Crypto Price Today: Bulls Pulls Bitcoin Above $57K, Ethereum Rises and Altcoin Market Loses Stream

On Tuesday, October 12, most cryptocurrencies have weakened their prices as most are trading lower. Apart from Bitcoin, all other nine top cryptocurrencies are lower as of the time of writing at 09:00 Eastern Time.

According to CoinMarketCap, Bitcoin is marginally up 1.77% currently trading at $57,546.41. The flagship cryptocurrency has surged its price to this level for the first time since May as market analysts anticipate that the crypto will retest the record highs reached in April this year – the $65,000 level.

Ether, the second-largest cryptocurrency by market capitalization and the coin associated with Ethereum blockchain, is lower 0.31% to $3,508.62.

Cardano also sheds its price 4.36% to $2.12, Binance coin trades lower 2.34% to $407.23, XRP eases 4.92% to trade at $1.10, Solana plunges by 5.07% to $143.46, Polkadot was down 4.97% to $33.32, and Dogecoin slips 4.10% to $0.2258.

Generally, while the global cryptocurrency market capitalization losses 1% to stand at $2.30 trillion compared to the previous day, the total crypto market volume increased more than 7% to stand at $105.63 billion.

Some of the renowned analysts have come forward and explained the phenomena taking place in the cryptocurrency market.

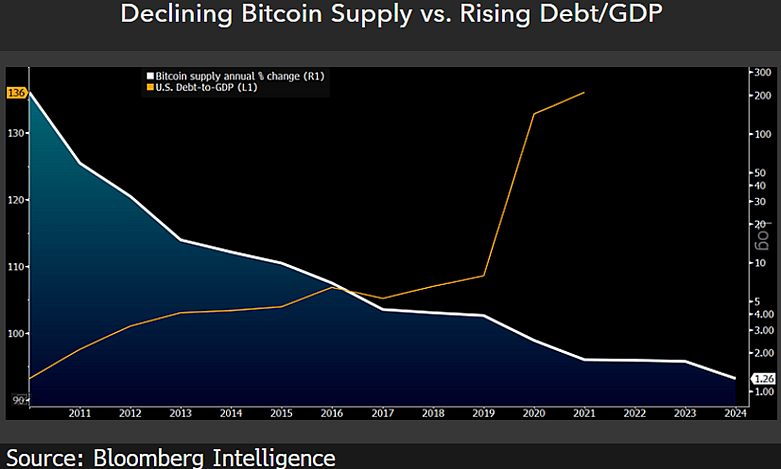

Mike McGlone, Bloomberg Intelligence’s senior commodity strategist, has explained the reasons why the prices of Bitcoin and Ethereum are set to see a rise.

The analyst states that Bitcoin could be in for a surge during the fourth quarter due to several fundamental catalysts.

He stated that many investors concerned about inflation and debt may be ready to put their faith in Bitcoin that gives the crypto its hard supply.

“Relative to rising US debt and tensions over a potential default, Bitcoin may be entering a unique phase for a 4Q price rise as markets gain trust in the coding that defines the crypto’s supply. The debt-ceiling drama may work against managers that avoid allocations to Bitcoin,” McGlone said.

In other words, the price of Bitcoin could soar to a 5-month high, rising by over 30% in October. As economies across the globe started to reopen and fast-track their path back to recovery, Bitcoin’s rally indicates investor confidence in the global economy and its increasing position as an asset class.

Meanwhile, McGlone also highlighted that Ethereum also is likely to see a price surge. He stated that the EIP-1559 update appears to place pressure on the ETH supply, which in the long term could benefit the asset and improve its price.

“Ethereum’s floor just below $2,000 from May-July appears to have added a handle to $3,000 for 4Q, tilting risk versus reward toward further price appreciation. It’s likely still the early price discovery days for Ethereum,” McGlone highlighted.

Image source: Shutterstock