Kraken Doubles Down: $648 Million Q3 Revenue Fuels 2026 US IPO Plans

A Record-Breaking Quarter for a Crypto Heavyweight

The road to an Initial Public Offering (IPO) is paved with strong financial results, and in its latest quarterly filing, Cryptocurrency exchange Kraken delivered exactly that. The company, officially known as Payward Inc., reported a spectacular third quarter, with revenue more than doubling from the previous year. This performance firmly positions the exchange as a heavyweight preparing to join the select ranks of publicly traded crypto companies in the United States.

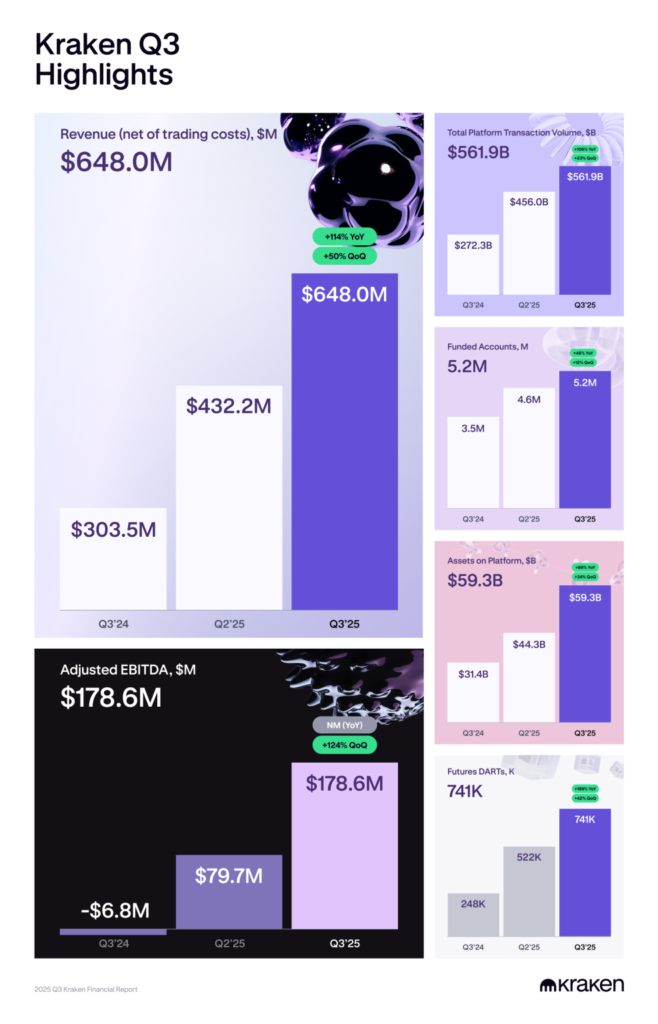

According to a recent statement, Kraken’s revenue soared to $648 million, marking a staggering 114% increase compared to the same period last year. This remarkable growth is a clear indicator of not only the resurgent health of the wider cryptocurrency market but also the platform’s strategic expansion and operational efficiency. The figure, which Kraken defines as GAAP gross revenue minus trading costs, provides a robust view of the company’s ability to generate income from its core exchange operations.

The financial surge was not limited to the top line. The company’s adjusted earnings before items, including taxes (Adjusted EBITDA), reached $178.6 million. This is a stark reversal from the previous year when the same metric was slightly negative, showcasing a significant improvement in profitability and cost management. This combination of soaring revenue and a strong swing to positive adjusted earnings provides the compelling narrative necessary to court investors in a major public listing.

Decoding the Financial Triumph

To truly appreciate the significance of Kraken’s third-quarter results, it is essential to delve into the specific financial metrics and the context of the broader market environment. The $648 million revenue figure is more than just a large number; it represents strategic gains across various operational fronts.

Understanding Kraken’s Revenue Metric

Cryptocurrency exchange Kraken takes a distinctive approach to reporting its revenue, which is critical for comparison against its peers. The company calculates revenue as GAAP gross revenue minus trading costs.

- GAAP Gross Revenue: This represents the total amount of fees, commissions, and other income generated by the exchange’s various services—including spot trading, derivatives, staking, and custody—before any deductions or costs.

- Minus Trading Costs: By subtracting trading costs, Kraken arrives at a metric that more accurately reflects the net earnings from its operational activities, allowing for a clearer, more comparable view of its trading-based revenue. This metric underscores a commitment to transparency, which is becoming increasingly vital for crypto firms seeking to enter the regulated public markets.

The 114% year-over-year jump in this metric suggests two powerful trends converging: a significant rise in overall trading volumes across the platform and a successful expansion into higher-margin products and services.

Profitability and Operational Efficiency

The move from negative to $178.6 million in Adjusted EBITDA is arguably the most powerful statement of the quarter. Adjusted EBITDA is a key measure of a company’s operational profitability, stripping out non-cash expenses and one-time charges to show the underlying health of the business.

This dramatic turnaround suggests that:

- Cost Discipline is Working: After navigating the crypto winter, Kraken has successfully implemented cost controls and efficiency measures, allowing a larger portion of its increased revenue to flow directly to the bottom line.

- Product Mix is Optimized: Kraken has been aggressively expanding its product suite, including derivatives, custody, and its professional trading arm, Kraken Pro. These new and enhanced offerings likely carry better margins than basic spot trading, boosting overall profitability.

The financial narrative for the company is now clear: Cryptocurrency exchange Kraken is not just growing its volume; it’s building a sustainably profitable business model ready for Wall Street scrutiny.

The Road to the US Initial Public Offering (IPO)

The impressive financial results are a critical prerequisite for Kraken’s most ambitious goal yet: a public listing on a major U.S. exchange. The exchange has been long-rumored to be pursuing an IPO, and the current market and regulatory climate appear to be highly conducive to making that vision a reality.

A Conducive Political Climate

The text notes that Kraken’s renewed push for a public listing is part of a growing trend among crypto heavyweights following a shift in the U.S. political landscape. The return of a “pro-crypto President,” in this context referring to Donald Trump, has often been cited as having an impact on the regulatory environment.

- Easing Regulatory Pressure: A perceived shift away from aggressive enforcement actions by agencies like the Securities and Exchange Commission (SEC) under previous administrations may be encouraging crypto firms to resume or accelerate their public offering plans. This reduction in regulatory uncertainty makes the U.S. market a more predictable and attractive venue for a multi-billion dollar IPO.

- Wave of Crypto IPOs: The movement by Cryptocurrency exchange Kraken follows other major players, such as Circle (the issuer of USDC) and a continued positive market performance of existing publicly traded crypto stocks like Coinbase (COIN). This creates a positive precedent and investor appetite for regulated crypto-focused companies.

The timing suggests a calculated strategic move to capitalize on both a positive market uptrend and a more favorable political and regulatory wind.

Valuations and Funding Dynamics

In the months leading up to a major IPO, private companies typically seek to secure pre-listing funding at high valuations to solidify their balance sheet and generate buzz. Reports in September indicated that Kraken was in advanced talks to raise fresh funding in a round that would value the company at around $20 billion.

While this valuation is subject to change based on market conditions, it places Kraken firmly in the upper echelon of crypto businesses.

- Strong Investor Confidence: A $20 billion valuation indicates significant confidence from private investors in Kraken’s long-term growth prospects and its ability to compete directly with its largest U.S. rival.

- Fueling Growth and Acquisitions: The capital raised will not only fund the costs associated with the public listing but also allow Cryptocurrency exchange Kraken to continue its aggressive strategic expansion, including product development, compliance infrastructure build-out, and further acquisitions. Recent moves, such as acquiring a U.S.-regulated derivatives platform, underscore this strategy to diversify and become a one-stop-shop for global crypto financial services.

Looking Ahead: Challenges and Opportunities

The immediate future for Cryptocurrency exchange Kraken is focused on maintaining its financial momentum and executing a flawless transition to a public company. While the financial results are encouraging, the path ahead is not without significant challenges.

Navigating Regulatory Scrutiny

Despite a potentially friendlier political environment, the crypto industry remains under intense regulatory scrutiny. The process of an IPO requires comprehensive financial disclosure and adherence to stringent securities laws. Kraken must ensure its internal controls, compliance frameworks, and reporting standards are unassailable. Any future regulatory shifts or enforcement actions—either in the U.S. or globally—could delay or impact the listing. Transparency, particularly through initiatives like its Proof of Reserves, will be key to managing this risk.

Competition in a Maturing Market

The market for centralized exchanges is highly competitive. Kraken must continue to innovate to fend off rivals like Binance, Coinbase, and emerging decentralized platforms. Its ability to double its revenue year-over-year suggests it is currently winning market share, but sustaining that growth will require:

- Product Differentiation: Continuing to expand its offerings, especially in areas like derivatives, institutional custody, and the burgeoning Real-World Asset (RWA) tokenization space.

- Geographic Expansion: Leveraging new regulatory licenses, such as those secured in the EU under the MiCA framework, to drive growth outside of its core markets.

The success of the IPO hinges on Kraken’s ability to articulate a clear and sustainable growth story that extends far beyond the current crypto market rally.

Stay informed, read the latest crypto news in real time!

Conclusion: Setting the Stage for an Open Financial System

Cryptocurrency exchange Kraken’s impressive third-quarter performance, highlighted by a $648 million revenue haul and a strong swing to profitability, is more than just a financial victory; it is a profound validation of the crypto industry’s maturation. By aligning its operational success with a clear, aggressive roadmap toward a 2026 US IPO, Payward Inc. is not only securing its future but also contributing to the mainstreaming of digital assets. The upcoming public listing will be a pivotal event, providing a new class of investors with regulated access to one of the industry’s most successful and enduring infrastructure providers.