Is the Solana price collapsing? – FTX sells all SOL coins

Until a few weeks ago, Solana (SOL) was one of the top performers among cryptocurrencies for the current year. However, recently the SOL price has experienced a roller coaster ride and collapsed. But what is really behind SOL’s recent price losses? We delve deeper into the current speculation and rumors surrounding FTX. In particular, we will shed light on the current situation with regard to FTX’s upcoming court hearing, which is taking place today. How will the Solana price react?

Aftermath of the FTX bankruptcy – what effects on Solana?

Since the beginning of the year, SOL has delivered an impressive performance. But in the past 24 hours, the Solana price has repeatedly been sold off heavily. This decline in the SOL price is not solely due to technical factors. Rather, there are concerns that have been fueled by recent developments surrounding the FTX crypto exchange.

Insolvent crypto exchange FTX is currently in Delaware Bankruptcy Court seeking approval to liquidate $3.4 billion in crypto assets. This has led to widespread concerns, particularly regarding Solana, FTX’s largest holding.

Rumors on crypto Twitter point to a massive dump of SOL by FTX. But these rumors are unfounded. A majority of FTX’s SOL tokens are locked by a lockup contract and will be gradually released over the coming years.

The SOL tokens owned by FTX are not readily available for sale. These tokens go through a linear process that extends from 2025 to 2028.

Accordingly, early access to these funds is not an option. Therefore, the fears indicating an impending SOL dump by FTX can be described as misinformation.

Current technical analysis of the SOL Coin price

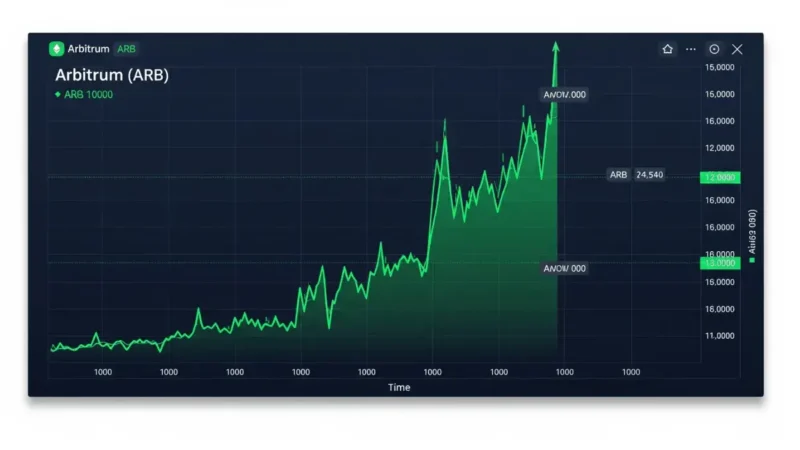

Solana has experienced an impressive rise in the SOL price since the beginning of the year. But true to the saying “After the high often comes the low,” Solana has now collapsed sharply. In this analysis, we delve deep into the technical aspects of SOL and try to classify the current events for the Solana price forecast.

SOL started the year with an impressive uptrend, but current resistance and market uncertainties have changed the tide. Since July, the momentum for SOL seems to be waning and the price has taken a noticeable hit. A striking sign was the resistance at $30, which sent the price into a downward spiral. With a current price of $17.37, Solana has lost an impressive 43 percent of its temporary high.

Bearish indicators make Solana (SOL) forecast negative

A key indicator in our analysis is the RSI (Relative Strength Index). It measures the speed and change of price movements. An RSI above 70 is considered overbought and below 30 is considered oversold. Solana’s RSI is currently trading at 32, indicating oversold levels. This could mean that the market is overreacting and the SOL Coin could expect a slight upside accordingly.

Another indicator that we will use for the Solana price are the so-called EMAs (Exponential Moving Averages). They show the average price of a cryptocurrency over a certain period of time. Unfortunately, Solana price has broken through both average lines, which is often seen as a negative signal. In addition, a so-called “death cross” has formed, which indicates further bearish tendencies.

Interestingly, a descending triangle has formed from the combination of the long-term uptrend line and the short-term downtrend line. This is often a sign that the price could fall further before rising again.

Despite Solana’s impressive performance at the beginning of the year, technical indicators are currently showing a bearish bias. It remains exciting to see how the SOL price will develop in accordance with the news about the crypto exchange FTX.

Conclusion and outlook for the further Solana forecast

While today’s FTX court hearing could undoubtedly have an impact on the crypto market, one should not get carried away by unfounded rumors. SOL remains a project with a strong foundation. How the SOL course develops after today’s negotiation remains exciting.

In summary, the technical analysis of the SOL price currently shows a number of bearish signals. It is always important to consider both technical and fundamental analysis in order to get a complete picture of the market.