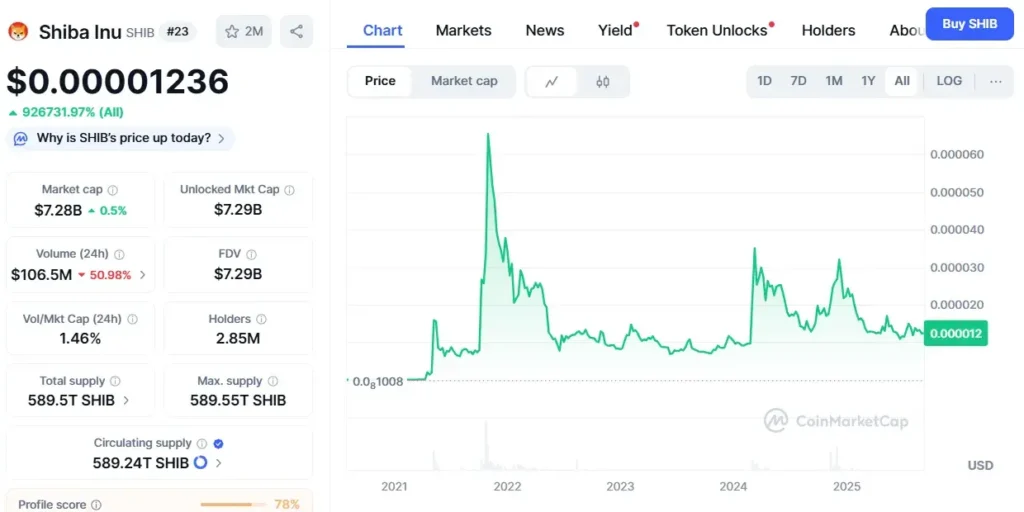

SHIB Price Outlook: A Battle for the $0.000012 Level

In the volatile world of meme coins, few assets capture the attention of retail investors and seasoned traders quite like Shiba Inu (SHIB). The digital currency, which has a massive and dedicated community, is currently hovering over a critical price level of $0.000012. This price point has not only garnered significant media headlines but has also become the epicenter of a fierce, ongoing struggle between bulls and sellers. For bulls, this zone represents a crucial line of defense, a support level that, if held, could signal a potential recovery. For sellers, a breach below this point would be a warning sign, potentially triggering a cascade of further declines. The outcome of this battle will likely determine the short-term direction of SHIB, making it a focus for anyone interested in SHIB Price Outlook.

The current market dynamic is a fascinating mix of technical analysis and on-chain behavior. While price charts tell one part of the story, the actions of large-scale investors—the so-called “whales”—provide another layer of insight. Recent data suggests that these powerful entities are accumulating more SHIB tokens, an action that could hint at renewed interest and confidence in the asset. However, as with all things in the crypto market, this does not guarantee a bullish turn. It is simply one piece of a complex puzzle, and the final SHIB Price Outlook remains uncertain, contingent on a variety of factors.

Understanding the Battle at the $0.000012 Price Point

The concept of a “critical price level” is a cornerstone of technical analysis. It is a price at which the asset has historically found significant support or resistance, making it a key psychological and technical barrier. For SHIB, the $0.000012 level has repeatedly demonstrated its importance. When the price falls to this level, buying pressure has historically stepped in to prevent further drops, creating a floor. This is where the bulls are fighting to maintain control. They see this level as a foundation from which the price can rebuild momentum and potentially launch a new rally.

Conversely, a sustained move below this support could be interpreted as a significant bearish signal. If the buying pressure at $0.000012 fades, it would indicate that bulls are losing their conviction. This could trigger stop-loss orders from traders and cause a sell-off as sellers take control, pushing the price towards the next support level. The current SHIB Price Outlook is therefore delicately balanced on this single, pivotal number.

The Role of Whales: Is Accumulation a Bullish Sign?

The actions of large holders, or “whales,” often provide a window into market sentiment and potential future movements. Whales have the capital to influence price, and their decisions to buy or sell can create significant market swings. When whales begin to “stack up” or accumulate more tokens, it’s often viewed as a bullish indicator. It suggests that these sophisticated investors see long-term value in the asset and are betting that the price will increase from its current levels.

However, this accumulation is not a guaranteed predictor of a price rally. Whales may be accumulating for a variety of reasons that do not immediately translate to a pump. They could be preparing to sell at a higher price, diversifying their portfolios, or simply taking advantage of what they see as a discounted price. The true SHIB Price Outlook depends not just on whale accumulation, but on whether that accumulation is a prelude to a significant buying wave from the broader market.

Factors Influencing the SHIB Price Outlook

Beyond the immediate battle at the $0.000012 level and whale activity, a number of other factors are shaping the SHIB Price Outlook. The overall market sentiment for cryptocurrencies, for example, plays a crucial role. If Bitcoin and Ethereum are experiencing a rally, it often creates a rising tide that lifts all boats, including meme coins like SHIB. Conversely, a bearish turn in the major cryptocurrencies can pull SHIB down with them.

Broader macroeconomic conditions also have a profound impact. A “risk-on” environment, fueled by loose monetary policy and low interest rates, encourages investors to seek higher returns in speculative assets like crypto. A “risk-off” environment, characterized by inflation concerns and rising interest rates, can lead to a capital flight from these same assets. The SHIB Price Outlook is thus a reflection of the global economic climate.

Furthermore, the development of the Shiba Inu ecosystem itself is a critical factor. The team behind SHIB has been working on various projects, including the Shibarium layer-2 blockchain, the ShibaSwap decentralized exchange, and a metaverse. The success and adoption of these projects could create real-world utility for the SHIB token, which would be a major positive for its long-term value. News related to these developments can generate significant community excitement and, in turn, influence price.

Technical Analysis: Key Levels to Watch

From a technical perspective, traders are keenly watching several key levels in addition to the $0.000012 support. If the bulls succeed in holding this level, the next major resistance points would be higher, such as the $0.000015 or $0.000018 marks. A successful break above these levels would signal a change in trend and could pave the way for a more significant rally.

On the other hand, if the $0.000012 support breaks, the next line of defense for bulls would be a lower support level, potentially at $0.000010 or even lower. Such a move would confirm a bearish trend and could lead to a period of consolidation at a new, lower price range. For traders, this means carefully setting stop-loss and take-profit orders to manage their risk and capitalize on potential movements. The SHIB Price Outlook from a technical standpoint is entirely dependent on which of these key levels is tested and whether it holds or breaks.

Stay informed, read the latest crypto news in real time!

Conclusion: The Final Word on the SHIB Price Outlook

The current state of Shiba Inu is a microcosm of the wider cryptocurrency market. It is an asset caught between competing forces: the fundamental fight between bulls and sellers at a critical support level, the speculative actions of large-scale investors, the influence of macroeconomic factors, and the ongoing development of its ecosystem. The fact that whales are accumulating tokens provides a glimmer of hope for the bulls, suggesting a renewed faith in the asset’s potential. However, this action alone is not enough to guarantee a bullish reversal.

The ultimate SHIB Price Outlook is a story that will unfold over the coming days and weeks. Will the bulls successfully defend the $0.000012 level, or will the sellers push the price below this critical threshold? The answer to that question will depend on a combination of market sentiment, technical momentum, and the continued actions of key market participants. For investors and traders, staying informed and agile is the best strategy for navigating this period of uncertainty and positioning themselves for whatever comes next. The community’s resilience will be tested, but its fervent support remains a key asset in this ongoing battle.