ETF, specifically, holds the underlying asset—in this case, AVAX—directly. This is a critical distinction from a futures ETF, which holds contracts that speculate on the future price of an asset, often leading to tracking errors and a lack of direct price correlation.

For investors, a spot Avalanche ETF offers several key advantages:

- Accessibility: It allows investors to buy into AVAX through a familiar, regulated brokerage account, bypassing the need to create a crypto exchange account, set up a wallet, or manage private keys.

- Security: The fund is managed by a professional entity, Bitwise, which is responsible for the secure custody of the underlying AVAX tokens. This eliminates the risk of loss due to user error, hacks, or forgotten passwords.

- Liquidity: ETF shares can be bought and sold throughout the trading day, offering a level of liquidity and ease of access that is often superior to a single crypto exchange.

- Institutional Participation: An ETF structure opens the door for institutional investors, pension funds, and wealth managers who are often restricted from holding cryptocurrencies directly due to regulatory and compliance reasons. The ability to invest via a regulated financial product could unlock a tidal wave of capital.

Bitwise’s Role and the SEC’s Approval Process

Bitwise Asset Management is a well-known entity in the crypto space, having been a vocal advocate for crypto-based ETFs for years. The firm was among the first to launch a spot Bitcoin ETF in January 2024 and has since expanded its offerings to include a variety of other crypto-related products. Their experience and credibility in navigating the complex regulatory landscape of the SEC give their Avalanche ETF application a strong foundation.

The SEC’s review process for an S-1 filing is rigorous and methodical. The S-1 form is the initial registration statement required for new securities. It outlines a vast amount of information, including the fund’s investment objectives, risks, management, and financial structure. The SEC staff meticulously reviews this document for accuracy and completeness, often issuing comments and requiring multiple amendments (known as S-1/A filings) before a final decision is made.

Given the SEC’s previous approval of spot ETFs for Bitcoin and Ethereum, a precedent has been set. This doesn’t guarantee approval for an Avalanche ETF, as each asset is evaluated on its own merits. However, it does suggest a maturing regulatory perspective and a clearer path forward for other major crypto assets. The SEC’s primary concern has always been investor protection, and a key factor in past approvals has been the presence of a regulated market for the underlying asset. Bitwise’s filing, which notes it will use the CME CF Avalanche–Dollar Reference Rate, speaks directly to this requirement.

Why Avalanche is a Prime Candidate for an ETF

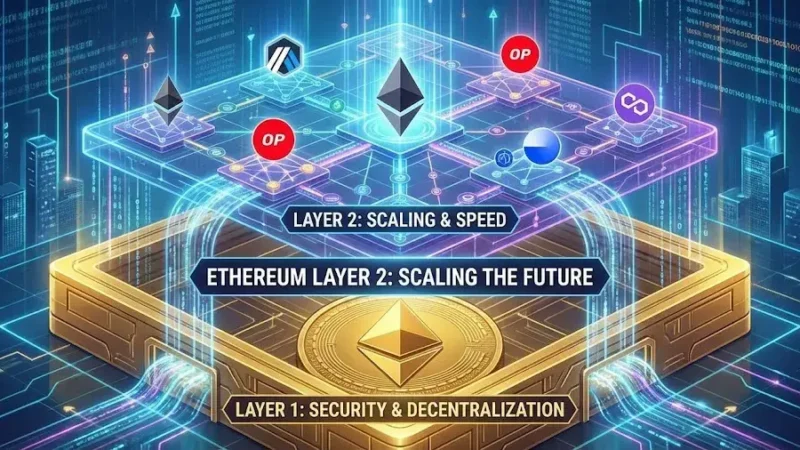

Avalanche (AVAX) is not just another cryptocurrency; it is a high-performance, scalable blockchain platform with a robust and rapidly growing ecosystem. Its key features make it an attractive asset for institutional investment:

- Scalability and Speed: Avalanche boasts impressive transaction speeds and near-instant finality, which make it ideal for decentralized applications (dApps) that require high throughput, such as DeFi protocols and gaming.

- Subnets: Avalanche’s unique “subnet” architecture allows developers to launch custom blockchains tailored to specific needs, which has attracted major players from the institutional world, including projects with firms like JP Morgan and BlackRock.

- DeFi and NFTs: The Avalanche ecosystem is a bustling hub for decentralized finance and non-fungible tokens. With popular dApps like Trader Joe and NFT marketplaces flourishing on the network, the utility of AVAX is clear and growing.

- Institutional Interest: The fact that Bitwise, an established and reputable asset manager, has chosen to pursue a dedicated Avalanche ETF is a strong vote of confidence. This institutional interest can lead to increased adoption and, in turn, potential price appreciation.

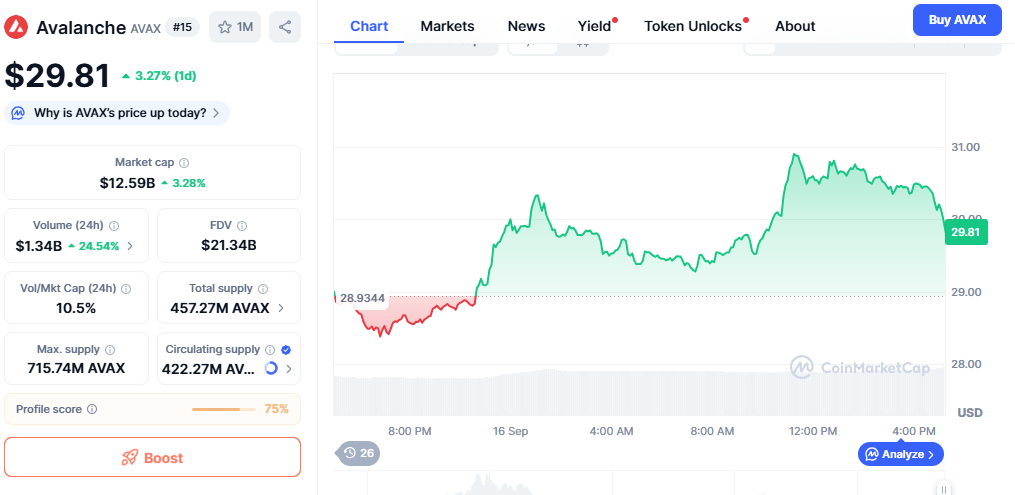

Potential Impact on AVAX and the Broader Crypto Market

If the Avalanche ETF is approved, its impact could be profound. A new source of demand from traditional finance could significantly boost the token’s market capitalization. Unlike retail investors who may be more reactive to market swings, institutional capital tends to be long-term and strategic, providing a new layer of stability and credibility.

The introduction of an Avalanche ETF would also have a ripple effect on the broader altcoin market. Following the Bitcoin ETF approvals, there was a surge in filings for other major cryptocurrencies. An AVAX ETF approval would reinforce the narrative that the SEC is becoming more open to assets beyond just Bitcoin and Ethereum, potentially accelerating the approval timeline for other tokens like Solana (SOL) or Chainlink (LINK). This could usher in a new wave of institutional investment into the wider digital asset class.

Risks and Considerations for the Avalanche ETF

While the potential for an Avalanche ETF is exciting, it’s important to consider the risks. Regulatory hurdles remain the biggest challenge. The SEC could delay its decision or, in a worst-case scenario, reject the filing, which could have a negative impact on AVAX’s market sentiment.

Furthermore, the price of Avalanche (AVAX), like any cryptocurrency, is highly volatile. While an Avalanche ETF makes the asset more accessible, it does not mitigate the inherent risks of investing in a speculative asset. Investors should conduct thorough due diligence and understand that they are exposed to the same market volatility as those who hold the token directly. The success of the ETF also depends on market demand; if it fails to attract significant inflows, its impact could be limited.

Stay informed, read the latest crypto news in real time!

In conclusion, Bitwise’s filing for a spot Avalanche ETF is a landmark event for the cryptocurrency world. It signals a new chapter in the institutional adoption of digital assets and highlights Avalanche’s position as a major player in the blockchain ecosystem. While the road to approval is not without its challenges, the momentum is undeniably building, paving the way for a more integrated future where traditional and decentralized finance coexist.